An important benefit of a lifetime income stream, such as a lifetime annuity, in a portfolio is that it can help address the issue of longevity risk. Annuities have evolved and changed over the years making them quite different to what they used to be. Whilst they still pay income for life, today’s lifetime annuities have many different features that can make them a lot more flexible than what they used to be.

This article addresses some common concerns and misconceptions of lifetime annuities amongst clients and demonstrates the benefits that an allocation to a lifetime annuity can bring to clients.

Lifetime annuities referred to in this article are Challenger’s Lifetime Annuity (Liquid Lifetime) and additional information on the product can be found in the Product Disclosure Statement.

Myth: If my circumstances change or if I die early, I am unable to access my capital and it is lost.

Unlike traditional annuities, modern day annuities can provide a withdrawal/death benefit for a long period of time after commencement. Challenger’s Liquid Lifetime Annuity offers a long withdrawal period based on the investor’s life expectancy where there is an ability to withdraw if circumstances change or a death benefit payable in the event the investor passes away. The withdrawal period is equal to the investor’s life expectancy rounded down to the whole number and capped at 27 years. For lifetime annuities commenced from 1 January 2020 the Australian Life Tables 2015-2017 is used to determine life expectancy.

The introduction of the Capital Access Schedule (CAS) within the Innovative Superannuation Income Streams Regulations in 2019, enables a lifetime income stream to provide a 100% death benefit1 to the estate of anyone who dies within the first half of their ‘life expectancy’ (this ‘life expectancy’ is based on historical data and ignores mortality improvements over time). Consistent with the government’s rules for Innovative Superannuation Income Streams, Challenger’s lifetime annuity provides a 100% death benefit during the first half of the withdrawal period (rounded down to the whole number).

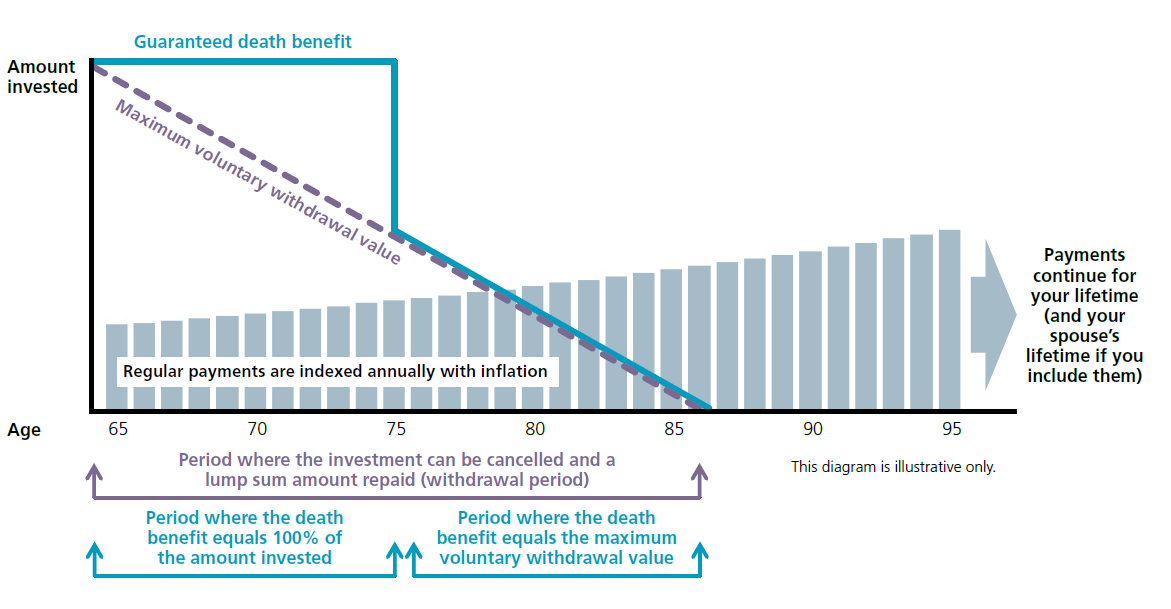

For a typical retiree at age 65, the 100% death benefit period will be 9 years for a male and 11 years for females. During the second half of the withdrawal period, a reducing death benefit is payable until it reduces to nil at the end of the withdrawal period. The investor also has the ability to withdraw during the withdrawal period. The maximum withdrawal value starts at 100% of the amount invested and progressively reduces until it reaches zero at the end of the withdrawal period. The actual withdrawal value is impacted by movements in interest rates and an allowance for the cost of breaking the investment. For more information on how the voluntary withdrawal value is calculated refer to the Product Disclosure Statement. The chart below provides an illustrative example of the withdrawal period, death and withdrawal values for an investor who is age 65, female and has invested in a lifetime annuity that pays regular income immediately (not deferred) that is indexed to CPI.

