More income in retirement

Thought Leadership

"Please sir, I want some more"

This is the classic line that launches the life of Oliver Twist beyond the workhouse, but the same line could be used by retirees to their super fund. Unlike the Dickens novel, there are some options available to the member who wants more out of retirement.

This is the classic line that launches the life of Oliver Twist beyond the workhouse, but the same line could be used by retirees to their super fund. Unlike the Dickens novel, there are some options available to the member who wants more out of retirement.

First, the easiest way to get more out is to put more into super in the first place. Saving 12% or even 15% of earnings will increase the amount of money available for retirement. In the current economic environment, low rates and low returns make accumulating the capital harder, so members might need to put even more in.

By the time a member retires, there is an additional challenge because they no longer have the option to contribute more. Having built up a nest egg, money to spend through retirement will have to come from that nest egg, along with the age pension entitlements (if applicable). The key for those who want more income in retirement is to maximise the income they safely take out of their nest egg. If they do this in the right way (and super funds can help here), the members won’t need to live off gruel. They will be able to enjoy the lifestyle that they desire all through retirement.

Super funds can help members in two ways:

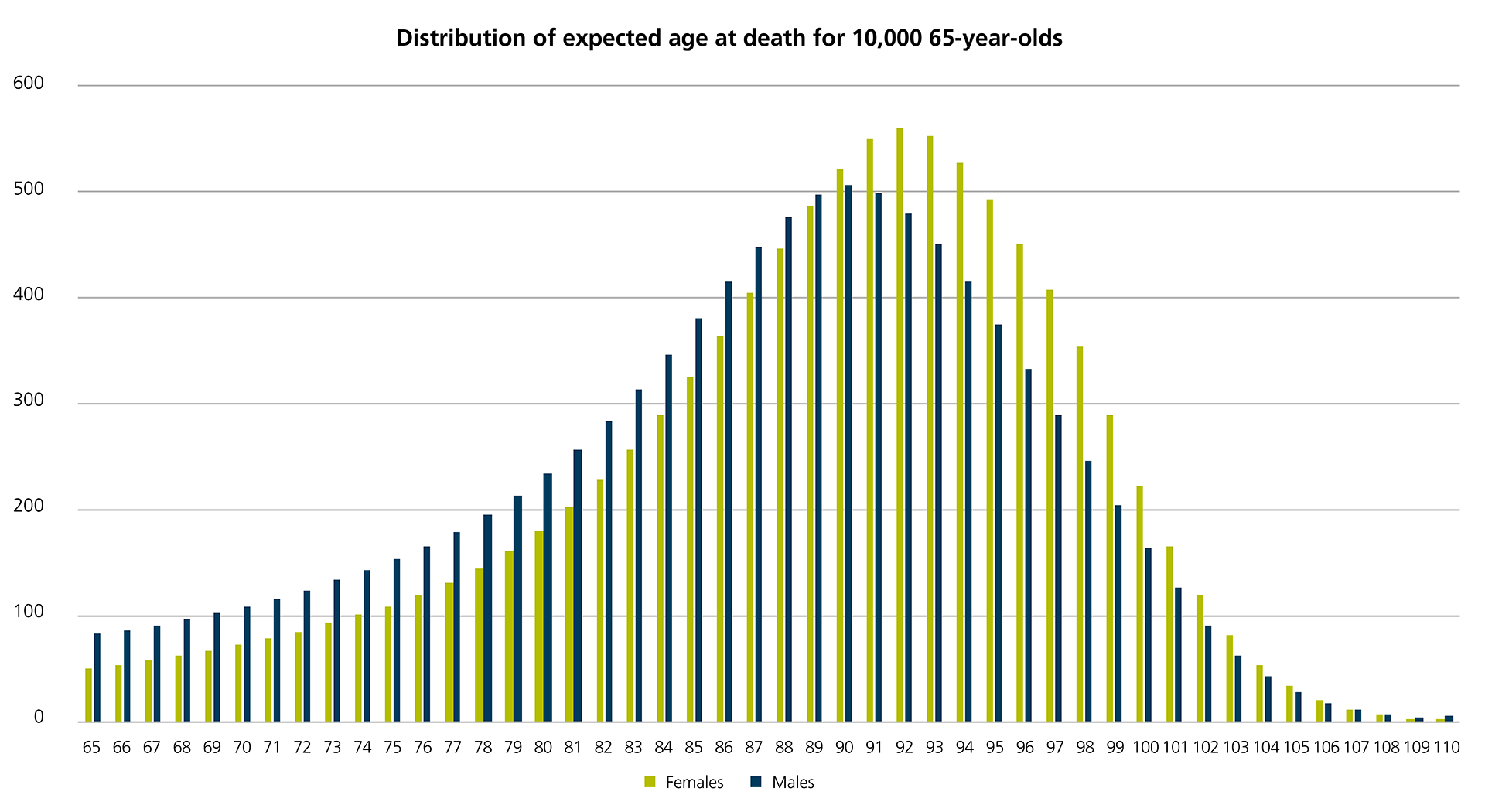

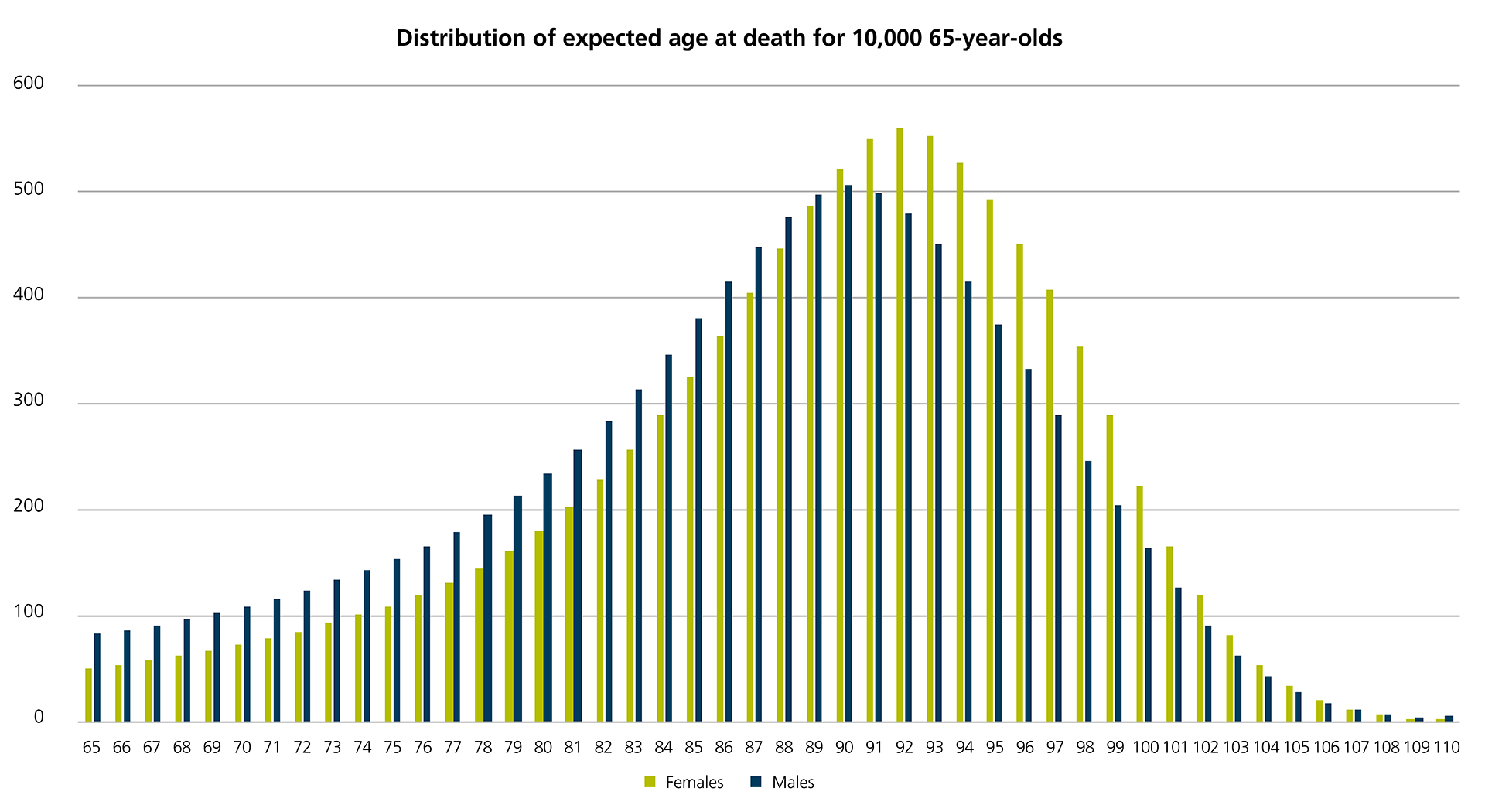

Retirees have concerns about how long they will need to fund their retirement. No one knows exactly how long they will live. Super funds can provide product solutions that can manage this uncertainty for their members. The solution is possible when you consider distribution of life expectancy for a large cohort of people of a similar age. A larger cohort is sequentially more likely to reflect the expected distribution lifespans. This provides the opportunity for pooling to help everyone spend as if they all lived to the average of the pool. The figure below shows the distribution of the expected age of death for 10,000 65-year-olds today, including the gender difference.

