What are the new deeming rates and when did they take effect?

What are the new deeming rates and when did they take effect?

Download the article below.

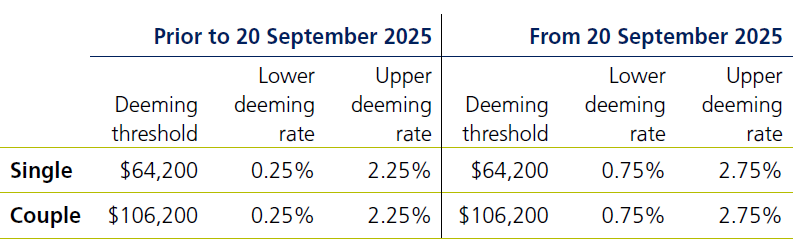

Deeming rates and thresholds determine the amount of income that is assessable from financial investments under the social security pension income test. Unlike deeming thresholds, deeming rates are determined by the Minister for Social Services on an irregular basis. Deeming thresholds are indexed each year on 1 July.

The current level of deeming rates have been in place since 1 May 2020 when they were reduced as an emergency COVID-19 measure. The Government subsequently committed to leaving deeming rates at these levels until 30 June 2025.

On 20 August, the Minister for Social Services has announced that a deeming rate of 0.75% for financial assets under $64,200 for singles and $106,200 for couples (combined) will apply from 20 September 2025. Assets over this amount will be deemed at a rate of 2.75%. This is an increase of 0.5% over the current lower and upper deeming rates.

The Minister also announced that the Australian Government Actuary (AGA) will take on the role of recommending future deeming rates. Guided by the returns that income support recipients can reasonably access on their investments, the AGA will advise the Government on the most appropriate rate to apply. They will not have the power to change the actual rate and this will remain with the Minister.

