Residential care reforms FAQ

Residential care reforms FAQ

Download the article below.

On 4 June 2025, the Government announced that the commencement of the new Aged Care Act would be delayed until 1 November 2025. This has given the Government more time to finalise the Aged Care Rules and prepare aged care facilities for the changes.

In November 2024, Challenger Tech article “Aged Care reforms FAQ”, we provided the answers to the most common questions about the aged care reforms. In this month’s article we provide further clarification on specific residential care reforms questions.

Accommodation payments

When can retention amounts be deducted from the RAC/RAD?

Retention amounts can be deducted monthly (or less frequently) from the refundable accommodation contribution/refundable accommodation deposit (RAC/RAD) for 5 years from the date the RAC/RAD was first paid. If the resident pays a RAC/RAD and then changes aged care facilities, the 5 years will not restart.

Will deductions from the RAC/RAD reduce retention amounts?

Yes, amounts deducted from the RAC/RAD, including retention amounts, will reduce the balance on which subsequent retention amounts are calculated. Retention amounts are calculated daily therefore, the calculation will reduce immediately after the amount is deducted.

Will additional RAC/RAD payments increase retention amounts?

Yes, additional RAC/RAD payments will increase the balance on which subsequent retention amounts are calculated. Retention amounts are calculated daily therefore, the calculation will increase immediately after the additional amount is paid.

Will retention amounts deducted from the RAD increase the DAP?

No, retention amounts deducted from the RAD will not increase the outstanding RAD therefore, will not increase the daily accommodation payment (DAP).

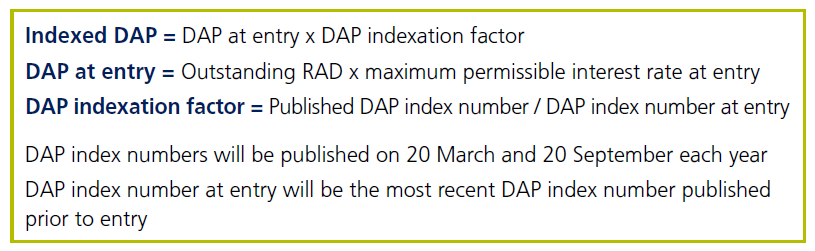

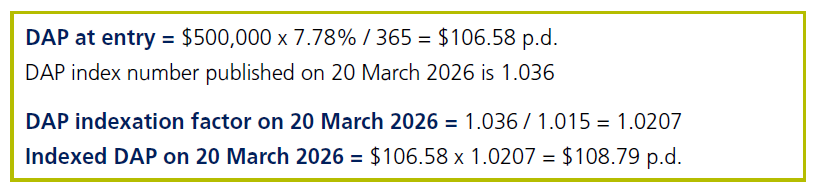

What is the calculation to index the DAP?

Example

Peter enters residential care on 1 December 2025 and pays $500,000 as a DAP. The MPIR on 1 December 2025 is 7.78% and the DAP index number published on 20 September 2025 was 1.015.1

Will deductions from the RAD increase DAP indexation?

Yes, amounts deducted from the RAD, excluding retention amounts, will increase the calculation of subsequent DAP indexation. The DAP at entry will be adjusted for the amount deducted before the next DAP indexation calculation. See question “What is the calculation to index the DAP?”

Will additional RAD payments reduce DAP indexation?

Yes, additional amounts paid as a RAD will reduce the calculation of subsequent DAP indexation. The DAP at entry will be adjusted for the additional amount paid before the next DAP indexation calculation. See question “What is the calculation to index the DAP?”

Does the minimum permissible asset amount still apply under the new rules?

Yes, aged care facilities cannot accept a lump sum within 28 days of entry that will leave the individual with less than the minimum permissible asset amount of $61,500.2 After 28 days, the minimum permissible asset amount will not apply the same as that under the current rules.

Ongoing costs

When will the Hotelling Supplement Contribution be payable?

