Pharmaceuticals: Hit me with your best shot

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

The past few years has been a wild ride for pharmaceutical stocks given the Covid-19 pandemic and the development of weight loss drugs. Picking winners is hard, and what looked like a good-thing for investors at one time can quickly sour.

The development of vaccines for Covid-19 was unprecedented. The first Covid-19 vaccines were rolled out just over a year after the first cases were identified, compared to the norm of 10-15 years. No vaccine had ever been developed for a coronavirus before, including for prominent viruses SARS (2003) and MERS (2012).

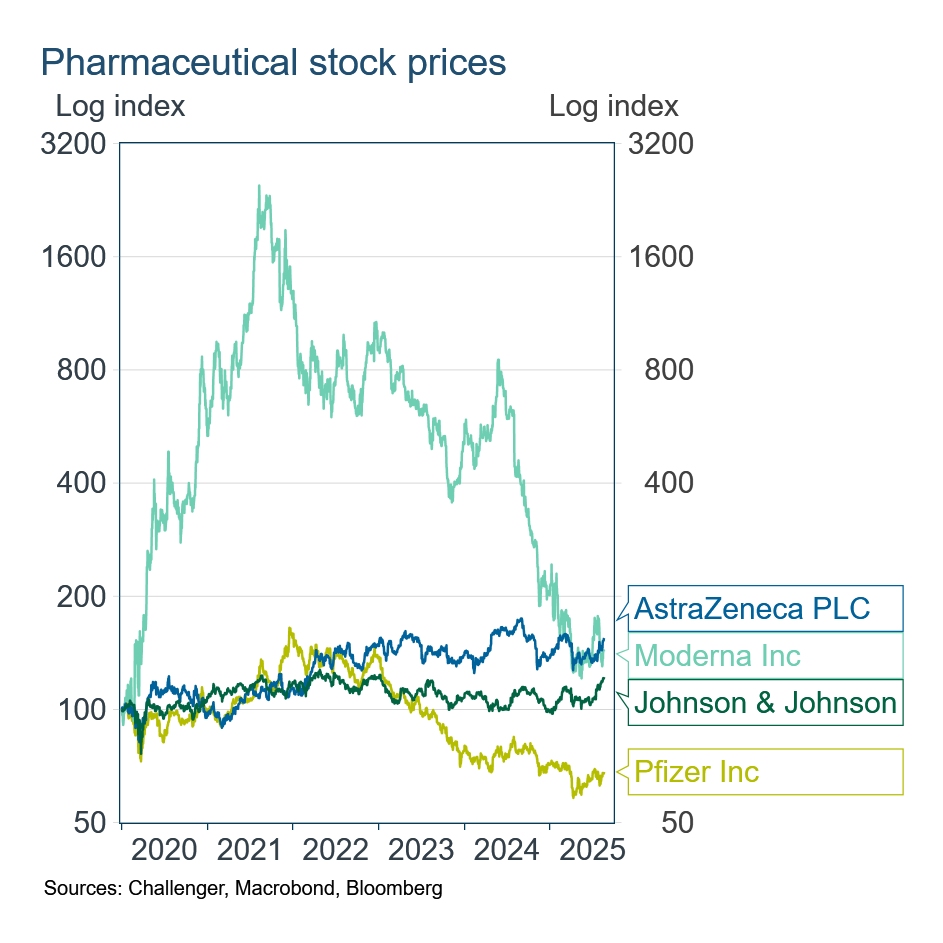

Given this, and the devastating effects of Covid-19 on people and economic activity, the prices of leading pharma companies that developed vaccines surged. The runup was absolutely massive for Moderna, which used the new mRNA technology, with its price peaking in August 2021 at 24 times its price at the start of 2020. Pfizer, who also developed an mRNA vaccine, saw a 65% increase in its stock price. Both companies’ prices have since collapsed, with Moderna down 95%.

AstraZeneca and Johnson & Johnson, whose Covid-19 vaccines used more traditional techniques rather than the new mRNA technology and have more diversified businesses, had much smaller increases, but also much smaller falls. Sometimes the tortoise beats the hare: AstraZeneca has outperformed Moderna, and Johnson & Johnson is well ahead of Pfizer

As the pandemic faded into the review mirror, new miracle weight loss drugs came in to focus. These GLP–1 drugs are seen to have a huge market given obesity levels in many countries. The drugs mimic a hormone people naturally produce and slow digestion and reduce the desire to eat.

