Why central banks are buying gold amid soaring prices

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

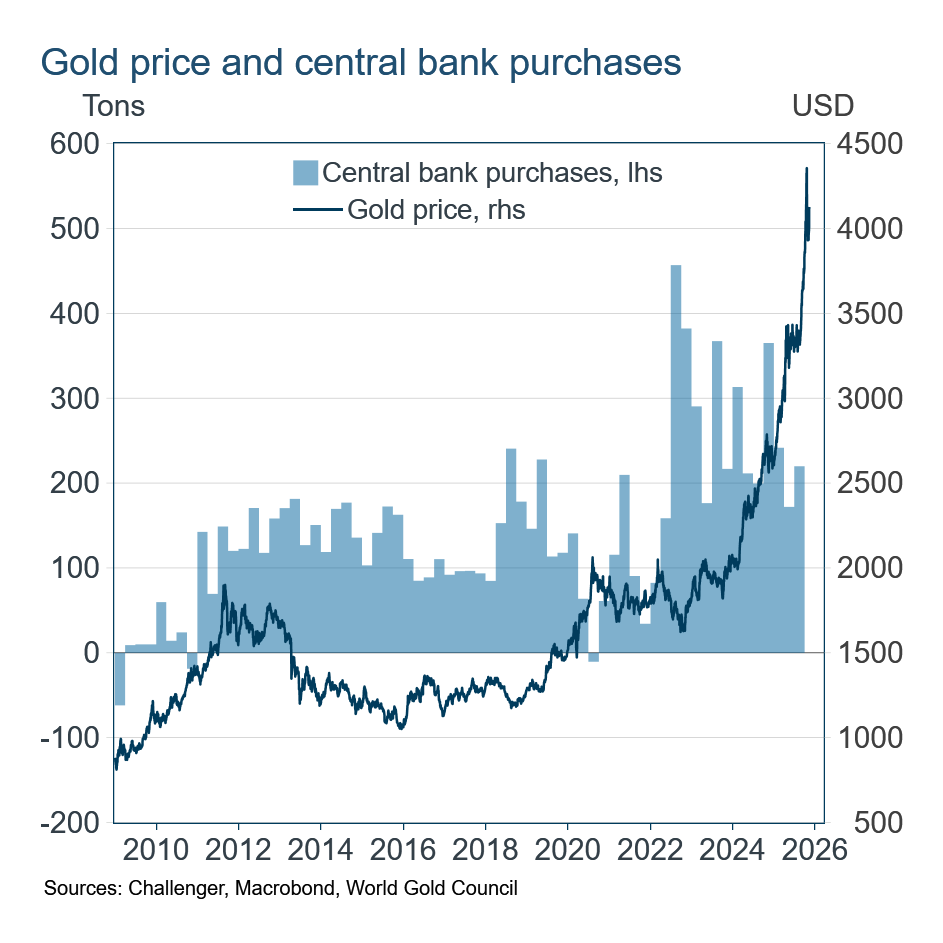

The price of gold has soared to peak at US$4,400 in October, and even after retracing some gains, at US$4,100 it has still doubled since the start of 2024. In the list of drivers for this stunning increase, purchases by central banks are often near the top. However, their role, and why they have been buying gold, is more nuanced than often suggested.

Central bank purchases of gold increased substantially in early 2022. For the first two years of their higher rate of purchases the gold price dipped and rebounded, but was little changed in net terms. Since early 2024 as the price of gold has increased rapidly, central banks have continued to buy large quantities of gold, although at a slightly lower rate, averaging 246 tons per quarter, compared to 266 tons per quarter in the preceding two years, 2022-2023.

