Adjusting this mix can therefore be just as important as rebalancing allocations within the market-exposed elements of their portfolios. Adjusting this mix takes on increased importance in times of higher inflation, as some product solutions, and some options within product categories, are more effective inflation mitigants than others.

Adviser Insight: Matching products to different needs within a retirement strategy

“Growth assets are critical to fighting inflation. Our rule of thumb is to try and ensure the client has the equivalent of three years’ income needs allocated to cash, giving them plenty of buffer and ensuring they can leave the growth portion of the portfolio untouched during the inevitable downturns.” Jacie Taylor

Table 1 below provides a useful comparison of how different product solutions can mitigate inflation risk, as well as market and longevity risk. (For the purposes of this paper, we are regarding the Age Pension as a product.)

Ideally, retirees will manage their exposure to longevity, market, and sequencing risks through a mix of products, each performing its own different role.

Table 1: Effectiveness of products in mitigating key retirement risks

| Risk |

Age Pension |

Account-based pension |

Lifetime annuity - nominal |

Lifetime annuity - CPI-linked |

Lifetime annuity - market-linked |

|---|---|---|---|---|---|

| Market risk |

Yes |

Not usually |

Yes | Yes | Not usually |

| Longevity risk |

Yes |

No |

Yes |

Yes | Yes |

| Inflation risk |

Yes |

Not usually | No |

Yes | Not usually |

The Age Pension

Australia’s Age Pension provides protection from inflation in several ways.

The first level of protection comes from the twice-yearly indexation of Age Pension payments. Age pension payments are increased by the percentage increase in either the CPI or the Pensioner and Beneficiary Living cost index (PBLCI), whichever is the higher. The PBLCI is similar to the more familiar CPI measure, but it is weighted to reflect the spending by households in receipt of the Age Pension or other Government benefits.

A second component is a benchmark requirement for the combined base payment for a couple on the full-Age Pension to be at least 41.76% of Male Total Average Weekly Earnings (MTAWE).

For those receiving a part pension, additional inflation protection occurs because the means test operates to reduce payments from the maximum Age Pension. When this maximum is increased in line with inflation, the reduction is not changed, meaning part pensions benefit from the same dollar increase as the full pension.

There are also two supplements paid to full and part pension recipients, the pension supplement, and the energy supplement, although at the moment only the pension supplement is indexed.

While entitlement to even a small amount of Age Pension has long been highly prized, for its predictability and associated benefits such as healthcare, transport and pharmaceutical concessions, its performance as an inflation fighter will undoubtedly attract further focus and may well change the way its role within a retirement strategy is perceived.

Adviser Insight: Discounts on rates, utilities and more – why a dollar of pension is so valuable

“When you add up the value of discounts and concessions available to clients receiving the Age Pension, it can be worth in the region of $2500 to $3500 per year. And these discounts –including rates, car registration, water and electricity, public transport, and pharmaceuticals – apply even if you only receive one single dollar of pension. Obviously, in the current environment, these benefits are becoming more sought after. Optimising pension entitlement is paramount.” Michael Miller.

Account-based pensions

As a mechanism via which superannuation balances are paid as a regular income stream, ABPs are the mainstay of many Australian retirees.

ABPs generally offer a choice of investment options, including market-linked ones, allowing holders to pursue growth as an inflation mitigant. They can also be structured to pay a fixed income as long as the minimum drawdown requirements are met. However, unlike lifetime annuities, when the account balance is exhausted, the income will cease.

The flexibility of ABPs means they can work very well in conjunction with the Age Pension and lifetime annuities, and subject to mandatory minimums, can be integral to a dynamic drawdown strategy. However, they are not in themselves, an effective inflationary mitigant because, while income payments can be increased to allow for a higher cost of living, this accelerates the rate at which the account balance is being diminished, making the exhaustion of that balance more likely.

CPI-linked lifetime annuities

A lifetime annuity pays a pre-agreed income stream for life, no matter how long a person lives, and regardless of equity market performance. As such, they can be a very effective mitigant of both longevity and market risk.

