Alternative Risk Premia: Timing vs Time in Market

Insights

Our approach to Alternative Risk Premia is to harvest, rather than time, the risk premia we invest in. Any switching between different premia is done with a strategic medium-to-long-term holding period in mind, rather than attempting to tactically position the portfolio for short-term movements.

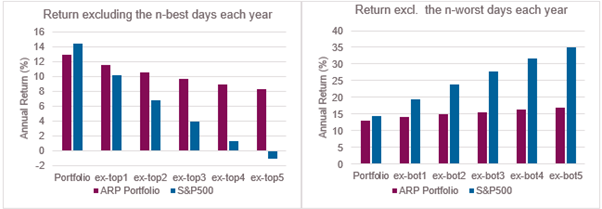

Many studies have been conducted on the pitfalls of trying to time equity markets, and how missing out on just the top couple of days of equity gains can severely adversely affect long-term investment performance. We find a similar (but less extreme) result using our Liquid Alternatives Balanced Fund. The cost of missing the best days is detrimental to long-term compounded performance, but not as detrimental as for equities.

Excluding the best days provides us with a measure of the potential opportunity cost of not being invested in the market at the wrong time. We can also attempt to measure the potential upside from timing the market and avoiding the worst performing days. Through this lens, the potential upside from timing the market is far greater for equities than for our Liquid Alternatives Fund.

To summarise the results, missing out on the top 5 performing days each year in the S&P 500 would have reduced annual returns since 2010 from 14.3% to -1.1%. For our Liquid Alternatives Fund, missing out on the 5 best days each year would reduce annual returns from 12.9% to 8.3%. The full results can be seen in Figure 1. In some sense this might be interpreted as meaning that the ‘cost of being wrong’ when trying to time the market is less for an ARP portfolio than for equities. But we also should consider the benefit from being right. Avoiding the worst 5 days each year would have boosted S&P500 returns from 14.3% to 35.1%, quite the boost when compounded over long periods! By contrast, the same approach would have increased the Fund returns from 12.9% to 16.8%, a far more modest uplift in performance. The potential benefit accrued from successfully timing an ARP portfolio is far less than for the S&P500.

Figure 1: Opportunity cost from missing the best days / Upside from missing the worst days

Because individual ARP strategies have low correlation to each other as well as to traditional assets such as equities and fixed income, portfolios of ARP strategies benefit substantially from diversification. This generally means that ARP portfolios end up with much lower volatility. Expressed differently, that means more stable returns. Intuitively, the more stable returns are, the less the need to try and time those returns.

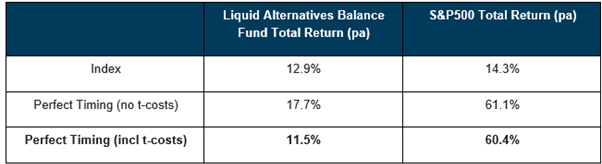

Moreover, because of the complexity involved in implementing strategies to harvest alternative risk premia, transaction costs tend to be higher than for vanilla equity indices. The ARP strategies we invest in are daily liquid, but the liquidity comes at a cost – in our case a 25bp entry/exit fee which covers the cost of buying/selling the entire portfolio of underlying holdings. That compares with transaction costs of 1-2bp for trading broad equity indices. Higher transaction costs serve to increase the hurdle rate for successfully timing the market.

To illustrate, imagine an investor has perfect foresight in predicting negative weekly returns. Each time the investor "knows” a negative weekly return is coming they would sell the portfolio at the start of the week and then repurchase it at the end. In doing so they would avoid the negative return of the portfolio, but they would also incur transaction costs in the process.

For the Liquid Alternatives Fund, the annual return of the “perfect foresight” strategy described would have been less than a simple buy-and-hold strategy, after taking transaction costs into account. Unsurprisingly, having perfect foresight would have been highly lucrative for an S&P500 investor, even after taking transaction costs into account.

Table 1: Annual Return from 2010 to 2022 for the portfolio and after excluding negative weekly returns and accounting for transaction costs.

The Solutions Team

The Solutions team provides derivative overlay and risk management fiduciary services to Asset Owners and Managers in Australia. Our goal is to provide asset owners and managers with an experienced overlay advisory and execution service to improve portfolio outcomes and cost efficiency.

Important notice

Financial services provided by Challenger Investment Solutions Management Pty Ltd (ABN 63 130 035 353 AFSL 487354) (CIP Asset Management, CIPAM). The material in this document is general background information about Challenger’s Investment Solutions activities and is current at the date of this document. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These individual circumstances should be considered with professional advice when deciding if an investment is appropriate. Nothing in this document should be considered a solicitation, offer or invitation to buy, subscribe or sell any, or a recommendation of, financial products. All reasonable care has been taken to ensure that the facts stated and opinions given in this document are fair and accurate. To the maximum extent permitted by law, the recipient releases each member of the Challenger Limited group of companies, their directors, officers, employees, representatives and advisers from any liability (including, without limitation, in respect of direct, indirect or consequential loss or damage or loss or damage arising by negligence) arising in relation to any recipient relying on anything contained in or omitted from this document. Any forward looking statements included in this presentation involve subjective judgment and analysis and are subject to significant uncertainties, risks and contingencies, many of which are outside the control of, and are unknown to, Challenger. In particular, they speak only as of the date of these materials, and they are subject to significant regulatory, business, competitive and economic uncertainties and risks. Actual future events may vary materially from forward looking statements and assumptions on which those statements are based. Given these uncertainties, recipients are cautioned not to place undue reliance on such forward looking statements. Any past performance information provided in this presentation is not a reliable indication of future performance. This document is not audited.