Unpacking the ins and outs of the superannuation disability benefit

Unpacking the ins and outs of the superannuation disability benefit

Download the article.

Retirement savings held via superannuation are generally preserved until retirement, on or after preservation age. However, in limited circumstances the regulations make an allowance to access those savings before retirement, with one such allowance being the Permanent Incapacity (PI) condition of release. A superannuation benefit can be accessed under the PI condition of release in several ways, with each option having different tax implications which can result in very different outcomes. This article outlines the process to meet the PI condition of release and the tips, traps and pitfalls when helping your clients decide how they access their benefits.

Meeting the PI condition of release - super regulations and interaction with the tax rules

A superannuation disability benefit payable on meeting the PI condition of release can comprise of the member’s superannuation interest and insurance proceeds from a Total and Permanent Disability (TPD) policy (if any) held in that superannuation fund.

Where a TPD insurance policy is held within superannuation, the proceeds of the claim are paid to the fund. Generally, from 1 July 2014 only TPD policies that align with the PI condition of release can be held within superannuation. Individuals who are able to claim under grandfathered policies that commenced before 1 July 2014 may not subsequently access their super benefits as they may not satisfy the PI condition of release (for example own occupation TPD policies).

The SIS regulations list the eligibility conditions for meeting the PI condition of release and the Tax Act allows for the tax concessions applicable to the disability superannuation benefit.

SIS regulations1

The PI condition of release is met if the trustee is reasonably satisfied that the member is unlikely, because of physical or mental ill-health, to ever again engage in gainful employment for which the member is reasonably qualified by education, training or experience.

Income Tax Assessment Act2

A tax concession is provided if the member’s lump sum withdrawn also meets the definition of a disability superannuation benefit – a benefit paid to an individual because he or she suffers from ill-health (whether physical or mental), and two legally qualified medical practitioners have certified that, because of the ill-health, it is unlikely that the individual can ever be gainfully employed in a capacity for which he or she is reasonably qualified because of education, experience or training.

While the Tax Act definition is similar to the PI condition of release under the SIS regulations, a key difference is the requirement of two medical certificates confirming the member’s disability while the SIS regulations only require the trustee to be ‘reasonably satisfied’. In practice, trustees will usually (but not always) ask for two medical certificates to be reasonably satisfied.

Tax implications and planning considerations

Members have a number of options when accessing their benefits under the PI condition of release.

- Withdraw as a lump sum,

- Roll over to another super fund,

- Retain in accumulation phase for a future withdrawal,

- Commence an income stream, or

- A combination of these options.

Superannuation benefits for individuals aged 60 or over are generally tax-free. However, for those under age 60, tax implications and planning considerations can differ depending on how a member chooses to access their benefit.

Withdrawing the benefit as a lump sum or rolling over to another fund

When accessing a super benefit as a superannuation disability benefit lump sum (including a rollover to another fund), a tax-free uplift can be applied by the fund that pays the lump sum or rolls over the benefit. The tax-free uplift is based on the future service period which reflects the time that the individual would have been expected to continue working had the disability not taken place.

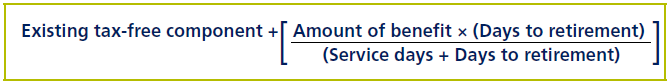

The tax-free component of a disability lump sum is calculated using the following formula:

Where:

- Amount of benefit = total disability benefit including any insurance proceeds.

- Days to retirement = number of days beginning from the day the individual stopped being able to work to their last retirement day (generally age 65).

- Service days = number of days in the service period for the lump sum which is generally from the beginning of the eligible service date of the member’s account till the date the benefit is paid.

- In the formula’s denominator, any days that are included in both ‘service days’ and ‘days to retirement’ are to be counted only once.

Once the total tax-free component is calculated, the balance of the total disability lump sum benefit is the taxable component.

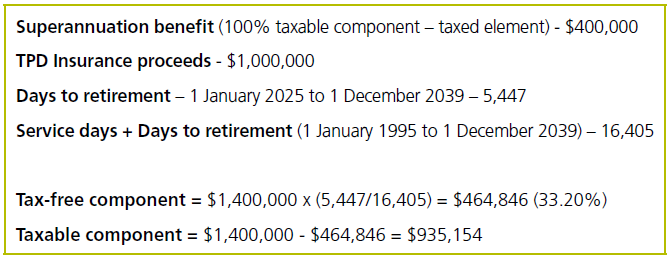

Example – Lena aged 50, born on 1 December 1974 became permanently incapacitated on 1 January 2025. The applicable eligible service date is 1 January 1995. Following are the details to calculate her tax-free component including the uplift.