Flexible Income (Immediate payments) illustration

This example is based on a 65-year-old female with CPI-indexed payments. For a personalised illustration, you can run a quote on Adviser Online or by calling us.

Myth: Regular payments from a lifetime annuity are fixed for life or only increases in line with inflation

Challenger’s lifetime annuity offers a range of payment indexation options to help meet the needs of a range of retirees. Depending on the indexation option selected, the regular payments can remain fixed, change annually, or changed in accordance with the RBA cash rate.

In its simplest form, investors can choose to have regular payments fixed for life. This option can be attractive for those who are after absolute certainty with the amount of income they will receive each year.

Investors who want to ensure their regular payments maintain purchasing power can choose to have their payments indexed to the Consumer Price Index (CPI). Under this option payments move up and down annually with changes in the CPI. If the change in CPI is positive, the investor’s regular payments for the following year will increase, and if the change in CPI is negative, their payments will reduce.

Investors can also choose the partial CPI option where the starting payment is higher as compared to the CPI option and the regular payments will change annually in line with any increase in the CPI that is greater than 2%. For example, if the change in CPI is 3%, payments will increase by 1%. If the change in CPI is between zero and 2%, payments will be unchanged. If the change in CPI is negative, payments will reduce by the negative CPI amount. i.e., if CPI was -1%, regular payments would reduce by -1% and not -3%.

Investors who would like to benefit from any potential future interest rate changes can choose to have their payments indexed to the Reserve Bank of Australia’s (RBA) cash rate. Payments under the RBA cash linked option changes whenever there is a change in the RBA cash rate and can be as frequently as monthly. Changes in the RBA cash rate (both positive and negative) will be applied to the following month’s payment.

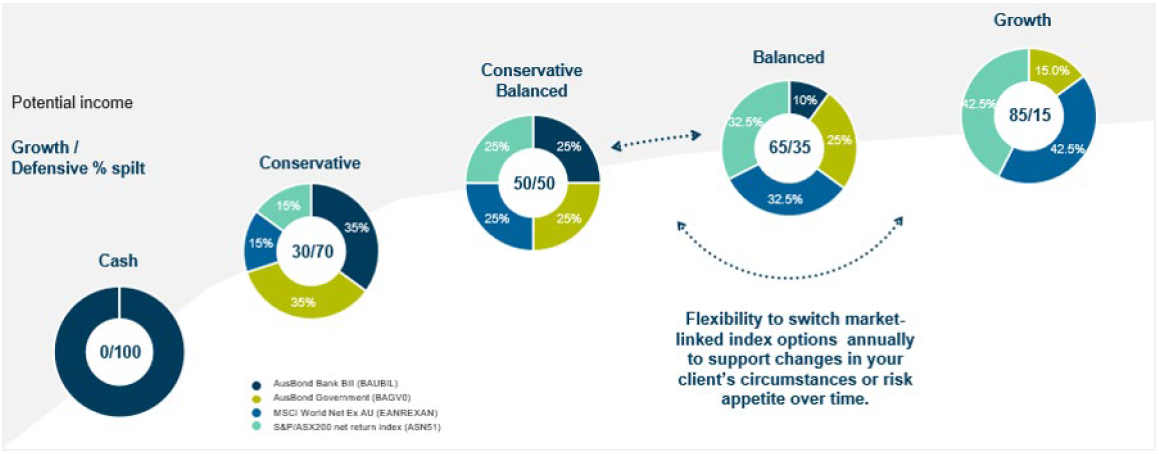

Those who are comfortable with volatility can have their payments linked to the performance of a market index to potentially maximise the amount of income from the lifetime annuity over the longer term. Clients can even choose to have higher starting payments in return for reducing future indexation by between 1% – 5% p.a. (Accelerated payment option). Challenger offers five different indices that the investor can choose from summarised in the chart below.

Investors have the flexibility to change their market index each year if their circumstances or risk appetite changes.

