To pay or not pay the RAD – does the narrative change from 1 November 2025?

To pay or not pay the RAD – does the narrative change from 1 November 2025?

Download the article below.

When clients are liable for a Refundable Accommodation Deposit (RAD), or in the case of low-means residents, a Refundable Accommodation Contribution (RAC), advisers often consider using financial assets to pay for the RAD / RAC.

This is particularly the case because the opportunity cost of not paying the RAD or RAC can prove to be expensive, given the ongoing payment is based on the quarterly rate prescribed by the Government applicable on the date of moving to aged care.

With the introduction of the 1 November 2025 aged care changes, one of the issues that advisers question is whether the 2% retention amount deducted from the RAD or RAC for up to 5 years impacts the strategic considerations around paying the RAD.

Like many things in financial planning, no one size fits all. That said, for most clients with liquid assets available, it would usually be worthwhile to pay the RAD even after accounting for the 2% retention amount.

This article discusses some of the strategic considerations for paying the RAD. Please note, that low-means residents, depending on their means tested amount, may have a RAC liability. This article does not discuss issues for low-means residents, although similar principles can apply.

Unless stated otherwise, the thresholds and principles used in this article are based on 1 July 2025 rates and thresholds and our understanding of the material released to date by the Government on the 1 November 2025 aged care changes.

Summary

While the financial arbitrage in paying the RAD in comparison to paying Daily Accommodation Payment (DAP) may reduce due to the 2% retention amount, our understanding is that there continues to be an arbitrage and financial benefit of paying the RAD when there are liquid funds available. This position is further reinforced with DAPs being indexed to consumer price index (CPI) from 1 November 2025.

Some issues to consider

When considering payment of RADs, some of the following factors may be relevant:

- 2% retention amount deducted from RADs capped at 5 years

- Indexation of DAPs

- Maximum Permissible Interest Rate to work out DAP on unpaid RAD

- Foregone earnings

- Personal income tax

- Fixed saving as opposed to volatility if funds are invested in market linked assets

- Age Pension means testing

- Estate planning issues

- Commonwealth Guarantee

2% retention amount from RADs and RACs

From 1 November 2025, an aged care facility is required to withhold 2% retention amount on RADs/RACs capped at 5 years. Please note, a resident who is in aged care prior to 1 November 2025 is generally not affected by the new aged care rules, even if they change facilities. For further detail on grandfathering of aged care fees, please refer to this article.

The 5-year period starts from the day a RAD or RAC is first paid by the individual, whether paid in full or in part. The 5-year retention amount period does not restart when changing facilities. The facility must not deduct a retention amount more than once in any one month period however they must deduct at least once every 3 months. The 2% retention amount is based on the RAD balance - therefore retention amounts reduce progressively as the RAD balance reduces either due to the retention amount itself or other deductions from the RAD such as DAP deducted from the RAD. Although the retention amount progressively reduces based on RAD balances over time, these deductions will not increase the outstanding RAD and therefore will not increase the DAP.

The original RAD less retention amounts and any other deductions from the RAD, that is the RAD balance, is then required to be refunded to the estate or to the resident upon moving.

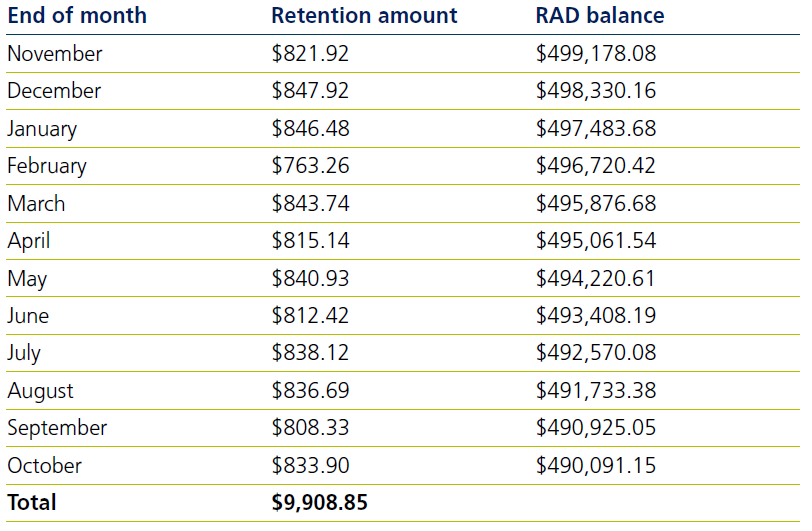

Example – retention amount in Year 1

Jasprit enters aged care on 1 November 2025 for the first time. He pays a RAD of $500,000 and does not have any other ongoing fees deducted from the RAD.

