Advice 2030: The Big Shift

Seven megatrends set to usher in a new world adviceDownload this report produced by Deloitte for IRESS, which predicts that the next and arguably more profound disruptions for advisers and advice businesses will come from seven external megatrends.

Maximise the opportunity for your practice

Australia is on the brink of a "retirement tsunami." With the wave of baby boomers reaching retirement age, the numbers are staggering. By 2056, nearly a quarter of the population will have reached retirement age, reflecting an economic impact of significant proportions1.

This monumental demographic shift presents a significant opportunity for financial advisers. Not only can you help your clients achieve secure and fulfilling retirements, but you can also position your practice to meet the rising demand for expert retirement advice.

1 ABS Population Projections Australia

* ABS Retirement and Retirement Intentions, Australia, 2022-23 financial year | Australian Bureau of Statistics

A complete retirement toolkit for your clients

Including lifetime annuities in your clients' retirement strategies can enhance their financial confidence and overall retirement outcomes. By helping to reduce risks such as inflation, market volatility, and fluctuating interest rates, annuities can provide a solid foundation in retirement planning. It can also strengthen your competitive edge, build trust, and deliver better retirement outcomes for your clients.

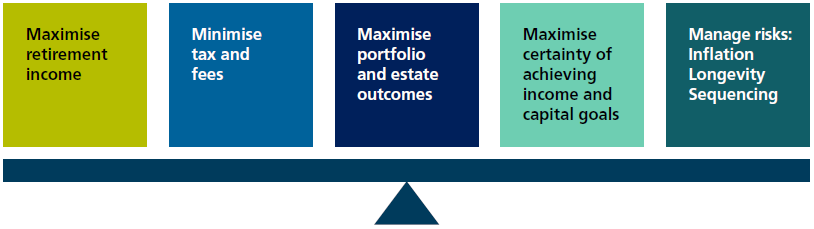

Balancing retirement considerations

Annuity myth busters

Annuities are a valuable tool in retirement planning, yet misconceptions can limit how they are used. Challenger’s Liquid Lifetime annuity is a truly differentiated product that may offer your clients flexibility and confidence in retirement.

What can a lifetime annuity achieve for a client?

Improve estate outcomes

Lifetime annuities can help reduce the drawdown on the account-based pension, improve age pension entitlements and increase long term income leading to improved estate outcomes.

Improve retirement income

Lifetime annuities can help your clients sustain higher levels of income over their retirement.

Tax efficient

Non super lifetime annuity income is treated favourably due to a deductible amount, reducing assessable income for tax. Super income is tax free for aged 60 or above.

Protection from inflation

Challenger’s lifetime annuity payments can be indexed to CPI, helping payments keep pace with inflation.

Confidence to spend

Guaranteed regular income for life provides clients with greater confidence to spend.

Improve pension entitlements

Lifetime annuities can help clients improve their Age Pension entitlements.

Adviser resources

Register now for AdviserOnline, our comprehensive adviser portal giving you access to tools that can help you guide your clients through retirement planning and transitioning to aged care. Register online now for your free access.

Get a quote

Client materials

Register for Challenger’s adviser portal, AdviserOnline to access a range of adviser and client facing materials such as case studies, white label materials, videos, webinars, brochures, guides and more.