By the time a member retires, there is an additional challenge because they no longer have the option to contribute more. Having built up a nest egg, money to spend through retirement will have to come from that nest egg, along with the age pension entitlements (if applicable). The key for those who want more income in retirement is to maximise the income they safely take out of their nest egg. If they do this in the right way (and super funds can help here), the members won’t need to live off gruel. They will be able to enjoy the lifestyle that they desire all through retirement.

Super funds can help members in two ways:

- Provide a product for retirement that progressively returns most of the capital to the member over their (unknown) retirement horizon.

- Help educate members about likely living and other expenses in retirement, particularly as members are uncertain what they will need.

Retirees have concerns about how long they will need to fund their retirement. No one knows exactly how long they will live. Super funds can provide product solutions that can manage this uncertainty for their members. The solution is possible when you consider distribution of life expectancy for a large cohort of people of a similar age. A larger cohort is sequentially more likely to reflect the expected distribution lifespans. This provides the opportunity for pooling to help everyone spend as if they all lived to the average of the pool. The figure below shows the distribution of the expected age of death for 10,000 65-year-olds today, including the gender difference.

Source: Based on ALT2015-17 with 25-year mortality improvement factors from the Australian Government Actuary

An appropriately pooled lifetime income product can also include a death benefit to those who don’t survive far into retirement. Many of these will leave behind a spouse so the death benefit preserves household finances.

By providing a product for their members that benefits from longevity pooling, super funds can provide the peace of mind that members will have income for as long as they live. Indeed, funds can offer members a simple product that meet a range of holistic needs. This does not need to cover all their spending— some will get the age pension as well—but a partial allocation can provide enough of a boost that retired members can spend confidently at the start of retirement. This is when most retirees are more active and able to enjoy the best of life. The potential increase in spending is significant. Compared to only drawing the minimum (a common approach), a pooled solution can increase income for members by over 30%. Instead of restricting their lifestyle to a gruel diet, it can be possible for retired members to have their cake and eat it too.

An appropriately pooled lifetime income product can also include a death benefit to those who don’t survive far into retirement. Many of these will leave behind a spouse so the death benefit preserves household finances.

By providing a product for their members that benefits from longevity pooling, super funds can provide the peace of mind that members will have income for as long as they live. Indeed, funds can offer members a simple product that meet a range of holistic needs. This does not need to cover all their spending— some will get the age pension as well—but a partial allocation can provide enough of a boost that retired members can spend confidently at the start of retirement. This is when most retirees are more active and able to enjoy the best of life. The potential increase in spending is significant. Compared to only drawing the minimum (a common approach), a pooled solution can increase income for members by over 30%. Instead of restricting their lifestyle to a gruel diet, it can be possible for retired members to have their cake and eat it too.