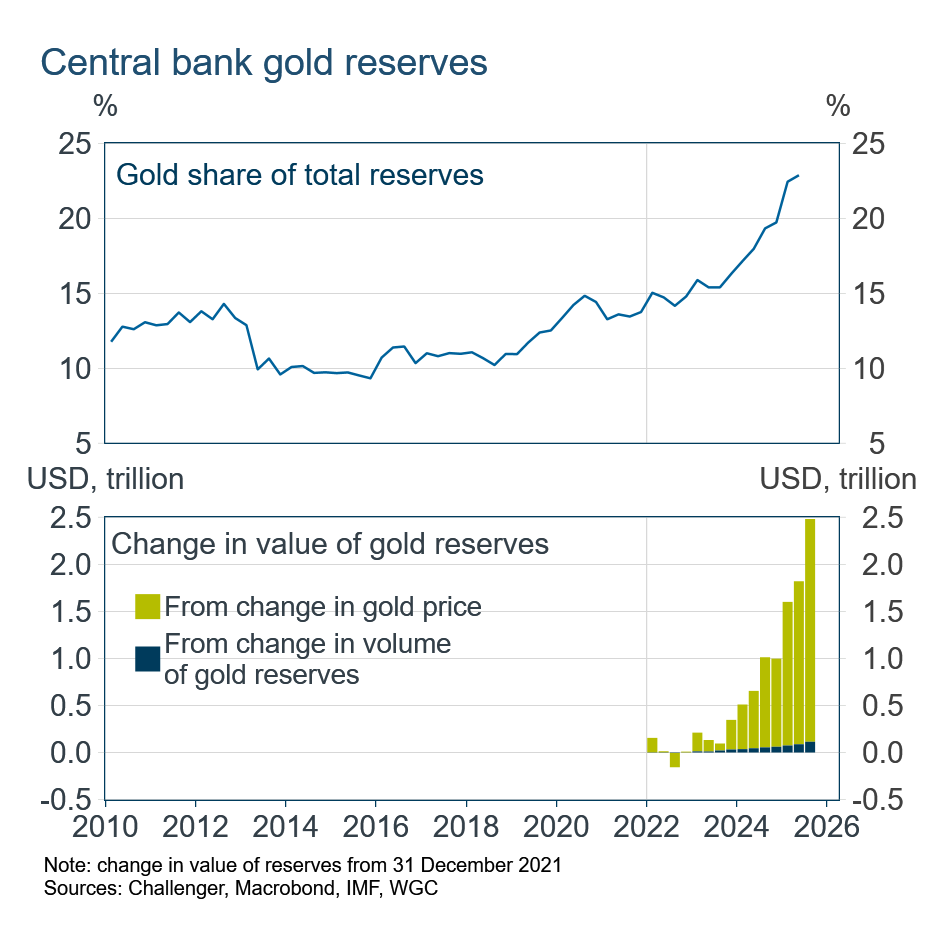

Some commentators have pointed to the substantial increase of the share of gold in central bank reserves as evidence of their role in pushing the gold price higher. Gold has increased to 23% of central banks’ reserves, up from 10-15% in the decade leading up to 2022. However, over 95% of gold’s increased share of reserves is a result of the higher gold price increasing the valuation of their existing holdings. Purchases of gold account for less than 5% of the increase in the value of central banks’ gold holdings.

