Reconciling commodities with YFYS ‘Other’ benchmark

Insights

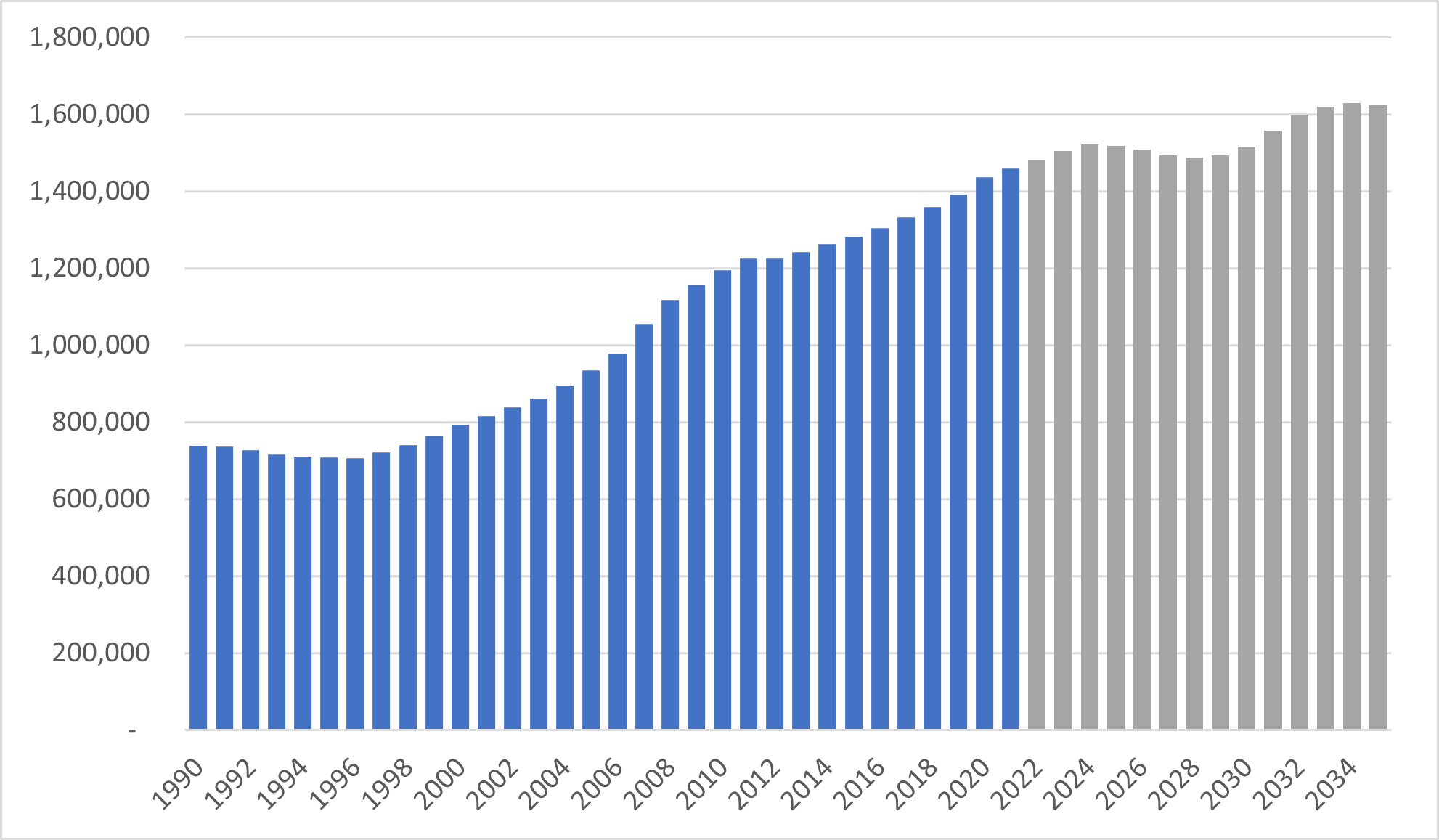

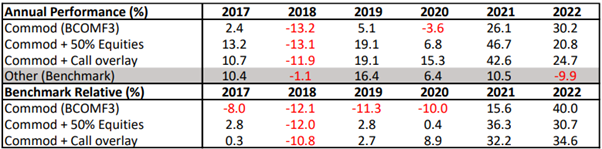

One of the most commonly cited benefits of commodities is as an uncorrelated asset class. At the risk of stating the obvious, that implies that commodity returns don’t move together with other asset classes such as equities and fixed income. The chart below plots long-term performance of Commodities (we use the BCOMF3 index) against the YFYS ‘Other’ Benchmark. The two look nothing alike (and the ‘Other’ Benchmark just looks like a scaled-down version of equities).

