Designing super solutions for retirement

Thought Leadership

- regular income that lasts for life;

- access to additional lump sums in case of emergencies;

- a potential estate value to support family, particularly in the event of early death; and

- the highest level of income while meeting these aims.

- how long a retiree will live;

- how investment markets will perform; and

- what inflation will mean for the future purchasing power of income.

Blended retirement solutions

A single product is unlikely to meet the desired retirement objectives for all fund members. Broadly, Trustees can utilise two types of retirement products when designing a retirement offering:

- An Account-based pension (ABP) – which offers flexibility but lacks certainty for members.

- A lifetime income stream – which lacks flexibility but makes payments for life and can provide certainty for members.

A key benefit of a lifetime income stream is that it pools longevity risk. This is why the government developed the innovative retirement income stream (IRIS) concept in 2017, to promote income streams in retirement. Incorporating an IRIS into a retirement portfolio can reduce one of the biggest risks faced by members – outliving their retirement savings. This option ensures an income for life no matter how long that is.

An IRIS provides a fund with flexibility in design and features. Some IRIS products make guaranteed payments, providing certainty for a member on the payment they will receive, others incorporate market exposure into future payments. This second option means trading certainty for higher potential payments.

For some retirees, blending an ABP with an IRIS provides all the desirable features: certainty of income for life; flexibility in emergencies; and an estate value upon death. The blended solution is usually better than either an ABP or an IRIS alone.

The cohorting approach

Designing a blended retirement solution should include a risk-based assessment of how solutions meet the needs of members. Although net investment returns are a recognised metric for assessing outcomes in accumulation, in the decumulation phase the returns achieved are only part of the equation. A more holistic metric is required. A metric which balances the objectives of providing income for life with the desire to leave a benefit to the estate can be used to compare retirement solutions for cohorts of members. Taking the present value of expected income and estate values can provide a simple measure of value for different cohorts. The following figures provide a graphical representation of such a measure.

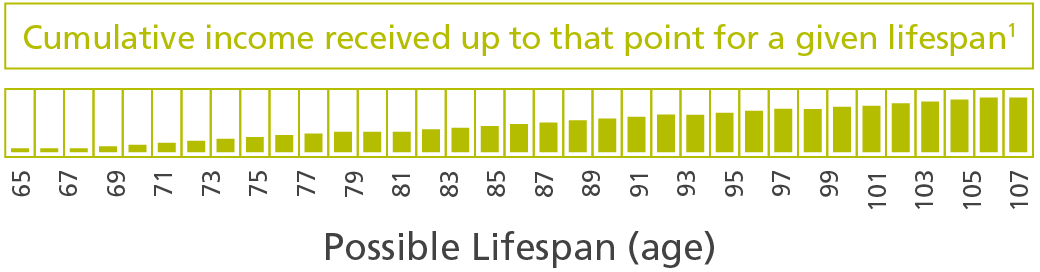

Total income received over the lifetime, for a given lifespan. (e.g. a female aged 65 today who passes away age 70 might receive 5 ½ years of income on average)

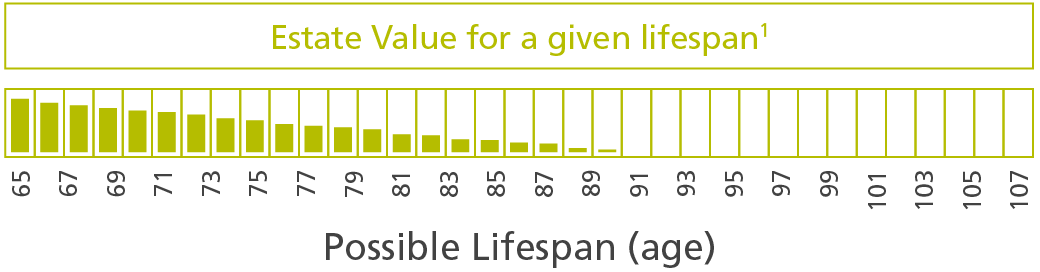

The estate value on death for a given lifespan. (e.g. a female member aged 65 today who passes away age 70 will have some ABP balance remaining plus any a potential death benefit from a lifetime income stream)

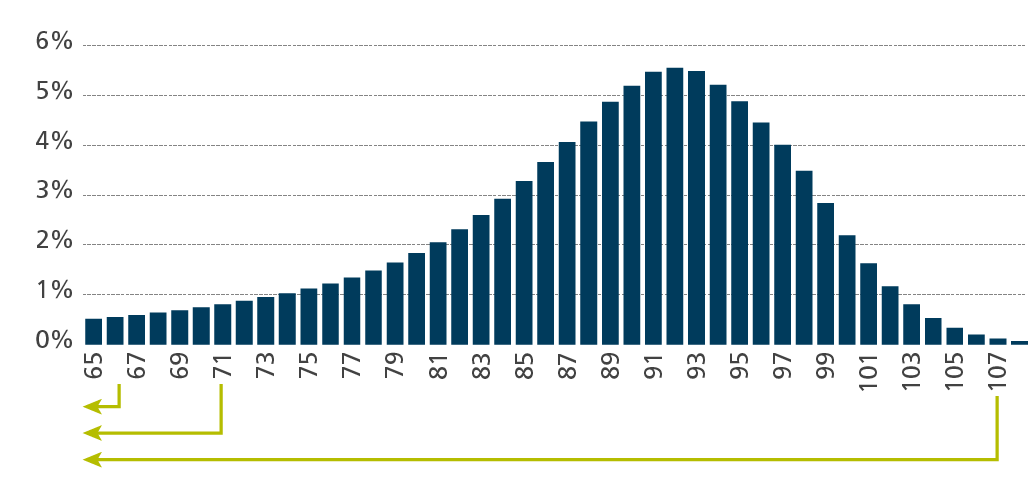

Range of possible lifespans, and the probability of occurrence. (e.g. out of every 10,000 females around 75 will pass away aged 70, and so the value at age 70 has a 0.75% weighting).

The payments are discounted back to the present to allow for the time value of money. This metric can identify the cohorts where members are expected to be better off (on average). It can be calculated for a range of retirement solutions to identify those with higher present values for a given asset level, age and gender.

Challenger’s recent paper ‘Guided choice retirement solutions’ uses this metric in a four-step framework to determine the appropriate blended retirement solution across member cohorts. The metric helps a fund to decide what blended retirement solution to offer members. Further, application of this framework confirmed there is a range of cohorts where offering a blended retirement solution will meet the needs of members better than an ABP alone.

You can view the complete framework and access the full paper ‘Guided choice retirement solutions’ here.

1 These visuals are illustrative only and are not to scale.