NCC, TSB, TBC & SG - what's changing from 1 July 2025 in super?

.png?h=540&iar=0&w=680)

NCC, TSB, TBC & SG - what's changing from 1 July 2025 in super?

Download the article below.

With the start of financial year 2025-26, there are a few changes relating to superannuation which impact contributions and commencements of pensions. Routine indexation brings about new dynamics and advice considerations for clients. In this article, we take you through some of these changes and discuss the impact on common advice issues relating to superannuation contributions and pension phase commencements.

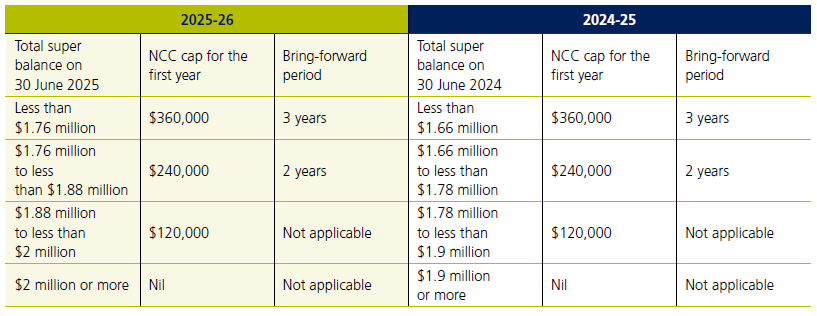

Non-concessional contributions cap – annual cap of $120,000

In 2025-26, there is no change to the annual non-concessional contributions (NCC) cap of $120,000 nor the bring-forward amount of $360,000. However, there is a change to the total super balance thresholds affecting how much NCCs can be made, including when contributions can be made under the bring-forward arrangements.

The total super balance (TSB) thresholds to be eligible to make non-concessional contributions are linked to the general transfer balance cap. The full three year bring-forward arrangement is available to those whose total super balance is less than $1.76 million (general transfer balance cap less two times the non-concessional contributions cap). A client’s NCC cap is nil if their total super balance is equal to or more than the general transfer balance cap.

While there may have been clients who have been unable to make desired contributions due to their relatively high TSB, the increase in TSB thresholds may allow an opportunity to revisit their eligibility to make NCCs. This could apply not only in this financial year but also in future years, with the indexation of both the NCC cap and TSB thresholds, provided they are under the age of 75.

The increase in the TSB thresholds to make NCCs also affects eligibility for:

- Spouse contribution tax rebate where the receiving spouse’s total super balance needs to be less than $2 million

- Government co-contributions

Clients can check myGov for details of their TSB including whether they are within a bring-forward period.

When would the NCC cap be indexed next?

The NCC cap is four times the annual concessional contributions (CC) cap (currently $30,000). The CC cap is increased in increments of $2,500. If Average Weekly Ordinary Time Earnings (AWOTE) increases by around 0.90% from December 2024 to December 2025, then the CC cap is anticipated to increase to $32,500 on 1 July 2026. On the other hand, if AWOTE was to increase by 8.66% for the same period, the CC cap will be $35,000 (and therefore NCC annual cap of $140,000) but based on softer increase in wages, this seems unlikely.

Therefore, the NCC annual cap is likely to be $130,000 and the 3 year bring-forward amount $390,000 in 2026-27. It’s worth noting that once the client has triggered the bring-forward arrangement, they cannot benefit from the NCC cap being indexed during the bring-forward period. That is, if the client contributes $360,000 in the current financial year and if the annual NCC cap does increase to $130,000 next financial year (and therefore the bring-forward amount increases to $390,000), they cannot make a further NCC of $30,000 during the next two financial years. Instead, they will have to wait until 1 July 2028 to assess whether any further NCCs can be made subject to their age and TSB on 30 June 2028.

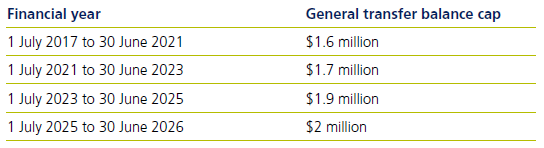

General transfer balance cap - $2 million

The transfer balance cap from 1 July 2025 is $2 million, an increase of $100,000 from 2024-25. This means that those who have commenced retirement phase income streams for the first time on or after 1 July 2025 will generally be able to commence retirement phase income streams with balances of up to $2 million.

However, clients who commenced retirement phase income streams before 1 July 2025 may have a personal transfer balance cap anywhere between $1.6 million and less than $2 million depending on the highest transfer balance cap used since 1 July 2017.

The increase to the personal transfer balance cap is affected by the rules relating to proportional indexation.

Proportional indexation

The transfer balance cap started out at $1.6 million on 1 July 2017 and has steadily increased to $2 million on 1 July 2025. The benefit of any increase of the general transfer balance cap for the client is based on the highest amount of the used transfer balance cap since 1 July 2017.

Clients who have fully used the transfer balance cap in a relevant year will not benefit from any indexation of the cap.

Clients who have started retirement phase income streams prior to 1 July 2025 and wish to commence income streams from additional monies may need to understand their personal transfer balance cap. This cap is determined by their transfer balance account (credits and debits) and increases in their personal transfer balance cap due to proportional indexation. Records available through myGov may assist to understand client’s personal transfer balance cap.

The ATO has advised that the updated proportionally indexed personal transfer balance caps are expected to display on myGov from 11 July 2025.