Over 5 years, the retention amounts total approximately $47,619. Assuming that the client passes away any time after being in aged care for five years and there were no other deductions from the RAD, the client’s estate receives a refund of $452,381 ($500,000 RAD paid less $47,619 retention amount).

Some clients put their house on the market and wait to pay the full RAD once the home is sold. In these circumstances, it may be worthwhile to pay a small RAD with any liquid assets available prior to the sale of the home, so that the 5 year retention period is started earlier and on the lower RAD paid. The retention amount will be based on the RAD paid and the client is permitted to top up the RAD to the agreed price at any time in the future. This may be helpful in case the client lives longer than 5 years.

Opportunity cost of not paying the RAD or RAC

If the client is liable for a RAD, the opportunity cost of not paying the RAD is the interest rate on the unpaid lump sum – referred to as the maximum permissible interest rate (MPIR). The ongoing payment of interest on the RAD is known as DAP. This interest rate is currently 7.78% but will likely change for future residents moving to aged care from 1 November 2025. The DAP is based on the MPIR in the quarter of entry for any unpaid RAD. Although the interest rate does not change, from 1 November 2025, the DAP can be indexed to movements in the CPI twice a year on 20 March and 20 September.

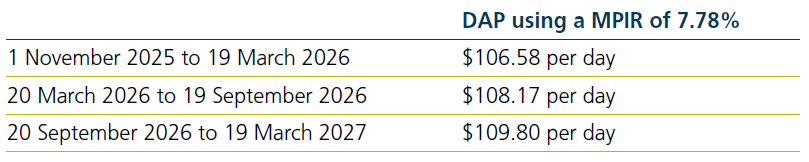

Example – DAP and indexation

Going back to Jasprit, let’s assume that he was liable for a RAD of $500,000. He did not pay any RAD and therefore was liable to pay DAP on the unpaid RAD. If we assume that the MPIR continues to be 7.78% in the October – December 2025 quarter, the following would be his DAP and the indexed amount on 20 March 2026 and 20 September 2026. This assumes that the relevant CPI indexation increased by 1.5% based on CPI changes from 20 September 2025 to 19 March 2026 and then another 1.5% based on CPI changes from 20 March 2026 to 19 September 2026.

As can be seen from the above table, the starting DAP is arguably quite high based on the rate of 7.78% and then progressively increases with higher movements in the CPI. The higher the inflation rate, the bigger the increase in the DAP due to indexation.

Maximum Permissible Interest Rate to work out DAP on unpaid RAD

Mechanically, the MPIR is calculated based on the monthly average yield of 90-day Bank Accepted Bills Rate + 4%. As a result, it is always likely to significantly exceed the interest earned from bank accounts. Given its relatively high rate, the DAP component of aged

care fees often requires significant cashflow to fund ongoing aged care fees. The pressures on cashflow are then further accentuated upon indexation of the DAP as outlined above.

Even if funds are in non-defensive assets such as shares, managed funds, or market-linked account-based pensions, a concern is the volatility and non-guaranteed nature of such investments. Some advisers consider the need to ‘de-risk’ the portfolio, given the uncertain but expected short life-expectancy for clients moving into aged care (due to older age and any medical conditions) when considering the asset allocation and risk profile of the client and the need to pay the RAD.

Foregone earnings

When articulating the benefits of paying RAD, advisers may need to incorporate any foregone earnings from those financial assets which would reduce the quantum of the financial arbitrage of paying RAD.

Age Pension impacts

While RAD is an assessable asset for aged care means testing (but is not deemed under the income test), it is an exempt asset for Age Pension purposes. The RAD is an assessable asset for aged care purposes but not deemed.

