What makes today’s lifetime annuities different?

What makes today’s lifetime annuities different?

Download the article below.

Modern lifetime annuities have many new features that make them different and more flexible than annuities of the past. These features can also be tailored so that they can meet specific needs of a much broader range of retirees.

This month’s article discusses five features of modern lifetime annuities and how they can benefit different types of retirees. Lifetime annuities mentioned in this article refer to Challenger’s Liquid Lifetime annuity. Additional information on these lifetime annuities can be found in the Product Disclosure Statement (PDS).

Access to capital and death benefits

Today’s lifetime annuities can provide a withdrawal/death benefit period over a long period of time after commencement, for example Challenger’s lifetime annuity provides a withdrawal and death benefit period equal to the investor’s life expectancy1.

The long withdrawal period provides the flexibility to withdraw and receive a lump sum when there has been an unexpected change in a retiree’s circumstances which makes a lifetime income stream no longer appropriate. The maximum lump sum payable is a reducing amount starting at 100% of the investment amount at commencement and gradually reduces to nil at the end of the withdrawal period.

The death benefit period provides a death benefit of 100% of the investment amount during the first half (rounded down to the whole number) of the death benefit period. A reducing death benefit is payable for the remainder of that period. The 100% death benefit period ensures capital is not lost if the investor unexpectedly dies shortly after commencing the annuity.

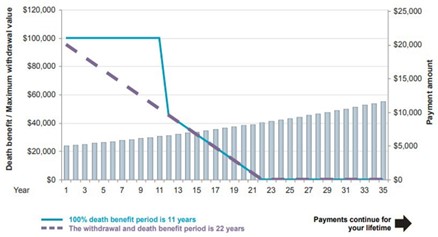

Below is an illustrated example of the withdrawal and death benefit period for a female investor who is age 65.

The withdrawal and death benefit periods for this investor are 22 years. The investor can choose to withdraw at any time during the 22-year withdrawal period and receive a lump sum up to the maximum withdrawal value (dotted line). If this investor dies in the first 11 years and did not nominate a reversionary beneficiary, 100% of their investment amount ($100,000 in this example) is paid to their estate or nominated beneficiary.

Source: Challenger Liquid Lifetime quote as at 01/05/2025 for a female age 65 with payments indexed to CPI.

Flexibility to remove the withdrawal/death benefit period

Investors have the flexibility (at the time they invest) to remove the withdrawal and death benefit period in return for a higher starting annuity payment. This option can be attractive to retirees wanting to maximise their income, particularly those who may not have any beneficiaries or dependants. This option can also be attractive to those wanting to provide lifetime income to a dependant without the ability for them to access the capital, for example investing in a non-superannuation Liquid Lifetime in the name of spend thrift beneficiaries or those who may have a gambling addiction.

Centrelink/DVA assessment has changed

Changes to the social security treatment of lifetime income streams effective 1 July 2019 means that the previous deduction amount methodology no longer applies from this date. However, lifetime income streams that commenced prior to this date are grandfathered under the old rules.

The Centrelink/DVA assessment of lifetime income streams from 1 July 2019 provides an immediate concession under the assets and income tests for income streams that comply with the Government’s declining Capital Access Schedule (CAS). Challenger’s lifetime annuity complies with CAS and has the following assessment.

- Under the assets test, only 60% of the investment amount is assessed until age 85 subject to a minimum of 5 years, and then 30% of the investment amount thereafter.

- Under the income test, only 60% of the regular payment is assessed.

This can be particularly useful for clients wanting to reduce assessable assets for social security purposes and increase their Age Pension entitlement. It can also be useful for self-funded retirees who currently exceed the assets test cut-off limits.

The concessional asset test assessment can help reduce their assessable assets to fall below cut-off limits and achieve a part pension including accessing the benefits from the Pensioner Concession Card.

Exposure to investment markets

Regular payments from lifetime annuities have traditionally been fixed or CPI-linked. With recent changes to superannuation rules and product innovation, regular payments from lifetime annuities can be linked to movements (up and down) in equity markets. As a result, investors can benefit from a source of lifetime income with the potential for their regular payments to increase significantly due to traditionally higher long-term returns from equity markets.

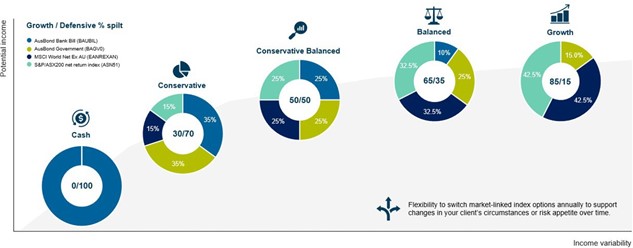

Challenger’s market-linked lifetime annuity guarantees regular payments for the investor’s lifetime and allows them to have their regular payments change in line with movements in five market indices (these are summarised in the chart below). There is also the flexibility for investors to switch indices over time to support changes in their circumstances and/or risk appetite over their lifetime.

