The devil is in the detail – navigating income stream considerations

The devil is in the detail – navigating income stream considerations

Download the full article below.

The cornerstone of effective retirement advice lies in creating a plan that delivers both income and security, enabling clients to enjoy the lifestyle they’ve worked hard for. Advisers play a pivotal role in demonstrating the value of advice by crafting strategies that mitigate risks such as longevity and market volatility, ensuring clients can sustain their desired standard of living.

With an ageing population and increasing life expectancy, this article explores the technical considerations behind structuring income streams to help clients comfortably meet their income requirements while understanding the implications for social security entitlements, when relevant.

Pre-retirement income stream considerations

Australians can access their superannuation when certain conditions are met, collectively referred to as conditions of release. The most common condition of release is retirement. However, under certain circumstances like suffering permanent incapacity, a client may be able to access their super before reaching retirement. The monies can be either accessed as a lump sum, as an income stream or a combination of both. Given the inability to work due to permanent incapacity, eligible clients may also apply for a Disability Support Pension (DSP) through Services Australia. Amongst other eligibility criteria, this payment is also means tested. A client’s access to super and where they invest their money after accessing may have an impact on their means test assessment for DSP.

From a social security perspective, for those under Age Pension age (currently age 67), super in accumulation phase is an exempt asset. Where these benefits are accessed as a lump sum, they are not assessed as income. However, after receiving those monies, the assessment depends on where those monies are invested. For instance, if left in a bank account, it is assessed as an asset subject to deeming. If the benefits are accessed in the form of a disability account-based income stream, it is assessed as an asset subject to deeming regardless of whether the client is under Age Pension age.

Those eligible for DSP may elect to retain their super in the accumulation phase and access them in the form of lump sums until they reach Age Pension age. Although this approach can help maximise their DSP entitlements, as accumulation-phase balances are not assessed while under Age Pension age, an impact on the overall strategy must be considered. For example the amount of tax payable with each of the options can vary. Refer to Unpacking the ins and outs of the superannuation disability benefit on the Challenger website to understand the eligibility requirements and tax implications on accessing these benefits.

Another condition of release on attaining age 60 entitles a person to access their superannuation in the form of income payments from a transition to retirement (TTR) income stream. This is not a full condition of release, as the income payments are subject to a restriction of a maximum of 10% of the pension balance at commencement and on 1 July in subsequent years. Since the advent of July 2017 reforms, earnings on these income streams are not exempt from tax and are taxed at up to 15% until it becomes a retirement phase income stream on a certain full condition of release, such as retirement or turning age 65. However, when it comes to social security assessment, TTR is considered an income stream with its account balance assessed as an asset subject to deeming.

Some clients may prefer or be forced (for example, due to redundancy) to retire early even before they reach their preservation age of 60. However, it is not an uncommon scenario when they change their mind and may want to go back to work. These clients may prefer to start a TTR income stream upon reaching age 60 and may also wish to apply for the Jobseeker Payment until they are able to be employed again. Amongst other eligibility requirements, Jobseeker Payment is means tested and starting a TTR income stream can impact their means test when applying for the Jobseeker Payment.

Structuring post-retirement income streams

Planning a retirement strategy that provides a dynamic structure like an Account Based Pension (ABP) whilst addressing challenges of retirement planning such as sequencing and longevity risk underscores the growing need for a multilayered income stream framework. For those eligible, social-security alignment is a consideration as well. In today’s world, advisers have access to a wide range of innovative retirement income streams, including lifetime income streams, that, when used in combination with other income streams and sources of retirement income, can help improve client retirement outcomes.

ABP are widely used in the Australian retirement income landscape. Some features like flexibility, tax efficiency and accessibility make them a cornerstone of most retirement strategies. For social security purposes, an account balance is assessed as an asset subject to deeming (with the exception of grandfathered ABPs from pre-1 January 2015).

Advisers often discuss increasing life expectancy amongst Australians which highlights the pertinence of helping clients achieve their income goals for a longer period. Having an allocation to a lifetime income stream in addition to an ABP can help provide this resilience as it will generate income for the client to meet their spending goals which may also assist with reducing the need to drawdown on the other assets. Lifetime income streams can help with managing retirement risks (such

as sequencing, volatility and inflation) and a partial allocation can help to improve estate outcomes for clients.

For social security purposes, the assets test assessment of lifetime income stream (including a lifetime annuity) that meets the Capital Access Schedule is 60% of the purchase price until age 85 (or until age 84 for lifetime income streams commenced from 1 July 2019 to 31 December 2024), subject to a minimum of 5 years, and then 30% of the purchase price thereafter. 60% of the annual income payment is assessed for income test purposes.

Case study

Drake and Deandra, aged 67, are a homeowner couple who have recently resigned from the work force and retired. With appropriate planning they find themselves in a position where much of their retirement savings are now held via superannuation ($450,000 each) allowing them to structure tax effective retirement income streams. In addition, they have $10,000 worth of personal assets and $90,000 in the bank as a cash reserve. They are debt free and currently receive a combined Age Pension of $5,759 p.a. Drake and Deandra are in good health, and like many Australians, they could live well past their life expectancy.

In their own words, Drake and Deandra want to be able to spend “comfortably, but confidently” through retirement and have estimated a combined income need of $80,000 p.a. As part of their total intended annual spend, they have also established that they need at least $60,000 p.a. to meet their essential spending needs in retirement. They are keen to ensure that this level of spending keeps up with inflation.

A recommended allocation of 30% ($135,000 each) of their ABP to a Challenger Lifetime Annuity (Liquid Lifetime) annuity helps improve the chances for the longevity of their capital whilst providing them with regular payments that are indexed to CPI for the rest of their lives irrespective of how investment markets perform.