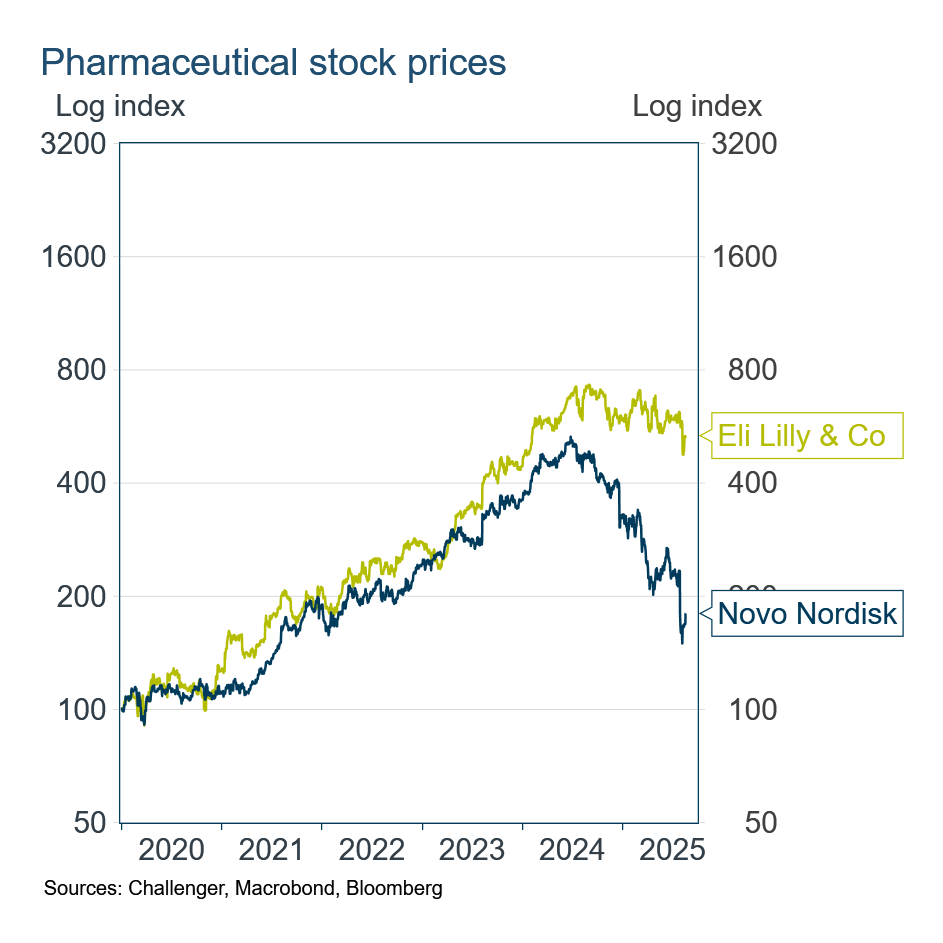

The stock prices of the major producers Novo Nordisk (producer of Wegovy and Saxenda) and Eli Lilly (Zepbound and Mounjaro) had a long runup increasing 5 to 7 times through to 2024, before gravity took hold. Increased competition and failure to rapidly expand supply have resulted in lower expected revenue, and share prices.

