What are the AGA Life Tables used for?

What are the AGA Life Tables used for?

Download the article below.

The Australian Government Actuary (AGA) releases the Australian Life Tables (ALT) every 5 years, with the most recent released on 1 January 2025 (the AGA 2020-22 ALT – see Table 1 below). These tables contain life expectancy factors that are used in various applications. Relevantly for retirement income streams, these life expectancy factors are used to determine:

- the deductible amount of non-superannuation sourced lifetime annuities,

- the maximum withdrawal periods for lifetime income streams for eligibility to the social security assets test concessions, and

- the maximum withdrawal period for a class of superannuation income streams – innovative superannuation income streams – in the superannuation regulations.

Deductible amount for tax purposes

The deductible amount is the amount of each regular payment from the annuity that broadly represents the return of the original investment capital. For lifetime annuities, it is calculated as:

The investor’s life expectancy (or relevant number) is based on the life expectancy factors in the relevant AGA ALT at the time the annuity commenced. For example, lifetime annuities that commenced from 1 January 2025 will use the most recent life expectancy factors from the AGA 2020-22 ALT. Annuities that commenced between 1 January 2020 and 31 December 2024 will use the AGA 2015-17 ALT.

Eligibility to the social security concessional assets test treatment

The government introduced new means testing rules for certain lifetime income streams, such as lifetime annuities, on 1 July 2019. Lifetime income streams that commenced on or after 1 July 2019 were subject to the new rules, while those that commenced prior are grandfathered under the previous rules.

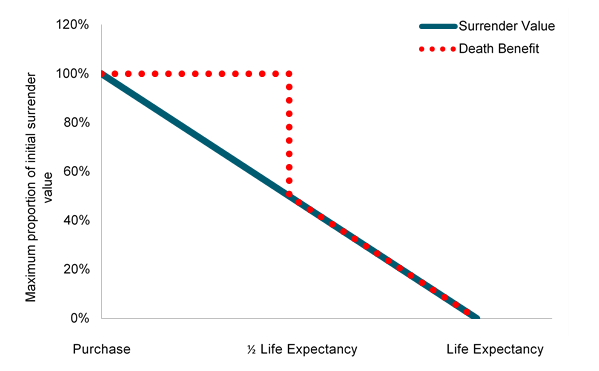

The new rules provided an asset test concession if the lifetime income stream does not provide surrender values and death benefits greater than certain limits. Chart 1 below illustrates these limits.

The surrender value limit is 100% of the initial purchase price and decreases on a straight-line basis to life expectancy. The death benefit limit is 100% of the initial purchase price up until half of life expectancy, at which point the death benefit limit drops to 50%. The death benefit limit then reduces on a straight-line basis to life expectancy, when the death benefit limit is zero. No surrender value or death benefit can be payable after life expectancy.

Chart 1: Social security surrender and death benefit limits for lifetime income streams

Source: Social Security Guide section 4.9.3.35

Life expectancy is the number of days based the life expectancy factors in the relevant AGA Life Tables for the investor at the assessment day (generally the commencement date of the income stream). For joint income streams, the life expectancy factor of the eldest is used. This is then rounded down to the nearest whole number of years and then converted back to a number of days based on 365 days in a year.

Lifetime income streams that comply with the above limits are assessed concessionally under the assets test.

Challenger Liquid Lifetime (flexible income) annuities commenced from 1 July 2019 complies with the above limits. As such their income and assets test assessment is as follows:

- Under the income test, 60% of the annuity’s regular payments is assessed. For deferred lifetime annuities, the above assessment will apply once income payments commence, i.e. no income assessment during the deferral period.

Under the assets test, 60% of the purchase price is assessable, reducing to 30% from age 85, subject to a minimum of 5 years under the 60% assessment. Where there is an eligible reversionary beneficiary nominated, they will inherit the primary investor’s assessment including the day the income stream’s asset assessment drops to 30%.

Age 85 (known as the threshold day) is also based on the AGA Life Tables and, as such, will change over time for future income streams – it was age 84 for lifetime income streams commenced prior to 1 January 2025.

Innovative superannuation income streams declining capital access schedule

To facilitate the development of innovative retirement income stream products, the Government introduced an alternate definition for a superannuation income stream in the Superannuation Regulations (SIS Regulations 1.06A). These regulations have been available since 1 July 2017 and require a declining access to capital but do not require minimum payments to be made in any year. Similar to the social security surrender value and death benefit limits above, the definitions limit the amount of capital that could accessed linearly from 100% of their purchase amount to nil at life expectancy with the ability for product providers to offer 100% death benefits during the first half of a person’s life expectancy. Life expectancy under this definition is also based on the life expectancy factors in AGA Life Tables at commencement of the income stream – see Table 1 below.