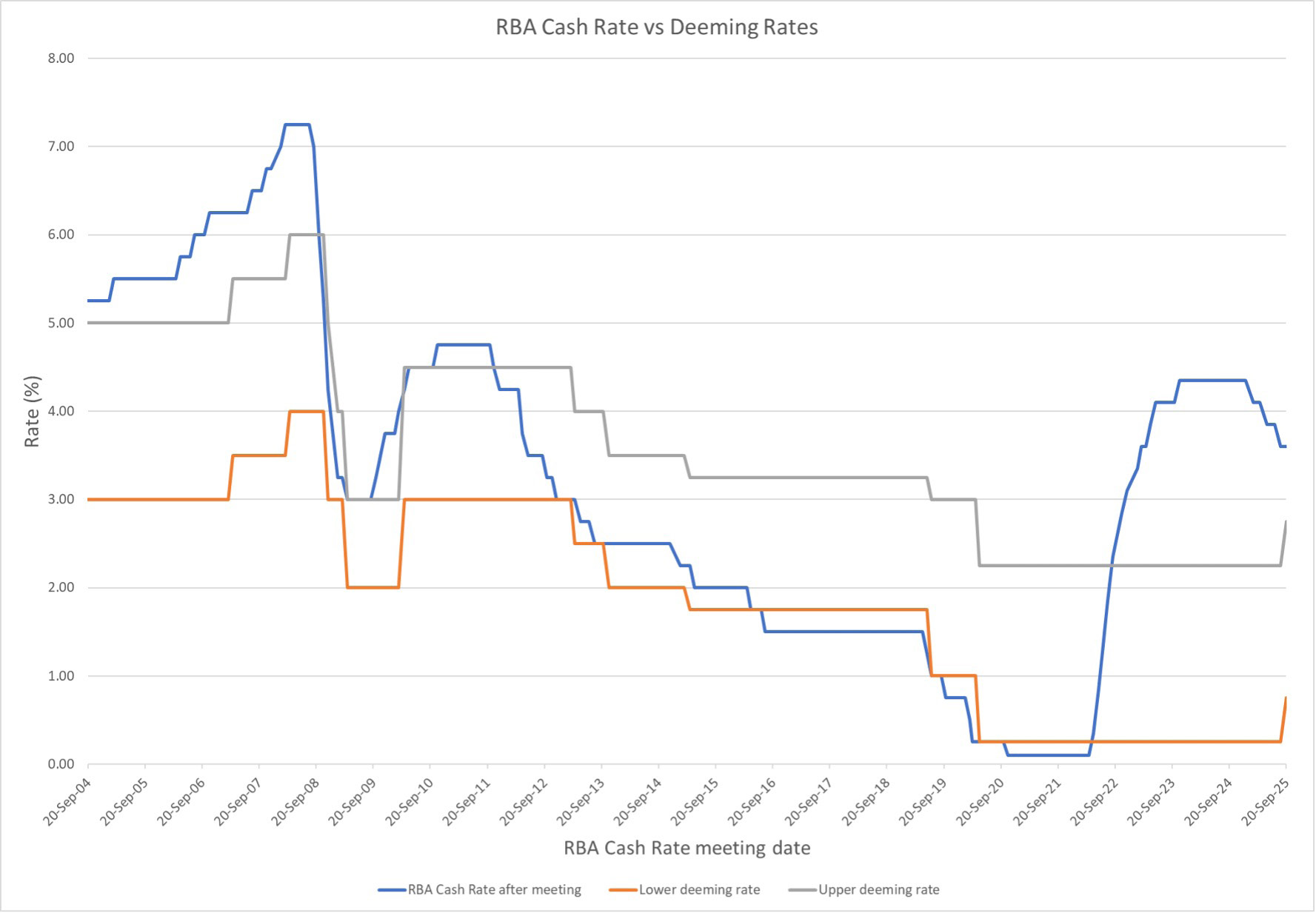

Despite the increase, deeming rates are still well below the current RBA cash rate of 3.6% (see chart below). Income support recipients will likely continue to earn higher returns on their investments than what they are ‘deemed’ to earn under the income test. For example, Challenger’s 3- year fixed term annuity rate is 4.25% p.a. at the time of writing.1

Who is impacted?

Those who have financial investments and currently have their social security pensions determined by the income test (income tested), are the ones that will see a negative impact to their entitlements.

However, by increasing deeming rates at the same time as the regular indexation of social security pension rates, the impact was minimised.

For pensioners, the impact of the 20 September 2025 changes (indexation to the maximum rate of pensions and the increase in deeming rates) can be summarised as follows2:

- Single homeowners with assets between $309,000 and $324,000 (inclusive) will see a negative impact to their pensions of between $1 p.a. to $37 p.a. with the maximum negative impact occurring at an asset level of $323,500.

- Single non-homeowners with assets between $309,000 and $637,250 (inclusive) will see a negative impact to their pensions of between $1 p.a. to $791 p.a. with the maximum negative impact occurring at an asset level of $625,000.

- Couple homeowners (illness separated and not illness separated) will not see a negative impact to their pensions (indexation to maximum pension rate more than offsetting the impact from higher deeming rates).

- Couple non-homeowners (not illness separated) with assets between $521,500 and $786,000 (inclusive) will see a negative impact to their pensions of between$1 p.a. to $770 p.a. (combined) with the maximum negative impact occurring at an asset level of $774,000.

- Couple non-homeowners (illness separated) with assets between $618,000 and$780,000 (inclusive) will see a negative impact to their pensions of between $1 p.a. to $391 p.a. (combined) with the maximum negative impact occurring at an asset level of $774,000.

What are the new income and assets test ‘crossover points’ with the new deeming rates?

