Macro Musing: When doves cry

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

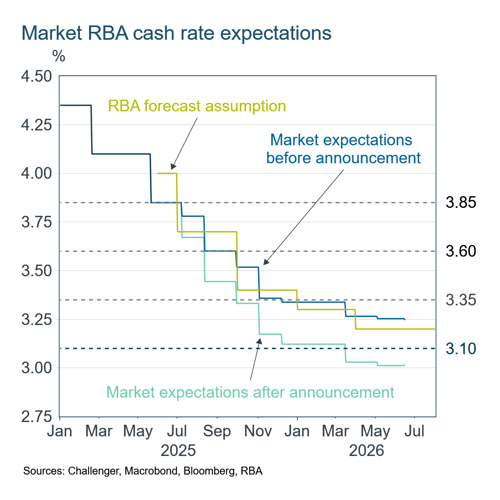

The market took the RBA’s rate cut this week as being dovish, in contrast to the expected ‘hawkish cut’. This led to a fall in the expected path of the cash rate, dragging down the Aussie dollar and other interest rates. But the market is either getting carried away with expectations of accelerated cuts, or it is clinging to pessimism driven by the Trump tariff turmoil.

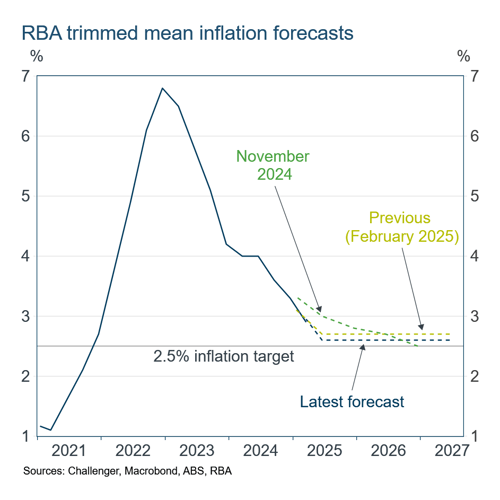

The RBA revised down its trimmed mean inflation forecasts slightly, from 2.7% to 2.6%. When the RBA cut in February, the Governor noted that forecast inflation was flat at 2.7%, above the 2.5% target, and so interest rates were unlikely to be able to decline as fast as assumed in the (market) path used in their forecasts.

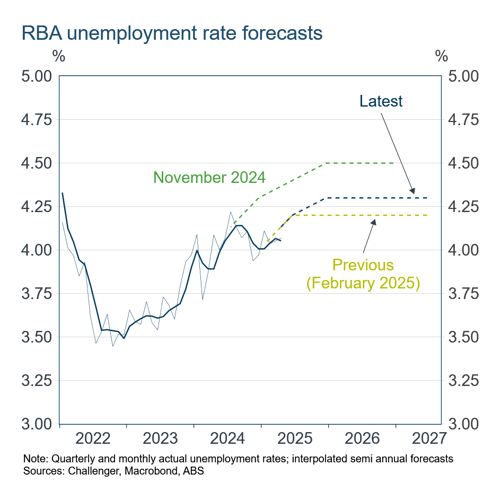

This week the RBA revised its forecasts for the unemployment rate a little higher, but still significantly below its forecasts at the end of last year. This reflects changes in the expected growth of the economy, but also that, like everybody, they are uncertain how tight the labour market is and what unemployment rate will stabilise inflation.

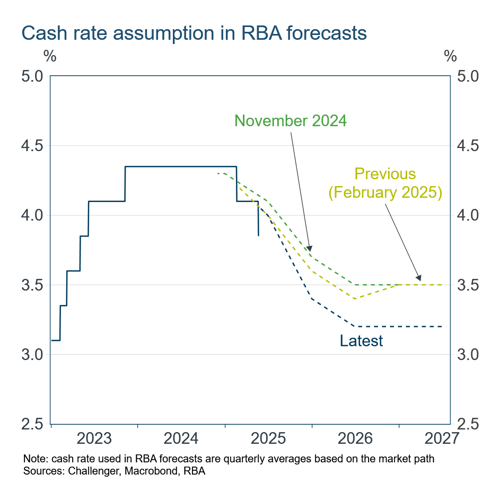

The latest RBA forecasts used a lower cash rate path than the February and November forecasts, one that was very similar to the market path immediately before the announcement. The cash rate path used in the RBA forecasts is based on market expectations, taken a week or so before the forecasts are published. The inflation and unemployment forecasts can then give a guide as to whether the cash rate path used in the forecasts would achieve the RBA’s goals.

However, after the RBA’s announcement of the May cash rate cut, the market became more dovish with an additional cut priced in by the end of the year. The market is now pricing almost three further cuts this year. This new market path is lower than the one used by the RBA that forecast inflation of 2.6%, which is still just above the RBA’s inflation target.

There are two likely explanations. Either the market over-reacted, not recognising that the RBA’s ‘dovish’ assessment was based on an already lower cash rate profile than its previous forecasts. Or, the market is still pricing some chance that a lower cash rate than the RBA’s central path will be needed because the Trump tariff turmoil will cause a sharper economic slowdown which will spill over to Australia. With indications that extremely high tariffs, and so stalling growth are less likely, it seems the market has over-reacted. Two further rate cuts this year still seems more likely than three.