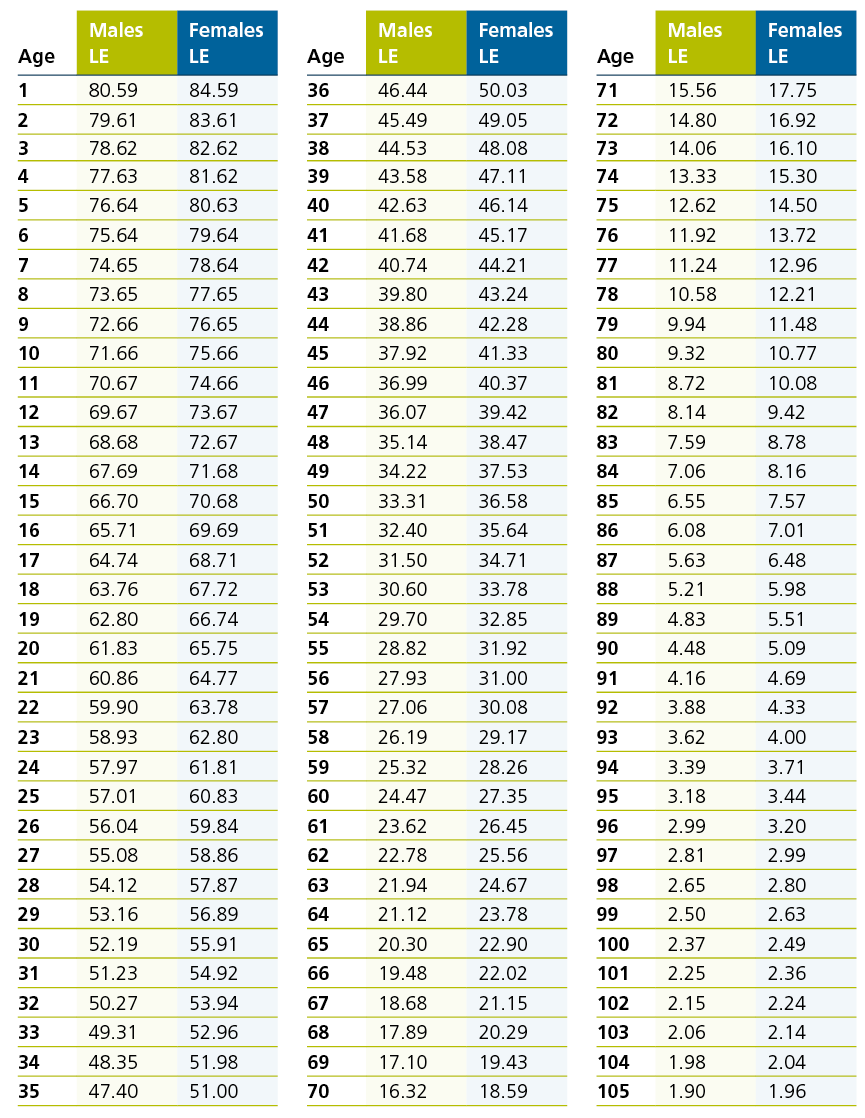

Table 1. Australian Government Actuary 2020-22 Australian Life Tables

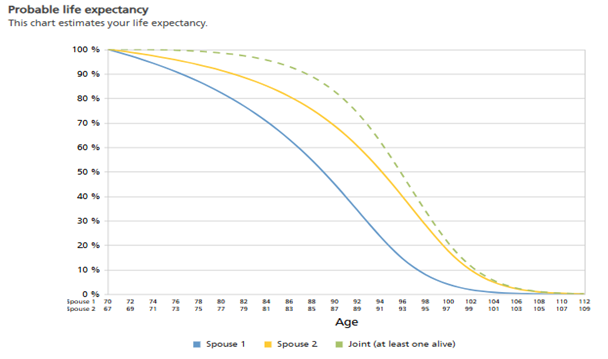

It is important to note that these life expectancy factors do not factor in mortality improvement overtime. AGA also publishes 25- and 125-year mortality improvement factors alongside their Life Tables. We can estimate ‘enhanced life expectancy’ by incorporating these mortality improvement factors into the life expectancy factors in Table 1. These ‘enhanced’ life expectancies can be a better estimate of retirement timeframes for clients. Furthermore, studies have shown that those in a relationship have longer life expectancies than their single counterparts, an important consideration when determining suitable timeframes for couples.

Challenger has calculated enhanced life expectancies including those for couples by incorporating the AGA’s 25-year mortality improvement factors into the life expectancy factors in Table 1. These enhanced life expectancies for specific ages are available and used in the Challenger Retirement Illustrator – See example in Chart 2 below.

Chart 1: Probable life expectancy of a 70 year old male and 67 year old female

Source: Challenger Retirement Illustrator

1For joint policies or policies with a reversionary beneficiary, the longest life expectancy of the two investors is used to calculate the deductible amount.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.