Example – proportional indexation

Shubhman started a retirement phase income stream with a value of $1.2 million on 1 October 2018. The transfer balance cap at that time was $1.6 million. He has not commenced any other retirement phase income stream since then. When the transfer balance cap indexed by $100,000 to $1.7 million on 1 July 2021, Shubhman received a $25,000 increase to his transfer balance cap (representing 25% of the unused $1.6 million transfer balance cap). This meant that he could start new income streams with $425,000 at that time.

When the transfer balance indexed by $200,000 to $1.9 million on 1 July 2021, Shubhman received a $50,000 increase to his transfer balance cap (25% of $200,000) which means that, effectively he could start new income streams with $475,000 at that time.

When the transfer balance cap indexed by a further $100,000 on 1 July 2025 to $2 million, Shubhman received a further $25,000 increase to his transfer balance cap, effectively meaning that he could start new income streams with $500,000 from 1 July 2025.

The increase in the client’s personal transfer balance cap through routine indexation may not be relevant for those who are not going to add to their superannuation holdings and who will always be below their transfer balance cap. However, it may be particularly relevant for those who are going to inherit death benefit pensions or make future non-concessional contributions and downsizer contributions.

For further details on proportional indexation, please refer to this ATO link.

When would the transfer balance cap be indexed?

The transfer balance cap is indexed to the consumer price index (CPI) in increments of $100,000. For the next indexation of the transfer balance cap by an additional $100,000, CPI would need to increase by around 3.6% from December 2024 to December 2025 for the general transfer balance cap to increase to $2.1 million on 1 July 2026.

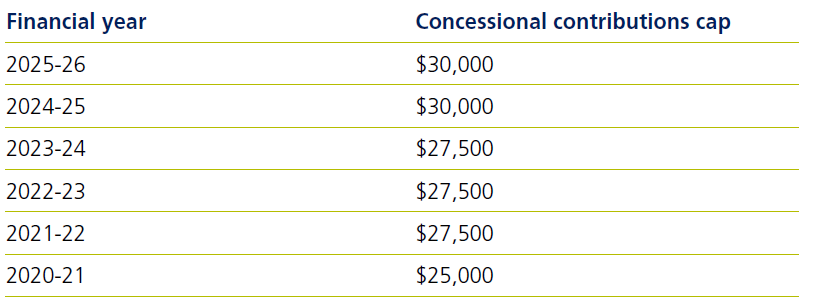

Carry forward of unused concessional contributions

The carry forward of unused concessional contributions provides an opportunity to use the concessional contributions from the current year in addition to the unused amounts of concessional contributions for the last five financial years, for those who have a TSB of less than $500,000 at the end of the previous financial year.

This means that a client who has not used any amount of the concessional contributions cap for the last five financial years could have a concessional contributions cap of up to $167,500 in 2025-26.

In accordance with the usual rules, amongst other things, clients will need to:

- Meet the superannuation work test of 40 hours over a consecutive 30 day period if aged 67 or over at the time of the contribution or meet the one-off work test exemption if they met the work test last financial year and TSB is less than $300,000

- Provide the Notice of Intent to their super fund within the required timeframes if making personal deductible contributions

- Consider that the tax deduction cannot reduce their taxable income below nil although in terms of deciding how much to claim as a tax-deduction, the effective tax-free thresholds are usually considered

- If the client’s assessed income and concessional contributions for Div 293 purposes exceed $250,000, they may be liable for Division 293 tax, which is an additional 15% tax on low-taxed contributions (that is, contributions within the client’s

CC cap)

myGov can also be used to gauge the client’s unused concessional contributions cap for the last five financial years.

Defined benefit income cap

The defined benefit income cap affects the taxation of superannuation capped defined benefit income streams in excess of certain thresholds. The defined benefit income cap will increase to $125,000 in 2025-26, an increase from $118,750 in 2024-25.

The increase in the defined benefit income cap of $6,250 may allow for a reduction in personal income tax for clients with high value defined benefit income streams or certain complying legacy pensions.

The defined benefit income cap is equal to the general transfer balance cap divided by 16 and therefore will increase every time the general transfer balance cap increases in the future.

As the defined benefit income cap increases, it may mean that clients with capped defined benefit income streams of greater than $118,750 may either have less taxable income to declare if they receive income from a taxed capped defined benefit income stream or receive 10% rebate on a higher amount.

For further detail on taxation of capped defined benefit income streams and defined benefit income cap, please refer to this link.

Superannuation Guarantee

From 1 July 2025, Superannuation Guarantee (SG) will be 12%, reaching its peak from the legislated incremental increase which started from 1 July 2013.

Due to an additional 0.5% SG, clients may need to review the level of their CCs to ensure that they are within the CC cap.

Maximum contribution base – Superannuation Guarantee

The maximum contribution base is the limit on quarterly ordinary times earnings on which an employer is compulsorily obliged to pay Superannuation Guarantee (SG). The maximum contribution base can’t result in the client exceeding the CC cap.

With the SG increasing to 12% from 1 July 2025, it has meant that there is a reduction in the maximum contribution base from the previous year. The maximum contribution base in 2025-26 is $62,500 per quarter or an annualised income of $250,000.

Division 296 tax – hasn’t been legislated yet

Division 296 tax seeks to impose 15% tax on growth in TSB on a proportion in excess of $3 million. This new tax was intended to commence from 1 July 2025. This proposal has not yet been legislated.

While legislation was introduced to Parliament late last year, it lapsed when the election was called in March 2025. Since the election, the Government has announced it intends to re-introduce a Bill to implement Division 296. With Parliament sitting again from 22 July 2025, we will keep advisers informed when this proposal is legislated.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.