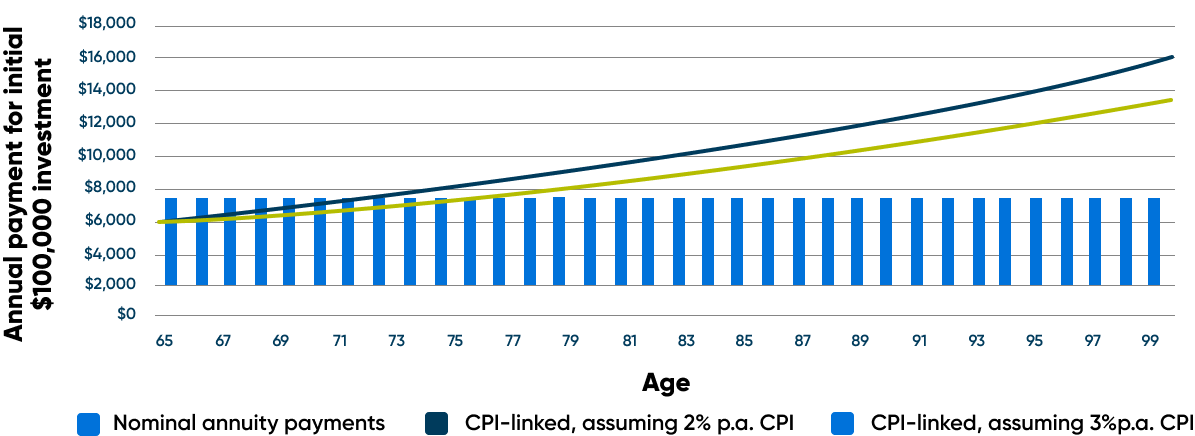

A variation on the ‘nominal’ lifetime annuity is the CPI-linked lifetime annuity. While initial payments under such an option are lower than those under the nominal annuity (reflecting the cost of providing that CPI protection), the heightened awareness of inflation risk, along with a medium-term expectation of elevated inflation, has increased the appeal of this particular option. As shown in Figure 1 below, even assuming a moderate inflation rate of 3%, the CPI-linked option will, over the longer term, deliver higher payments.

Adviser Insight: Priceless peace of mind as well as an inflationary hedge

“We use CPI-linked lifetime annuities with many of our clients. When used in conjunction with the Age Pension they can help ensure a substantial percentage of your annual income needs are always inflation protected. But as effective as they are as an inflationary hedge, I’d argue their true value is that they effectively allow retirees to buy peace of mind, which is priceless.” Jacie Taylor

Figure 1: Comparison of nominal and CPI-linked annuity payments over time

Source: Calculations based on payment rates as at October 10 2022.

Adviser Insight: Lifetime annuities – increasingly on the radar

“The certainty of annuities really appeals to retirees and while to date the majority have been using fixed-term annuities in lieu of term deposits, the current perfect storm has increased their willingness to consider an allocation to lifetime annuities, especially CPI-linked offerings. We are definitely having more of those conversations.” Nick Arkoudis.

Market-linked lifetime annuities

A relatively recent innovation in lifetime annuities has been to provide payments that increase in line with either an underlying diversified portfolio or a nominated basket of market indices.

When the income stream is payable for the lifetime of the retiree and their access to capital is constrained appropriately, government legislation permits the beneficial application of the means test rules for users of such income streams. This provides the same treatment as guaranteed lifetime annuities and can increase the entitlement to the Age Pension, particularly early in retirement.

The common theme in these market-linked annuities is that changes in income payments are linked to investment market returns. The income payments will go up and down with markets, meaning their effectiveness as an inflation hedge is market-dependent and variable over time. Over the longer term these products can be expected to provide income streams in excess of inflation, unless a particularly defensive portfolio or index is chosen.