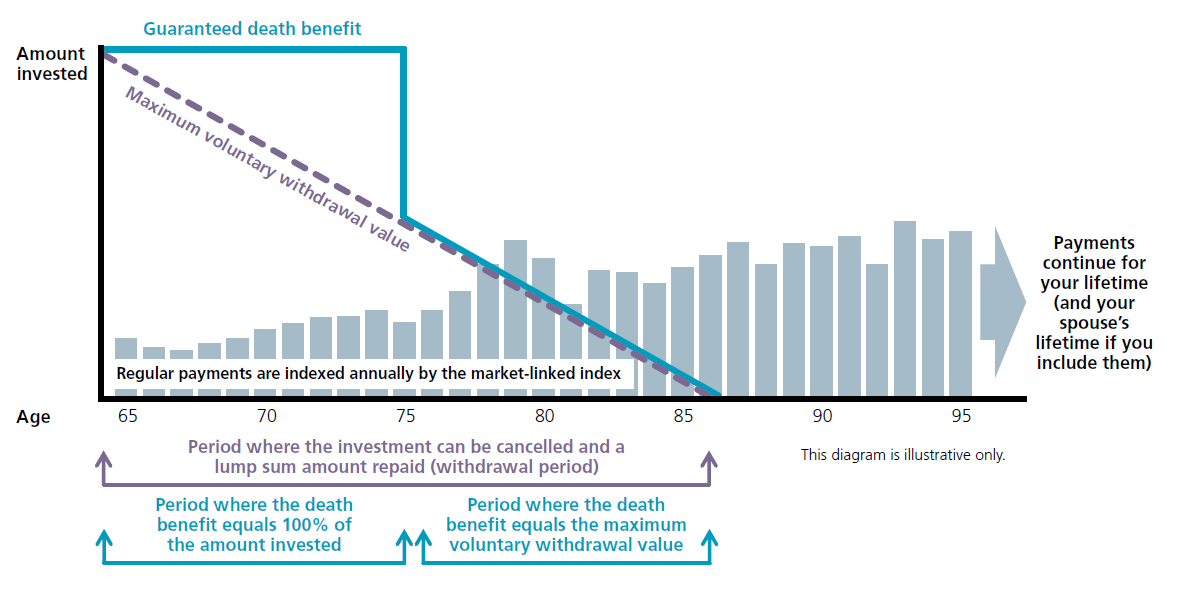

The chart below provides an illustrative example how payments can change (up and down) over time with changes in the performance of the underlying index.

Flexible Income (Market-linked payments) illustration

This example is based on a 65-year-old female with Balanced index market-linked payments. For a personalised illustration, you can run a quote on Adviser Online or by calling us.

Myth: Lifetime annuities are fully assessable for Centrelink purposes

Challenger lifetime annuities that commenced from 1 July 2019 are assessed concessionally under the social security income and assets tests.

Under the assets test, only 60% of the purchase price is assessed until age 84 (linked to the life expectancy of a 65-year-old male and can change over time), subject to a minimum of five years, and then 30% of the purchase price thereafter.

This means, for a 65 year old male investing $100,000 in a lifetime annuity, only $60,000 is assessed under the assets test until he turns 84 and then $30,000 thereafter. This can be particularly helpful for existing clients on a part Age Pension who are assets test sensitive and for those not on Age Pension as a result of having assets over the assets test cut-off limits (where the immediate asset test reduction reduces their assessable assets below these limits).

Under the income test, only 60% of the income payment is assessed.

For annuities that commenced before 1 July 2019, the amount counted towards the assets test is regularly reduced using the deduction method formula. The assessable value under the assets test reduces every six months by half of the deduction amount where payments are more frequent, or every 12 months where yearly payments are made.

Purchase price – (deduction amount2 x term elapsed)

Under the income test, the annual payment is reduced by the deduction amount using the formula above. If the deduction amount exceeds the annual payment amount, no income is assessed. For lifetime annuities commenced between 1 January 2015 – 31 December 2019 the Australian Life Tables 2010-2012 is used to determine life expectancy.

Myth: My investment is at risk in an annuity

Challenger annuities are provided by Challenger Life and the assets of Challenger Life that support the annuity payments are held in a separate statutory fund along with the capital received from other annuity customers. All regular payments to Challenger’s annuity customers are paid from this fund. These assets are unaffected by the share price of Challenger Limited.

Challenger Life (and any investment it makes in relation to the statutory fund) is regulated under the Life Insurance Act and the prudential standards made under it. Compliance with these requirements is supervised by the Australian Prudential Regulation Authority (APRA) to ensure Challenger is able to meet their obligations to investors now, and in the future.

The margin of safety APRA requires to be provided by way of capital backing must be sufficient to meet a 1-in-200-year adverse market event. While future markets can go awry, APRA actively monitors life company investments with the aim of ensuring that the life company can meet the promises they have made to their customers, both now and into the future. Challenger, like most life companies, holds significantly more capital than the regulatory minimum providing even greater security for annuity owners.

Conclusion

Times have changed, and so have annuities. As a result, annuities with various withdrawal and indexation options can be offered as a part of your clients’ retirement income strategy, allowing you to tailor the needs of a broad range of clients.

An allocation to a lifetime annuity as part of a retirement portfolio can:

- Increase total retirement income

- Improve the likelihood of meeting retirement income objectives

- Help manage the risks of retirement faced by retiree clients, including market, sequencing and longevity risks; and

- Help improve capital and estate outcomes.

For further information refer to the product documents on the Challenger website.

To find out more:

Speak to your Challenger BDM

Log in, or register for AdviserOnline.

Call Adviser Services on 13 35 66

1 Unless a reversionary beneficiary is nominated where regular payments will be continued to be paid to the reversionary beneficiary upon the death of the primary investor.

2 Deduction amount = purchase price/life expectancy at start of annuity. Where a reversionary is nominated, the longer life expectancy is used.