Market-linked lifetime annuities can be attractive to clients who value a source of lifetime income but have a higher risk appetite, or those who may be comfortable with trading off some certainty to maximise their income later in life.

Example

Sonja, age 67, has a higher risk appetite than a typical retiree, believing in the prospect of higher long-term returns from ‘growth’ asset classes. She is comfortable with an asset allocation of 65/35 growth/defensive and the potential level of volatility that comes with this level of exposure to growth assets.

She is a single homeowner with $400,000 in superannuation savings and understands that based on her income objective of $52,000 p.a. to achieve her desired lifestyle, her retirement savings may not last her lifetime.

She is keen to have another source of lifetime income to supplement any Age Pension she may be entitled to and is comfortable to dedicate 30% of her superannuation for this purpose. The idea that income payments move in line with the performance of a market index is attractive to her - she likes the idea that she could potentially maximise her income later in life, at a time when her retirement savings may have depleted.

Sonja’s financial planner recommends investing 30% of her superannuation into Challenger’s market-linked lifetime annuity with payments linked to the ‘Balanced’ option that has an asset allocation of 65/35 growth/defensive to maintain her overall asset allocation. Her remaining superannuation savings are to be invested in to an account-based pension providing her with the flexibility to adjust her level of income to meet her needs.

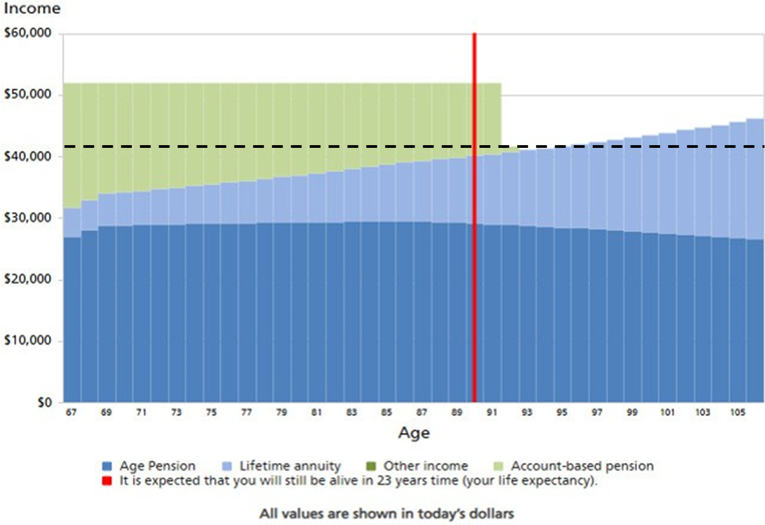

Chart 1 below projects Sonja’s retirement income (in today’s dollars) over time using Challenger’s Retirement Illustrator, available to advisers via AdviserOnline. The projections are based on the tool’s default fixed return assumptions of 6.26% p.a. for the market-linked lifetime annuity’s Balanced option and 8% p.a. and 4% p.a. before fees for the growth and defensive portions of the account-based pension respectively. For all other assumptions refer to the Illustrator’s assumptions guide.

Chart 1: Sonja’s projected income with a 30% allocation to Challenger’s market-linked lifetime annuity.

Based on the above assumptions, Sonja is expected to still be able to achieve combined income from the annuity and the Age Pension of over $40,000 p.a. (in today’s dollars) when her account-based pension has depleted.

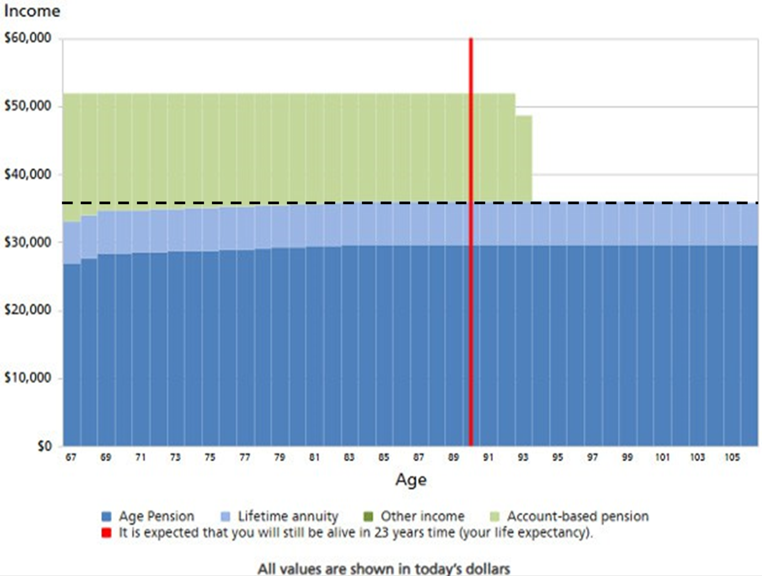

This compares to approximately $36,000 p.a. (in today’s dollars) of combined income if she had invested in a lifetime annuity indexed to the consumer price index (CPI) instead (Chart 2 below).