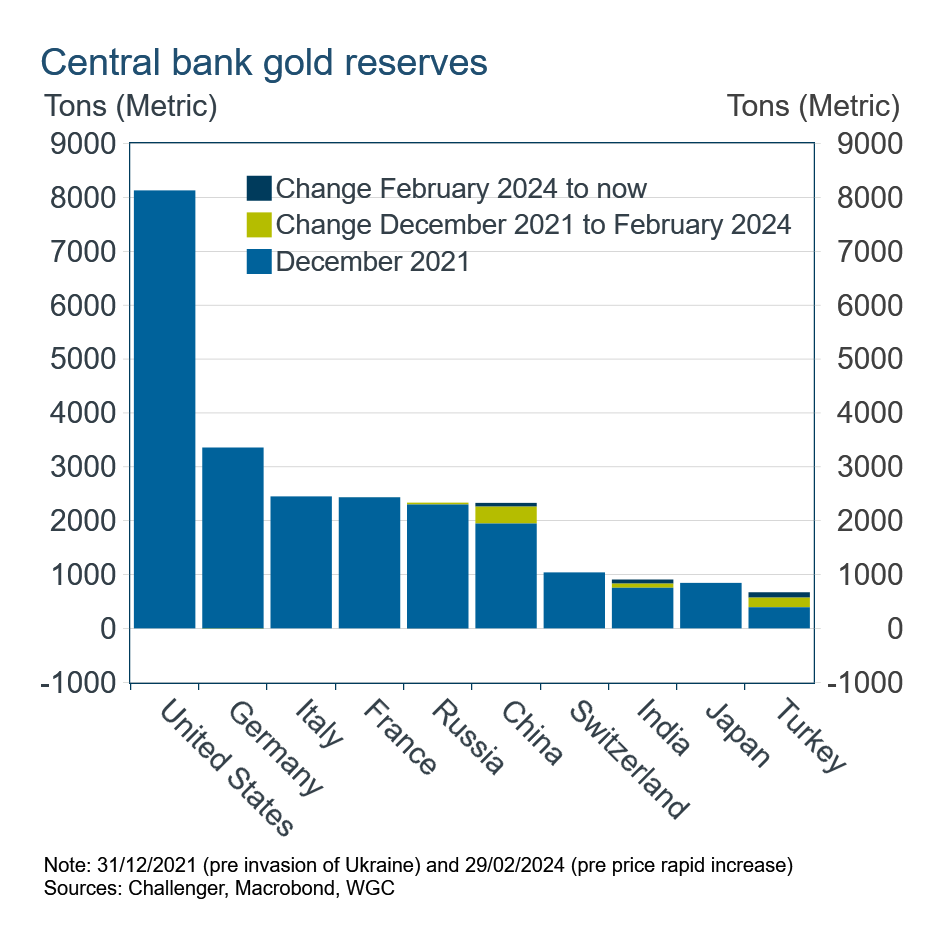

The central banks with the largest gold holdings, and so who have benefited most from the increase in the gold price, are the United States, large European countries (Germany, Italy and France), Russia and China. Of the largest holders of gold, only China, India and Turkey have made significant purchases of gold in recent years. The Reserve Bank of Australia owns little gold, having reduced its holdings significantly in the late 1990s.

Russia’s invasion of Ukraine in February 2022 resulted in the imposition of financial sanctions on Russia including impounding their foreign currency reserves. That has been cited as the impetus for central banks purchasing gold, a reserve asset which can be located so that it cannot be impounded by the United States and its allies.

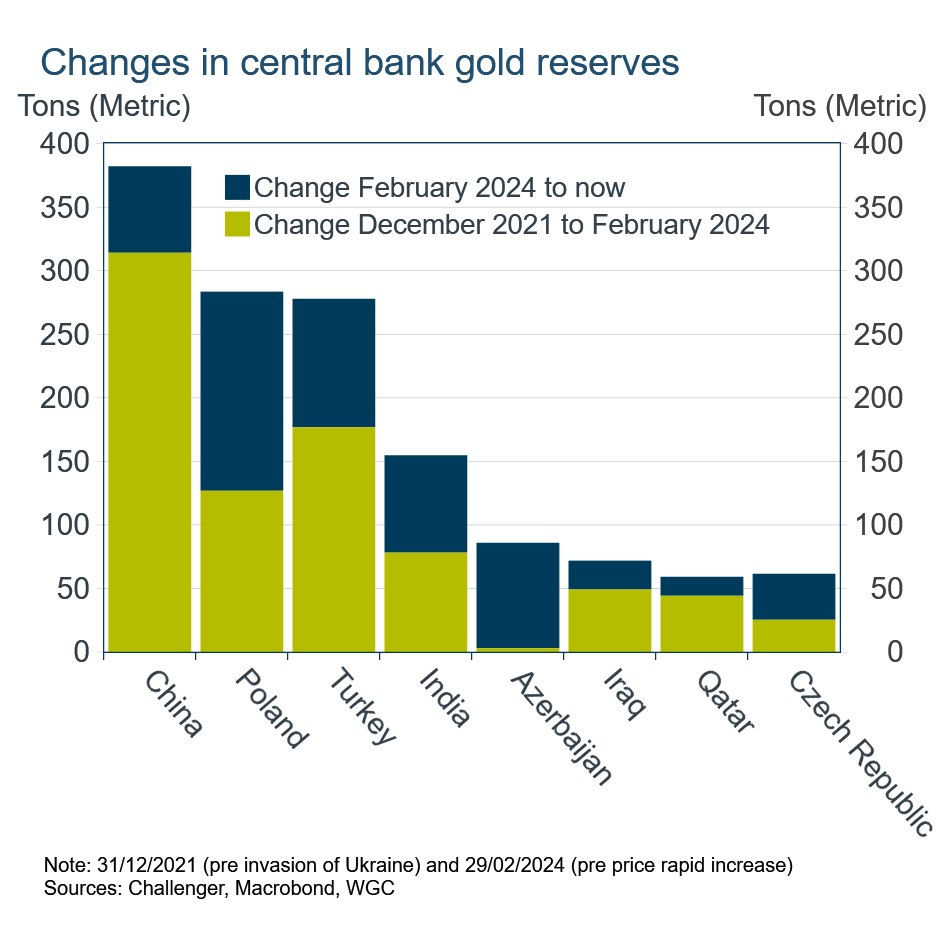

However, while China has been the biggest buyer of gold, several of the largest purchasers are US allies, notably NATO members Poland, Turkey and the Czech Republic, and also Qatar. Another possible explanation for increased gold holdings is a desire to diversify away from foreign currency, in particular the US dollar which is the largest reserve currency, given the large and growing US debt. The increase in central bank gold purchases started before the election of President Trump. The drivers appear wider than concerns about the US dollar’s role as the United States pulls back from global trade and various international organisations.

Overall, while central banks’ gold purchases have undoubtedly put upward pressure on the price of gold they appear to largely have been beneficiaries, rather than the main drivers, of the higher gold price. And while concerns about the potential for foreign currency reserves to be impounded may have played a role in central banks increasing their gold holdings, a more general desire to diversify reserve assets appears to have been important.