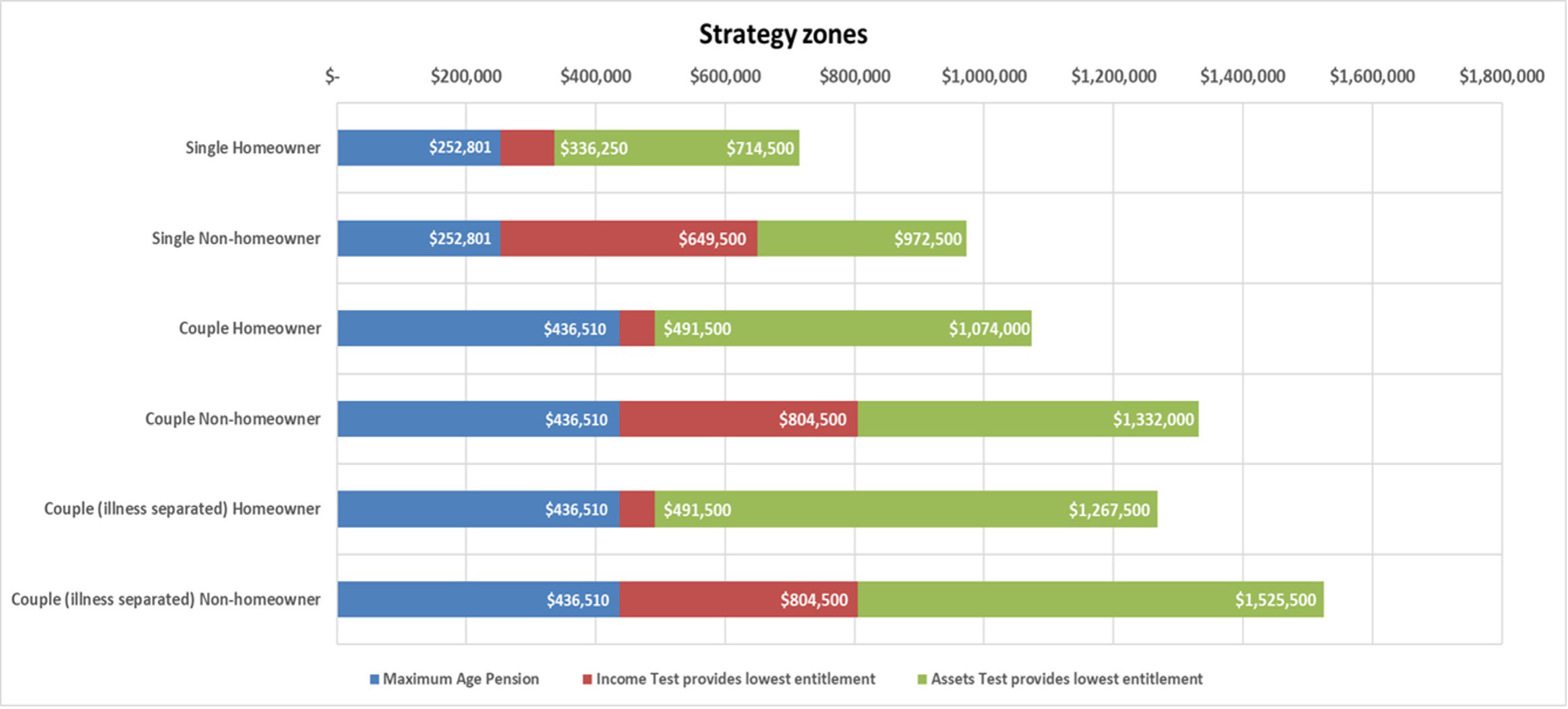

The pension ‘crossover points’ can be a useful tool to quickly determine whether clients are likely to have their pensions determined by the income test (income tested) or by the assets test (assets tested). This can then help with determining whether clients should focus on asset test strategies or income test strategies to maximise their entitlements.

The new deeming rates changes these ‘crossover points’ to the ones shown on the chart below3.

As an example, couple homeowners now with financial investments of less than $436,510 will receive the full rate of pension. From $436,510 couple homeowners will see a reduced pension under the income test (income tested) and from $491,500 their pensions will reduce under the assets test (asset tested). Couple homeowners will not be entitled to a part pension once assets reach $1,074,000.

1Challenger rates as at 25/08/2025.

2Assumes all assets are financial investments subject to the deeming rules.

3Centrelink rates and thresholds as at 20 September 2025 and assumes all assets are financial investments subject to deeming. Non-homeowner cut-out thresholds may be higher if eligible for rent assistance.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.