Tax

Where clients have income producing assets, they may have taxable income and be liable for personal income tax. By reducing financial assets to pay for the RAD, it might mean that the client will have lower taxable income which potentially might have a positive outcome on the financial arbitrage.

Estate planning

Specific estate planning goals and objectives may lead clients to prefer a particular course of action in terms of paying or not paying RAD. The refund of RAD ultimately becomes an estate asset and this may be a concern for some clients, when comparing retaining funds in non-estate assets such as jointly owned bank accounts, shares and managed funds, where generally the deceased’s share directly transfers to the other joint tenant bypassing the estate.

Commonwealth Guarantee

In case the facility becomes insolvent and noting that there are specific rules in how the RAD can be invested by the facility, if the insolvent facility cannot provide a refund of the RAD to the client, there is a Commonwealth Guarantee to ensure that the client or their estate receives the RAD balance.

Case study

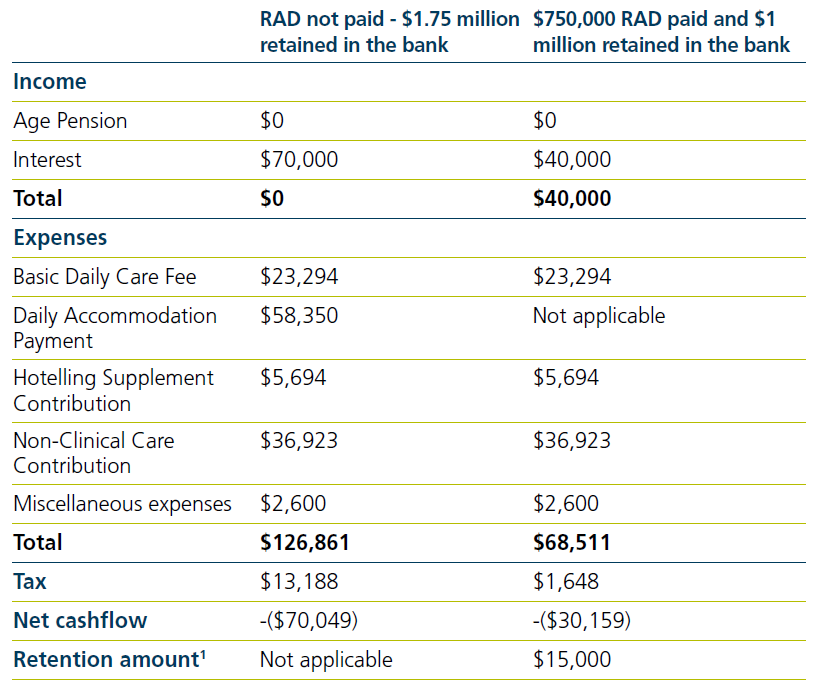

With failing health and early onset of dementia, Marnus aged 85, will need to move to an aged care facility after 1 November 2025. The facility’s advertised RAD is $750,000. Most of the wealth is in the family home worth $1.7 million. His other assets are $50,000 in the bank and $10,000 in contents. Marnus decides to sell his home in order to fund his aged care costs and charges.