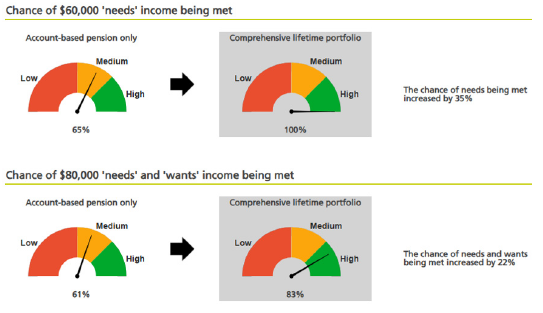

Using Challenger’s Retirement Illustrator (accessible to all financial planners via Challenger’s AdviserOnline portal), their financial planner explains their probability of meeting their expected income requirement of $80,000 based on a combination of $315,000 (each) invested in an account-based pension and $135,000 (each) in invested in Challenger Lifetime Annuity (Liquid Lifetime). Because in reality investment returns are never constant, the Portfolio analyser function stress tests both portfolios using returns that change over time. To do this, it models and analyses 2,000 market scenarios over 40 years (stochastic modelling). Each market

scenario has different asset class returns and related market indicators such as the level of inflation.

The stochastic modelling in the dials below compares the current portfolio’s likelihood of meeting Drake and Deandra’s income objectives with the new comprehensive lifetime portfolio. This comprehensive retirement portfolio provides Drake and Deandra with a structure that offers a relatively higher chance of meeting their income goals (including being able to meet their essential spending goal of $60,000 in 100% of modelled scenarios).

Furthermore, this diversified portfolio also helps enhance their Age Pension entitlement by 146% in year 1. As a result, Drake and Deandra will have income from various sources to meet their desired retirement lifestyle whilst ensuring their capital lasts relatively much longer.

Still have grandfathering status retained for pre 2015 account based pensions?

On 20 September 2025, the deeming rates increased to 0.75% for assets below the lower threshold and 2.75% for assets above the lower threshold ($64,200 for singles and $106,200 for couples). Although ABPs are assessed as an asset subject to deeming for social security entitlements like Age Pension, many clients may still have retained grandfathered income streams which were commenced before 1 January 2015 that have different income test assessment rules. Refer to Revisiting grandfathered account-based pensions for more details on grandfathered ABPs.

The deeming rates were set at a historic low of 0.25% and 2.25% from May 2020 until 19 September 2025. Advisers often weigh up the pros and cons of retaining a grandfathered ABP or losing grandfathering and making the ABP a deemed income stream. The 20 September 2025 deeming rate change may cause advisers to revisit whether it is beneficial to retain grandfathering on the ABP or convert it into a deemed ABP.

For those who have retained the grandfathering status, a review can often be worthwhile from time to time to consider whether grandfathering should still be retained for clients, which could include factors such as:

- having to draw down relatively high income due to increased minimum pension payments as client’s age increased

- balances may have reduced since 1 January 2015 due to a combination of receiving pension payments, lump sum withdrawals and earnings, or

- have made large commutations in previous years and as a result have had their deduction amount recalculated and reduced over time.

Advice considerations

- It is important to note that once grandfathering is lost, it cannot be regained.

- If clients consider losing grandfathering and opting into the deeming method, certain strategies can be considered that couldn’t be implemented previously due to losing grandfathering status and potential unfavourable Age Pension outcomes. These can include:

– rolling over funds to save on fees

– rolling over funds to another income stream to access more appropriate investment options or specialist options in lin with the client’s investment goals

– refreshing the account-based pension to include accumulation monies from contributions such as downsizer contributions

– implementing re-contribution strategies

– consolidating multiple account-based pension accounts

– adding a reversionary beneficiary where the product provider requires the restarting of an existing pension to add the beneficiary; or

– where the client wants the convenience of maintaining high income payments to fund their retirement without regularly taking lump sum withdrawals. - Besides comparing which income test assessment provides a better outcome, consideration should also be given to the overall impact of the strategy. For example, if any gain in the savings of fees or tax outweighs any loss in their

existing entitlement. - Immediate benefits with having a deemed ABP instead of retaining grandfathering (including the ability to implement strategies outlined above) should be weighed against any future impacts in the longer term such as the potential for higher deeming rates in the future.

- In the case of clients holding a Commonwealth Seniors Health Card (CSHC), losing grandfathering could mean losing the card. Income from grandfathered ABPs is not assessed for CSHC. If grandfathering is lost due to the income from an ABP being assessed, consideration should be given to whether the client may lose their CSHC if their adjusted taxable income plus deemed income from ABPs is above the CHSC income test threshold (currently $101,105 for singles and $161,768 for couples).

Commutation of Legacy Pensions – next step

On 7 December 2024, new regulations came into effect, allowing individuals to exit non-commutable legacy pensions (for example market-linked pensions like Term Allocated Pension) within a 5-year amnesty period. Some of these legacy pensions have a 50% or a 100% social security assets test exemption, depending on the type of pension and when it commenced. Previously, if these pensions were commuted, the commutation could result in a retrospective loss of their asset test exemption and could incur a five-year clawback of social security entitlements.

However, to align with the intent of these new regulations, a debt waiver instrument was issued to allow the Secretary of the Department of Social Services to waive any debts arising from the commutation of these legacy pensions. This waiver has now come into effect post the disallowance period coming to an end on 27 October 2025.

Only those legacy pensions with a withdrawal value can be commuted. Considerations can be given to reinvesting commuted legacy pensions in products having concessional assets test treatment like a lifetime annuity that can help cushion the impact of any loss of social security entitlements. Please refer to Exiting legacy pensions - opportunities and considerations on the Challenger website

for more details.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.

.png?h=700&iar=0&w=1000)