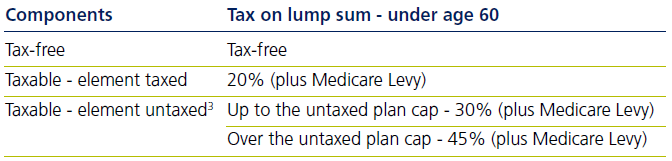

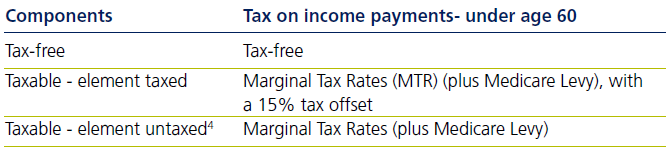

Where a disability superannuation lump sum benefit is withdrawn prior to age 60, the following table outlines the tax implications. The tax rates are levied on the taxable amount derived after the tax-free uplift is calculated.

Considerations when holding Insurance in super

Where TPD insurance proceeds are paid to the superannuation fund, they form a part of their taxable component. As the eligible service date of the super fund plays an important role when calculating service days and therefore the tax-free uplift, any premiums funded via rollovers can impact the applicable eligible service date.

The eligible service date is the earlier of:

- The day the individual joins the fund

- The start date of a rollover benefit received by the fund

- The day the individual started working with an employer that set up the fund.

For example, if the eligible service date of the existing fund is 1 January 2010 and the eligible service date of the fund that rolls-over the premiums is 1 January 1990, the applicable eligible service date for the tax-free uplift calculation for the existing fund will be 1 January 1990.

The earlier the eligible service date (increasing the denominator), the longer the service period and the lesser the tax-free component calculated as a part of the disability benefit. Alternative premium arrangements like personal contributions to the existing fund can be considered if the roll-over could end up in a reduced tax-free component. Alternatively, holding a TPD insurance policy in a fund with a relatively recent applicable eligible service date can be beneficial.

Where individuals have a Non-concessional Contribution (NCC) to be contributed to superannuation, making it prior to withdrawing lump sum or rolling over superannuation disability benefit can maximise the tax-free outcome when the uplift is calculated.

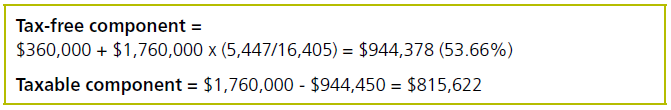

Example – In Lena’s situation above, if she made a NCC of $360,000 to the super fund before the tax-free uplift was calculated, her components are calculated as follows based on the total benefit of $1,760,000:

When providing strategy advice, it is important that the core or dominant purpose of a superannuation strategy aligns with the client’s retirement objectives rather than the sole purpose being a scheme designed to obtain a tax benefit. For instance, the dominant purpose for making NCCs to a super fund can potentially be an increase aimed towards larger savings for retirement which aligns with the sole purpose test.

The ATO has provided some guidelines outlining what constitutes a scheme as opposed to tax planning or tax-effective investing when it comes to rules regarding tax-avoidance provisions outlined in Part IVA of the Tax Act.

Retaining the benefit in accumulation phase and things to keep in mind

There could be a few reasons where an individual meets the PI condition of release but decides to leave those funds within the accumulation phase for future withdrawals. For instance, the individual may not require those funds and prefer continuing to invest within a concessionally taxed superannuation environment.

There can be cases where monies are retained for maximising the assets test exemption for Centrelink income support payments (like the Disability Support Pension), where superannuation in accumulation for those under Age Pension age is exempt. In such cases, the monies once classified as unrestricted non-preserved retains its status and can be withdrawn at any time

However, if the funds are not withdrawn within a short period of time, the trustee may require updated medical evidence to ascertain if the individual still meets the criteria for the PI condition of release to ensure tax concessions continue to apply. If there is a possibility that the individual (where under age 60) may re-evaluate their career options in order to return to work in future and they may not be able to provide the medical evidence, consideration may be given to roll over the benefits to another fund to avail the tax-free uplift whilst they are eligible. There is no black and white rule on what constitutes a ‘short period of time’. However, taking a page of reference from ATO ID 2015/19, the Commissioner confirmed in a case that medical certificates provided in November 2007 satisfied the condition to provide the tax concession for three subsequent payments, the last being made in April 2008.

Commencing an income stream

Where the superannuation disability benefit is to be taken as an income stream instead of a lump sum, the adjustment of the tax components by applying the taxuplift is not made to reflect the future service period. However, where the funds are rolled over to a disability income stream in another fund, it could increase the taxfree component of the income payments subsequently being received.

1 SIS regulations - reg 1.03C.

2 ITAA 1997 – s995-1

3 Untaxed element of the taxable lump sum component for those aged 60 and over are taxed at 15% plus Medicare Levy up to the untaxed plan cap and 45% plus Medicare Levy for over the untaxed plan cap.

4 Untaxed element of the income payment for those aged 60 and over are taxed at MTR (plus Medicare Levy) less 10% tax offset up to the Defined Benefit income cap and at MTR (plus Medicare Levy) over the Defined Benefit income cap.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.