It is important to note however that this illustration is based on fixed market returns and do not take into account market volatility. Regular payments from a market linked lifetime annuity can also fall if the performance of the chosen market index is negative. Sonja is trading off a level of certainty that comes with a CPI-linked annuity with the potential of higher income in the long term. If Sonja experiences periods of prolonged poor market returns, her combined annuity and Age Pension income under the market-linked annuity scenario can fall below that of the CPI-indexed annuity scenario.

Chart 2: Sonja’s projected income with a 30% allocation to Challenger’s CPI-indexed lifetime annuity

Income can be deferred for a chosen period

Today’s lifetime annuities allow investors to choose when their payments start. They could choose to have one commence immediately or deferred for a number of years before they start receiving their first payment.

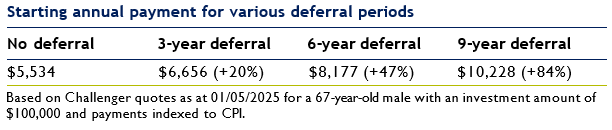

The main benefit with deferring payments is the significantly higher starting payment once they commence. The table below summarises the starting payment for a 67-year old male investing $100,000 into a Challenger lifetime annuity across various deferral periods. For example, if this particular investor chose to receive their payments immediately, they would receive $5,534 p.a. indexed to CPI for life. However, if they instead chose to defer the commencement of their regular payments for 6 years, their starting payment would be 47% higher and would receive $8,177 p.a. (in today’s dollars) in the 7th year indexed to CPI for life.

The ability to defer payments can be attractive to those who are still working. These clients would typically choose a deferral period equal to the number of years they plan on working since they won’t require income from the annuity (they typically have access to other sources of income to meet their needs - work income, required minimum pension payments from their account-based pension, and any social security entitlements). This would allow them to commence a tax-effective retirement phase superannuation income stream and not be required to drawdown a minimum amount each year. In return they would be able to maximise the income they would receive once payments commence and be able to reduce drawdowns from their other income streams at that time.

For those who are on a part Age Pension whilst working past age 67 (particularly those working part time), a deferred superannuation lifetime annuity can help reduce assessable income and increase Age Pension entitlements. As no income is being received during the deferral period, no income is assessed from the annuity (it is not subject to deeming). This compares to deemed income if retirement savings were left in an account-based pension or left in accumulation phase.

Income can be indexed to more than just CPI

Modern lifetime annuities provide investors with a range of choices when deciding how they would like their regular payments indexed over time. These choices allow today’s lifetime annuities to be tailored to suit various client preferences.

Non-market linked Challenger lifetime annuities, whether payments start immediately or deferred, can have their regular payments fixed and remain constant for life or indexed based on:

Changes to CPI

Regular payments will change annually so that they keep pace with changes in the CPI. Payments will be indexed after each anniversary of the start of the policy, i.e. the first payment to be indexed will be the 13th monthly payment.

If the change in CPI is positive, regular payments will increase, however, if the change in CPI is negative payments will reduce.

Partial changes to CPI

Regular payments will change annually in line with any increase in the CPI that is greater than 2%.

For example, if the change in CPI is 3%, payments will increase by 1%. If the change in CPI is between zero and 2%, payments will be unchanged. If the change in CPI is negative, payments will reduce by the negative CPI amount. i.e. if the change in CPI was

-1%, regular payments would reduce by -1% and not -3%.

Changes to the Reserve Bank of Australia’s (RBA) cash rate

Regular payments will change whenever there is a change in the RBA cash rate. This means regular payments can change a number of times throughout the year. Regular payments will change in line with the change in the RBA cash rate, whether that is an increase or decrease.

Having payments linked to CPI can suit those who prefer certainty, particularly where the annuity income is earmarked for their essentials. Partial CPI can be suitable for those who believe their need for the annuity’s income will likely fall in their later years but want to protect themselves against periods of very high inflation. Partial CPI or fixed payments can also be suitable for those who are utilizing other means to protect themselves against inflation. Finally, payments linked to movements in the RBA cash rate can be suitable for those who may not want to ‘miss out’ on any increase to interest rates.

1 Life expectancy based on the Australian Government Actuary’s Life Tables at commencement rounded down to the whole number and capped at 27 years.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.