Asset class returns during inflation and growth periods

Insights

This month we look at how various asset classes have performed in the rising and falling growth and inflation regimes. We have defined a rising (falling) inflation regime as the times when inflation is above (below) its 10y average. The same methodology to real GDP growth to determine the growth regimes.

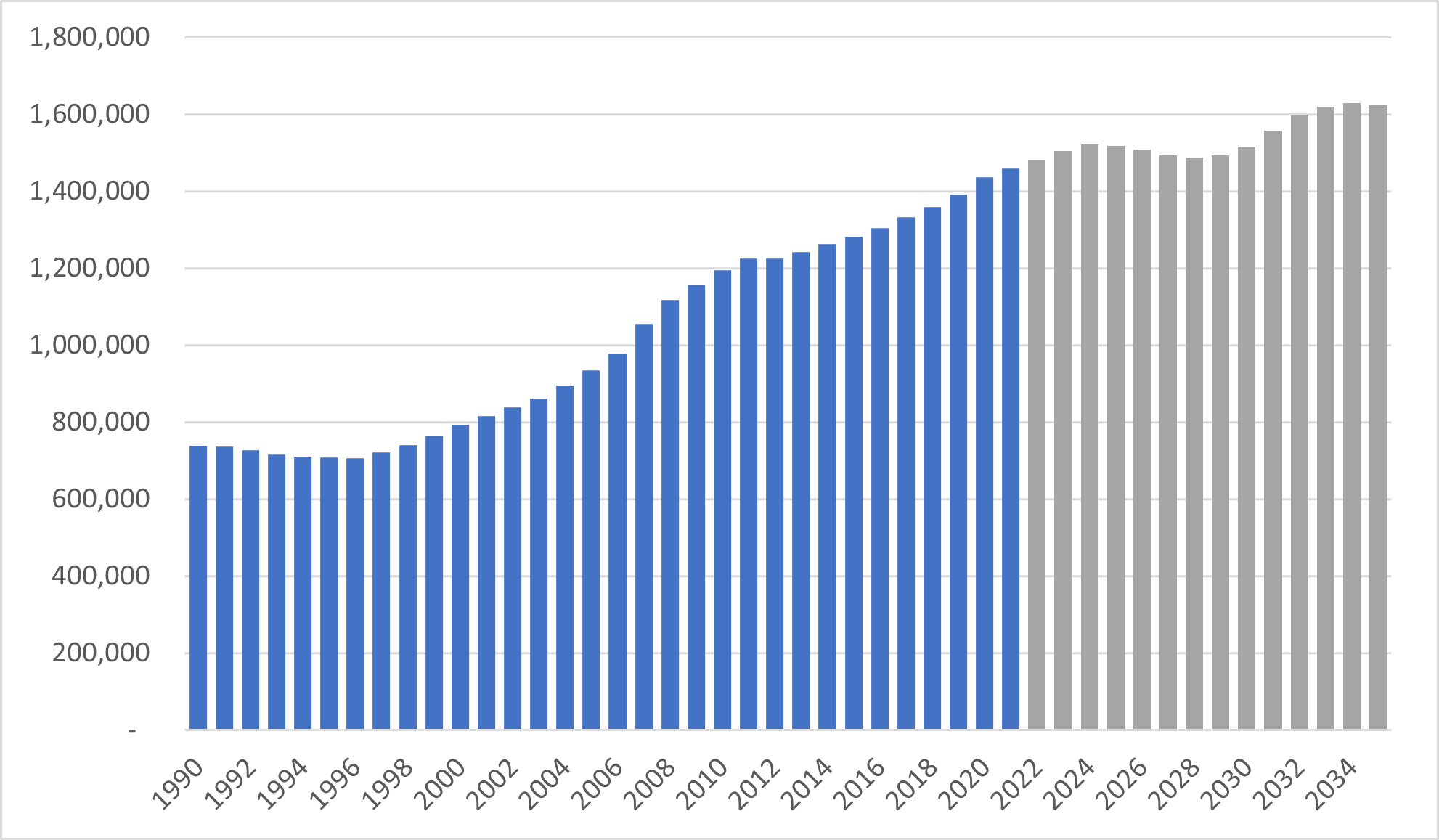

Figure 1: Growth and inflation regimes

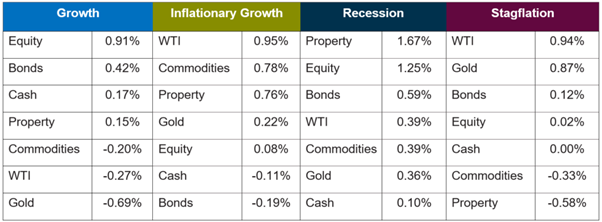

For each regime we have calculated the median monthly returns of equities, property, fixed income, cash, gold, commodities & crude oil going back to 1971. Table 1 shows the asset classes ranked by their median return in each regime. As can be seen, more traditional asset classes – namely equities, fixed income and property – perform well in falling inflation regimes. It’s worth noting that the period from March 2020 to Feb 2021 was classified as falling inflation, falling growth period, but equities and property produced above-average returns during this time which lifted the median return in this regime.

However, Property and equities delivered a subdued performance in inflationary growth and stagflation environments. Over recent months many Australian investors have been looking to inflation-proof their portfolios considering allocations to inflation-linked bonds, commodities, oil. Table 1 shows that commodities and oil have historically been the best assets to own in the current Inflationary Growth regime.

It’s also worth remembering that inflation-linked bonds owners are compensated for inflation by earning real yields. However, rising growth regimes generally go hand-in-hand with rising real yields and therefore underperformance of inflation-linked bonds. The returns are protected against rising inflation but not rising growth. If real yields keep rising over the coming months there may be an inflection point where inflation-linked bonds become attractive to own to hedge against inflation, but until then including a dynamic allocation to the commodity complex can benefit the overall portfolio during this inflationary growth environment.

Table 1: Asset class performance ranking per regime

Important Notice

Financial services provided by Challenger Investment Solutions Management Pty Ltd (ABN 63 130 035 353 AFSL 487354) (CIP Asset Management, CIPAM). The material in this document is general background information about Challenger’s Investment Solutions activities and is current at the date of this document. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These individual circumstances should be considered with professional advice when deciding if an investment is appropriate. Nothing in this document should be considered a solicitation, offer or invitation to buy, subscribe or sell any, or a recommendation of, financial products. All reasonable care has been taken to ensure that the facts stated and opinions given in this document are fair and accurate. To the maximum extent permitted by law, the recipient releases each member of the Challenger Limited group of companies, their directors, officers, employees, representatives and advisers from any liability (including, without limitation, in respect of direct, indirect or consequential loss or damage or loss or damage arising by negligence) arising in relation to any recipient relying on anything contained in or omitted from this document. Any forward looking statements included in this presentation involve subjective judgment and analysis and are subject to significant uncertainties, risks and contingencies, many of which are outside the control of, and are unknown to, Challenger. In particular, they speak only as of the date of these materials, and they are subject to significant regulatory, business, competitive and economic uncertainties and risks. Actual future events may vary materially from forward looking statements and assumptions on which those statements are based. Given these uncertainties, recipients are cautioned not to place undue reliance on such forward looking statements. Any past performance information provided in this presentation is not a reliable indication of future performance. This document is not audited.