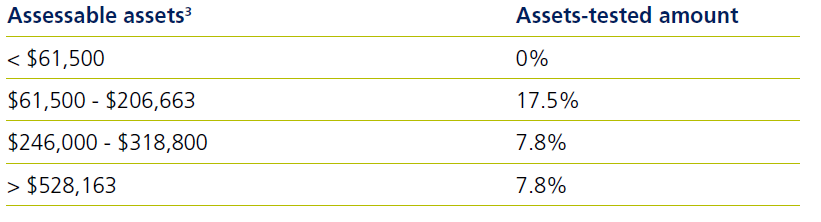

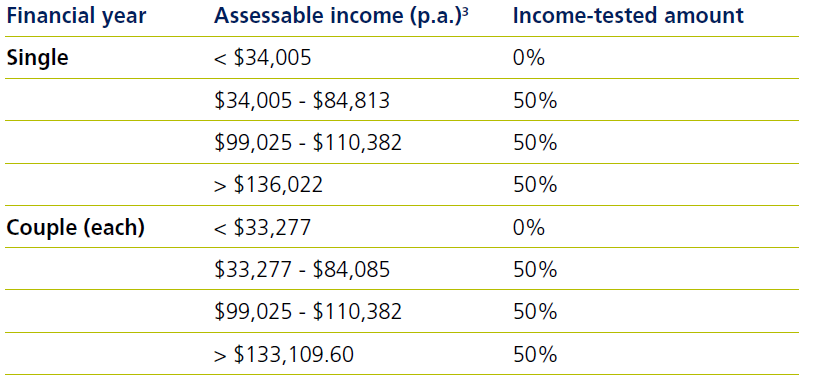

The Hotelling Supplement Contribution (HSC) will be payable when the resident’s means-tested amount exceeds $69.79 p.d.2 The means-tested amount will exceed $69.79 p.d. when assessable assets exceed $246,000, or if assets are less than $61,500, when assessable income exceeds $99,025 p.a.2 See question “How will the mean-tested amount be calculated?”

At what level of assets will the maximum Hotelling Supplement Contribution be payable?

The HSC cap of $15.60 p.d. will be payable when assessable assets exceed $318,800, assuming assessable income is less than $34,005 p.a. (single) or $33,277 p.a. (couple each).3 See question “How will the mean-tested amount be calculated?”

When will the non-clinical care contribution be payable?

The non-clinical care contribution (NCCC) will be payable when the resident’s means-tested amount exceeds $85.39 p.d.3 The means-tested amount will exceed $85.39 p.d. when assessable assets exceed $528,163, or if assets are less than $61,500, when assessable income exceeds $136,022 p.a.3 See question “How will the mean-tested amount be calculated?”

The NCCC will no longer be payable after 4 years of paying the contribution or when the lifetime limit of $130,000 (indexed) is reached. If the resident pays the NCCC and then changes aged care facilities, the 4 years will not restart.

At what level of assets will the maximum non-clinical care contribution be payable?

The NCCC of $101.16 p.d. will be payable when assessable assets exceed $1,000,244, assuming assessable income is less than $34,005 p.a. (single) or $33,277 p.a. (couple each).3 See question “How will the mean-tested amount be calculated?”

Will participant contributions for the Support at Home program count towards the lifetime limit for non-clinical care contributions?

Yes, participant contributions for the Support at Home program will be added to NCCCs for residential care to determine when the lifetime limit is reached.

Means testing

How will the means-tested amount be calculated?

Means-tested amount = Assets-tested amount + Income tested amount

Assets-tested amount

Income-tested amount

Will assessable assets and income be assessed differently under the new rules?

No, assessable assets and income will be the same as that assessed for aged care purposes under the current rules. The assessment of the former home and definition of the protected person will also be the same as that under the current rules.

Will the low means classification be determined differently under the new rules?

No, the low means classification will continue to be determined by the individual’s means-tested amount at entry, the same as that under the current rules. Where the individual’s means-tested amount is less than $69.79 p.d. at entry, they will be classified as low means residents.4

How much will a resident pay for ongoing costs if they do not disclose their means?

If a resident does not disclose their means, they will pay the HSC cap of $15.60 p.d. and NCCC cap of $101.16 p.d.4 These residents will continue to pay the NCCC cap until they reach the lifetime limit of $130,000 (indexed).

Grandfathering

What is the effective date to be grandfathered for residential care?

Grandfathering for residential care will be separated into accommodation payments and ongoing costs. Individuals in residential care on 31 October 2025 will be grandfathered for accommodation payments and ongoing costs. Individuals must be in permanent residential care and not respite residential care to be grandfathered.

Can grandfathered residents elect to cease grandfathering?

Grandfathered residents can elect to cease grandfathering for ongoing costs at any time after 1 November 2025 however, they cannot elect to cease grandfathering for accommodation payments. Grandfathered residents do not have to change aged care facilities to elect to cease grandfathering for ongoing costs.

When will a resident lose grandfathering for accommodation payments?

Grandfathered residents who cease accessing residential care for more than 28 days after 1 November 2025 will lose grandfathering for accommodation payments. However, these residents will continue to be grandfathered for ongoing costs unless they elect to cease grandfathering.

Grandfathered residents who elect to cease grandfathering for ongoing costs after 1 November 2025 and then change to another aged care facility will lose grandfathering for accommodation payments.

Will grandfathered home care recipients also be grandfathered for residential care?

Grandfathered home care recipients who enter residential care after 1 November 2025 will be grandfathered for ongoing costs however, will not be grandfathered for accommodation payments. These residents will pay the means-tested care fee instead of the HSC and NCCC.

1 Assumed rates and thresholds.

2 Rates and thresholds as at 1 July 2025.

3 Rates and thresholds as at 1 July 2025.

4 Rates and thresholds as at 1 July 2025.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.