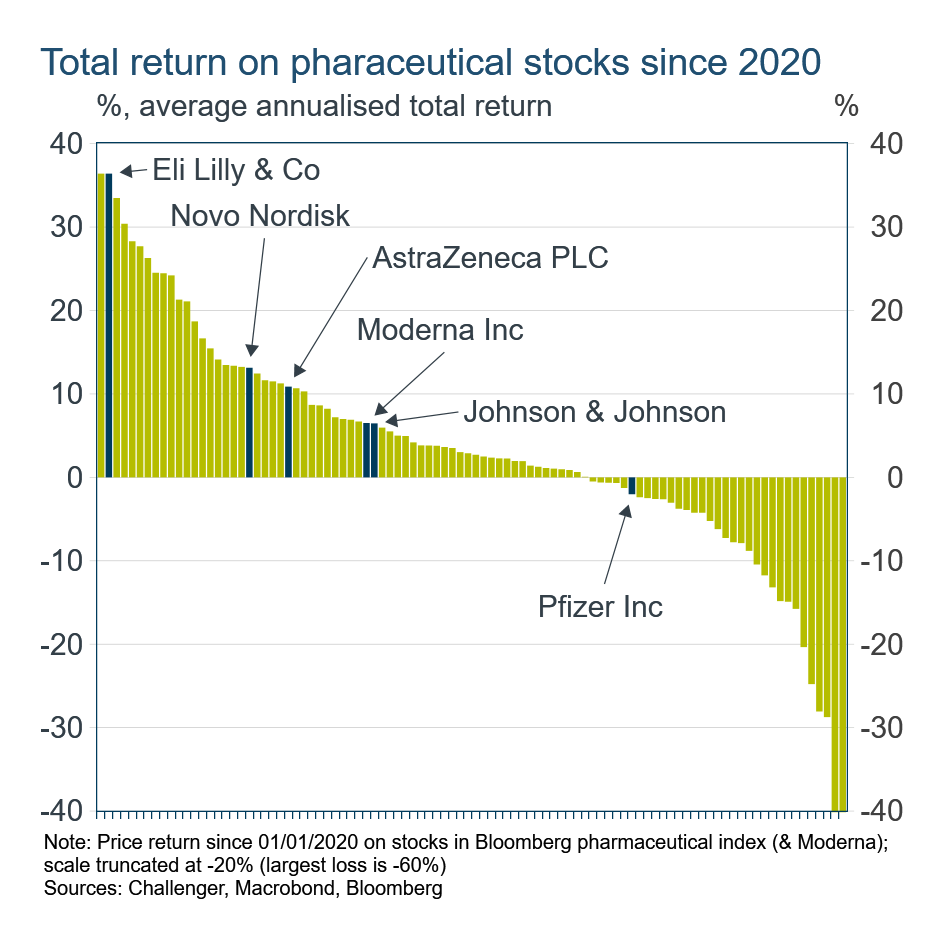

While Eli Lilly, the largest pharma stock, has still returned an impressive 36% annualised total return since the start of 2020, the returns for the other pharma companies have been much more modest at 6-13% and Pfizer giving a negative return over this time.

With the US and other equity markets looking expensive given historically high PE ratios and other benchmarks, the experience of pharma companies whose earnings has failed to live up to inflated expectations is worth reflection. This is particularly so when it comes to the prices of AI-related stocks.

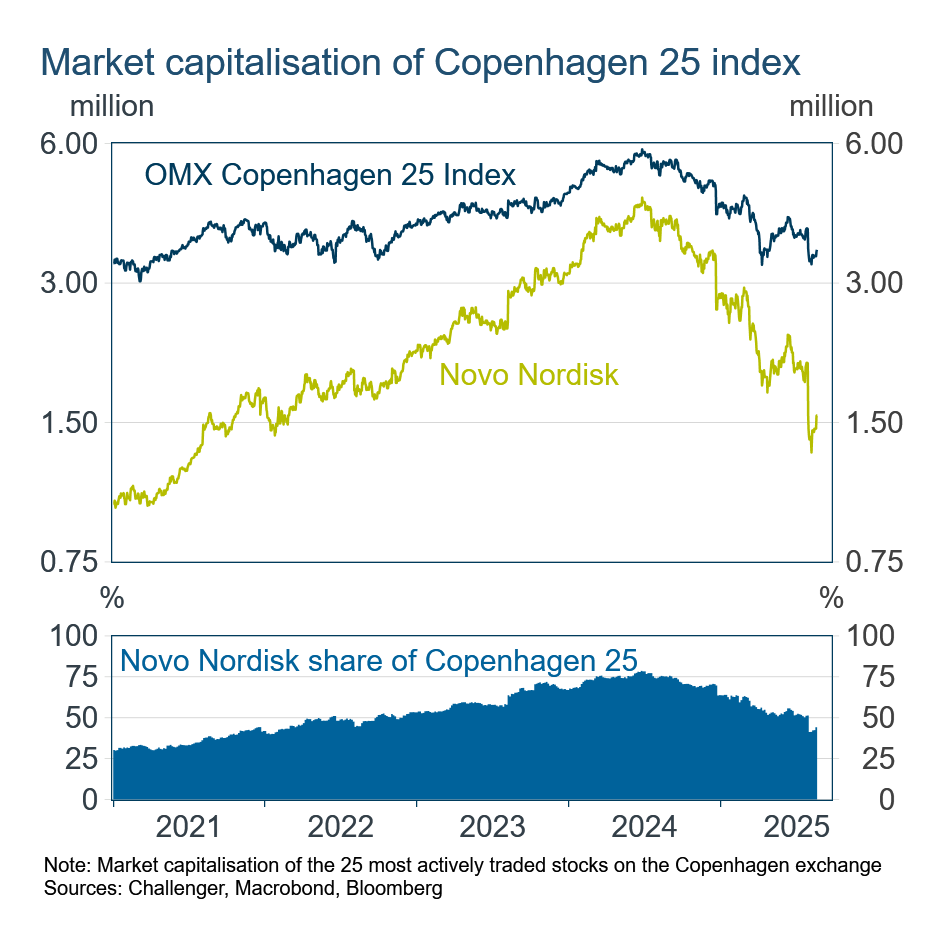

The runup in Novo Nordisk has had a particularly large impact on the Copenhagen stock exchange where it is listed. When its share price peaked in mid-2024 it constituted almost 80% of the market capitalisation of the Copenhagen index of 25 companies (which includes household names such as shipping giant Maersk, brewer Carlsburg, jeweller Pandora as well as major Danish banks Nordea and Danske). That’s serious market concentration.