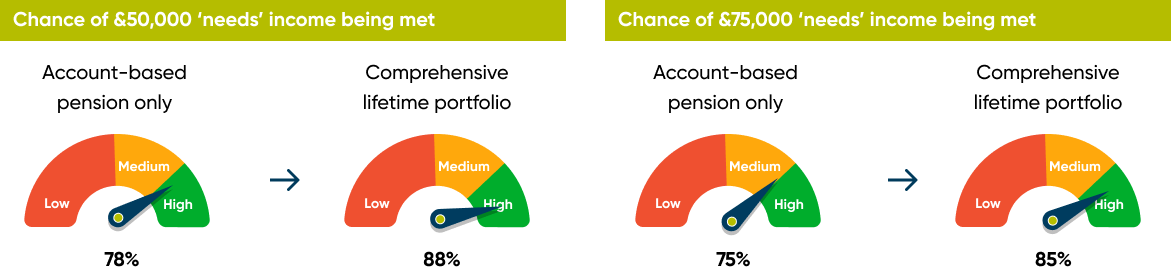

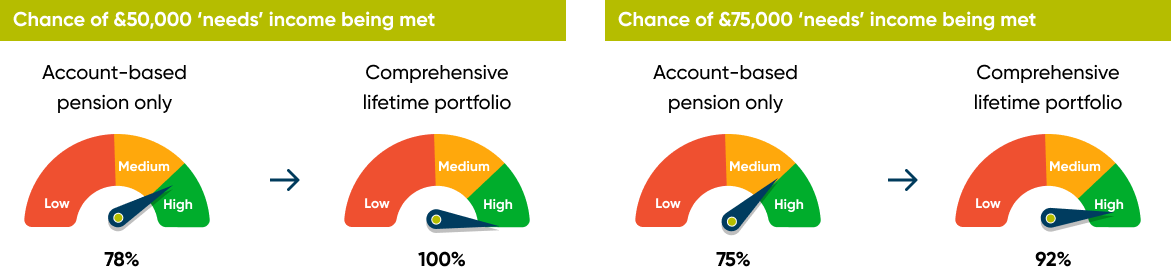

Lifetime annuities – improving the odds

To demonstrate in practical terms the value of lifetime annuities as an inflation mitigant, we have illustrated below two example scenarios using CPI-linked lifetime annuities. Results are presented in terms of the likelihood of meeting different income thresholds for the duration of retirement and compare an ABP-only approach, versus a strategy using both an ABP and a lifetime annuity.

As can be seen, the incorporation of the lifetime annuity into the portfolio substantially improves the odds of the retiree couple being able to meet their retirement income goals, for both essential spending (‘needs’) and discretionary spending (‘wants’).

Scenario:

1. Self-funded retiree couple, both aged 67

2. Homeowners

3. Each with $750,000 in super

4. 50/50 defensive investors

5. $20,000 in non-financial assets

6. Need $50,000 for essentials pa

7. Want to spend $75,000 pa

The charts below compare the potential outcomes when either 10% (Figure 2) or 20% (Figure 3) of superannuation savings are allocated to a CPI-linked lifetime annuity, in conjunction with an ABP and the Age Pension.

Figure 2: ABP vs ABP + CPI-Linked lifetime annuity (10% allocation)

Figure 3: ABP vs ABP + CPI-Linked lifetime annuity (20% allocation)

Source: Challenger Retirement Illustrator (04/10/2022) using Social Security rates and thresholds effective 20 September 2022. 67 year old male/female client couple. $750,000 each in account-based pension. Assumes returns of 3.0% p.a. for defensive assets and 6.0% p.a. for growth assets before fees. $50,000 cash/TDs earning 3% p.a. interest. Non-financial assets of $20,000. $75,000 p.a. desired income including $50,000 p.a. essential income. Amounts shown are in today’s dollars. CPI of 2.5% p.a. See Challenger Retirement Illustrator for all assumptions. Reference number: RIC221004000264.

Adviser Insight: Lifetime annuities and the ‘barbell approach’ to asset allocation

“The fundamental problem we face with all our retiree clients is the trade-off between wanting downside protection to ensure a sustainable spending stream and also wanting portfolio growth and greater upside to mitigate inflation and even allow some more aspirational spending.

We think the 4% rule of thumb is a bit inflexible in this regard, which is why I advocate, for some clients at least, a floor leverage rule. This aims to lock in a high level of total desired income and then leverage up the remaining exposure to market risks in an attempt to improve the available income to spend. This is an example of a barbell strategy, with one end of the barbell comprising very conservative assets and the other comprising riskier assets (with nothing in between). A common approach might be cash and fixed interest at one end and equities at the other, with the combination being structured in such a way that an acceptable standard deviation on the overall portfolio can be achieved (say around 6 – 7% for a conservative portfolio).

As we have seen, even fixed-interest investments can be volatile. By using a lifetime annuity with no standard deviation, you can effectively dial up to riskier, more growth-focused assets on the other end and still achieve the same overall standard deviation, but with more upside potential.” David Reed.

Ultimately, a retiree’s mindset is critical when responding to any disruption

Ultimately, perhaps the most fundamental change retirees can make when dealing with inflation and other risks to their retirement income – and therefore their lifestyle – is to their expectations.

One of the greatest challenges to retirement income policymakers is the inheritance maximisation mindset prevalent amongst previous generations of retirees. This preference to sacrifice the quality of their retirement lifestyle in order to pass on a bigger estate to their children makes it harder to ride out volatile times, and perversely may underpin a risk tolerance that is too cautious for a long investing horizon. It might see retirees enduring an unnecessarily frugal life, devoid of the joy and indulgences earned over a long working life.

Are mindsets changing? Perhaps.

Adviser Insight: Retiree mindsets are changing

“I think the desire to leave a legacy or inheritance for future generations is less so now than perhaps in the past. There is now much more of an expectation or desire to provide an upfront inheritance and support to establish children earlier on, such as with a substantial contribution to education funding or support to enter the housing market.

This has meant that come retirement; many retirees have shifted expectations to say, ‘the resources I have here and now are primarily for my benefit. There is also a common theme of ‘when I’m going, if there are resources left, then my family is most welcome to them, but they are there to be used to support me and my needs first’.” Michael Miller, Director of Capital Advisory Financial & Business Advisers.