Challenger launches guaranteed floating rate lifetime annuity

Media Release

In the first of its kind in the Australian market, Challenger Limited (Challenger) has launched a guaranteed floating rate lifetime annuity, with payments linked to the Reserve Bank of Australia (RBA) cash rate.

The new, innovative RBA Cash Linked option, provides customers with guaranteed payments that move with the RBA cash rate. It also provides them with peace of mind and enables customers to look forward with confidence by having certainty of income for life, while not missing out when rates start rising again.

The RBA Cash Linked option has been developed to support advisers and their retiree clients. It is the latest innovation from Challenger which in recent months released Retire with confidence, a new tool for Australian retirees and pre-retirees designed to help educate them on their retirement income options.

"The innovative new RBA Cash Linked option allows customers to receive higher annuity payments as the RBA cash rate increases. Challenger’s lifetime annuity provides customers with

peace of mind and enables them to look forward with confidence by having certainty of income for life. Payments will move in line with rises and falls in the cash rate," said Angela Murphy, Chief Executive of Distribution, Product and Marketing at Challenger.

"It is an Australian first for a retirement income stream to deliver the combination of income certainty with a variable component linked to the RBA interest rate. The option maintains

substantial estate and withdrawal benefits, and for asset test affected clients it could improve Age Pension eligibility and outcomes."

Lifetime annuities guarantee income for retirees, no matter how investment markets perform or how long they live. The benefits of annuities have been demonstrated during the COVID-19

pandemic, where customers have continued to earn a guaranteed income stream while income from other investments, such as some dividend payments, have unexpectedly fallen or been

suspended.

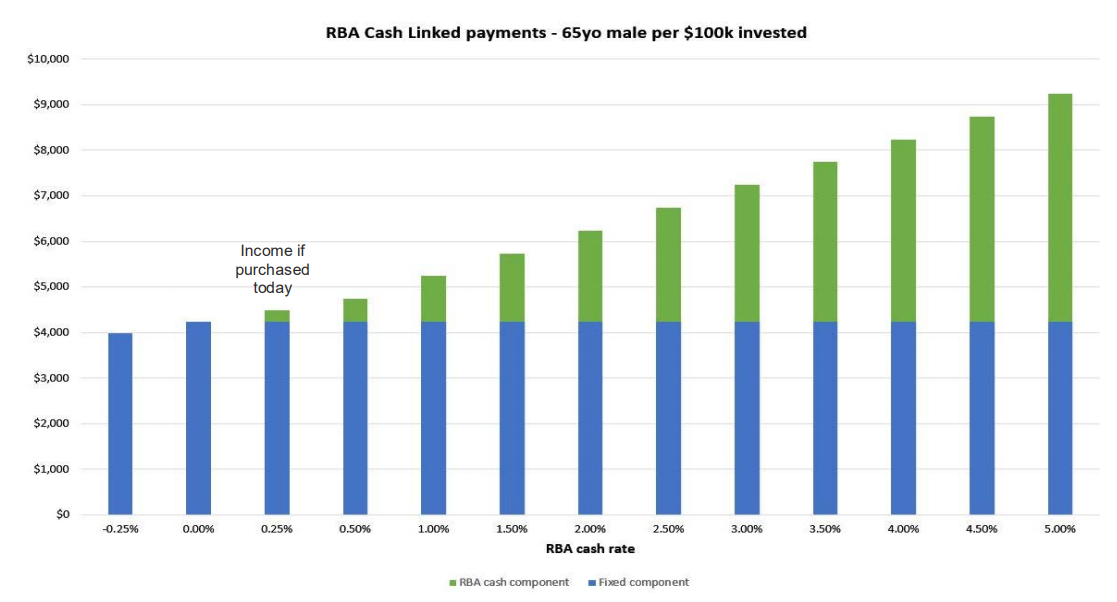

"This is a smart new defensive solution for providing income certainty, particularly given current global market volatility and can be combined with other products, such as account-based pensions to build comprehensive retirement solutions," Ms Murphy said. "A lifetime annuity is designed to complement other sources of retirement income like an accountbased pension or the Age Pension, and can be used to fund everyday living costs, providing peace of mind that no matter what investment markets do, an income stream will be paid." The RBA Cash Linked option is part of Challenger’s Guaranteed Annuity (Liquid Lifetime) product range, which also includes options for annuities that are fully or partially linked to the consumer price index or have no indexation. Under the new option, annuity payments will rise, and fall, in line with the RBA cash rate. Below is an illustrative example of payments allocated using different RBA cash rates, based on a 65-year old male investing $100,000 into a lifetime annuity - RBA Cash Linked option.

About Challenger

Challenger Limited (Challenger) is an investment management firm focusing on providing customers with financial security for retirement. Challenger operates two core investment

businesses, a fiduciary Funds Management division and an APRA-regulated Life division. Challenger Life Company Limited (Challenger Life) is Australia's largest provider of annuities.

For more information contact:

Sean Aylmer

Head of External Relations

+61 409 817 039

saylmer@challenger.com.au