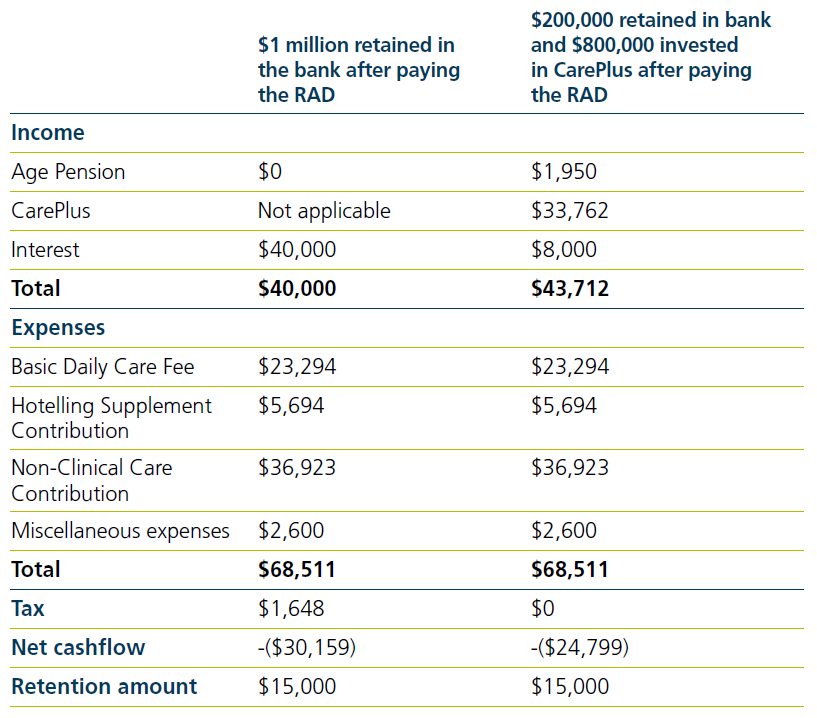

Using the Challenger Aged Care calculator, available on AdviserOnline, the following table looks at the cashflow and estate values when paying or not paying the RAD.

It’s worth noting that these high cashflow deficits are likely to persist for 4 years. After 4 years, Marnus will reach the Non-Clinical Care Contribution lifetime cap and will no longer have to fund the $36,923 (indexed) amount anymore. Therefore, from the start of the 5th year, he will likely be in a cashflow surplus position.

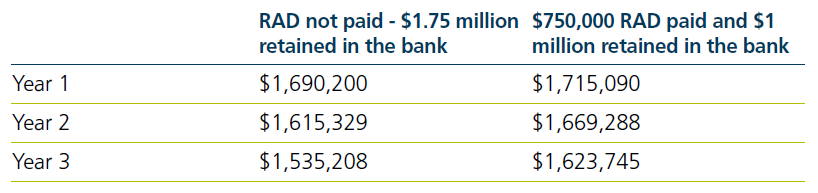

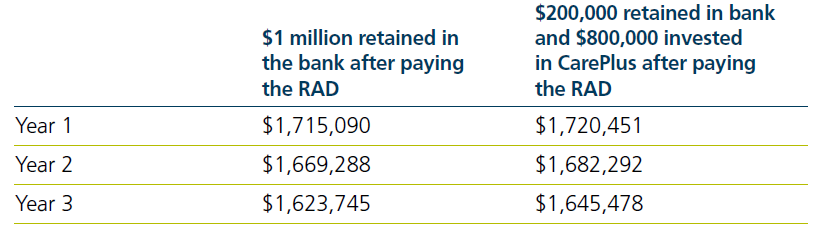

Comparison of estate values

Due to higher cashflow deficits when not paying the RAD, which are ultimately funded from drawing down the cash balance, his estate value is projected to be lower than when paying the RAD.

Further strategic considerations in paying the RAD and investing money in Challenger CarePlus

Marnus’s adviser has heard of Challenger’s CarePlus offering, which is purpose built for aged care residents. The adviser is trying to ascertain what benefits could be achieved by considering investing in CarePlus after paying the RAD. The adviser is aware that depending on the client, CarePlus could assist with:

- 100% return of purchase price2, irrespective of when death occurs

- Tax effectiveness

- Providing guaranteed regular income which is competitive compared to cash and term deposit rates

- Potentially increasing social security entitlements

- Potential reducing aged care fees

- Estate planning certainty and estate administration efficiency

Comparison of estate values

While every client is likely to differ, with varying priorities for optimisation, in this case, by considering CarePlus, the adviser helped Marnus to receive an Age Pension entitlement and the accompanying Pensioner Concession Card, reduce tax and provide improved cashflow. This outcome has helped reduce the cashflow deficit and ultimately improve the projected estate values at different periods.

For further detail on CarePlus, please refer to this page.

Challenger’s Aged Care calculator

Challenger has an aged care calculator which can also assist you with modelling for clients who need aged care advice. You can download the calculator from Adviser Online.

1For simplicity, 2% retention amount is assumed to be deducted once at the end of the year. In future years, the 2% retention amount is based on the RAD paid less retention amounts.

2For South Australian investors, 1.5% stamp duty applies on the premium paid for the CarePlus Insurance which is deducted from the death benefit

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.