Figure 1: Long term performance of Commodities compated to YFYS ‘Other’ Benchmark

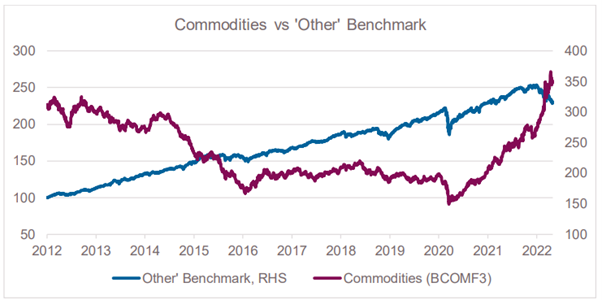

How then are Super Funds supposed to approach such an asset class when it is benchmarked against equities and fixed income? Or more accurately, when it is benchmarked against Equities, since, as the correlation table below shows, the ‘Other’ benchmark is >90% correlated to international equities (both hedged and unhedged in AUD).

Figure 2: Correlation of Commodities (BCOMF3) with other asset classes and the ‘Other’ Benchmark

Commodities might only be 28% correlated to the benchmark, but that doesn’t really matter unless performance diverges substantially. Which, of course, it does. How much confidence does one need to have in an investment thesis – for example, that inflation is going to remain high and that in such an environment commodities will be a good asset class to own – when tracking error to the benchmark is 13.6% and annual underperformance has been as high as -29%?

![]()

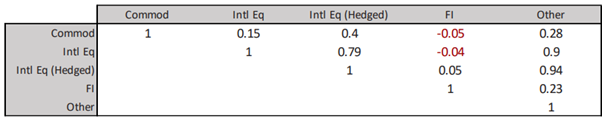

Figure 3: Year-by-year performance and tracking error of Commodities versus ‘Other’ Benchmark

Since commodities and the benchmark are essentially two completely different things, underperformance can, and has, come from two places.

- Commodities themselves may post negative returns. This is particularly evident in the 2014, 2015 and 2018 annual returns in the table above, for example.

- The benchmark (which in a correlation sense is just equities) may post an outsized positive return, as was the case in 2019 and to a lesser extent 2017.

For an investor who wishes to take on commodity exposure, the first risk is presumably addressed as part of the investment case. But the second risk – the benchmark doing well in an absolute sense – is completely independent of the investment case for commodities. There may be a need to ‘hedge’ the risk that the benchmark does really, really well.

One way to do this might be to simply add back the ‘benchmark’ by taking a 50% long position in international equities. It can’t make up for bad performance from commodities, but it does protect against underperformance due to very strong equity markets. But if equity markets go down, you also lose on your hedge. By adding a linear 50% long equity exposure to your commodity investment, you’ve just made your commodity investment look more “equity-like”. If part of the appeal of commodities is that they’re uncorrelated to equities, it doesn’t quite feel right to forcibly make them behave like equities again.

What if we could get exposure to the upside in equities but not the downside? Then we could benefit from strong equity markets without suffering as much if equities sell-off. We can get that kind of asymmetric exposure from a call option. We have designed a systematic call buying strategy specifically for this purpose. It does almost as well as the 50% “delta-1” hedge when equities are going up, and much better when equities are going down.

The table below shows the last 5 years of performance for commodities, commodities with a 50% equity overlay, and commodities with a call overlay. It’s a useful period to look at because it includes periods of strength in both commodities and the ‘Other’ benchmark. The value of adding back some equity exposure is evident in 2017 and 2019, periods where commodities posted positive returns, but nevertheless underperformed the benchmark. The asymmetric behaviour of the call overlay is evident in the 2018, 2020 and 2022 (YTD) – periods with meaningful equity drawdowns.

Figure 4: Year-by-year performance of Commodities with equity upside versus ‘Other’ Benchmark

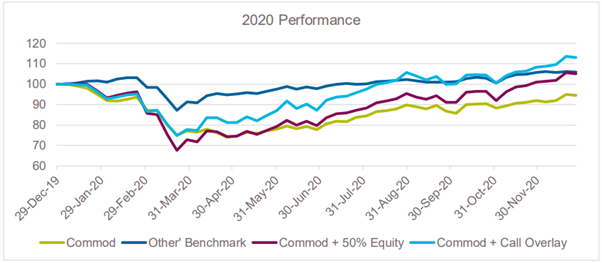

We can also see the benefit of using the asymmetric call overlay as the benchmark ‘hedge’ in the chart below, which shows the performance through 2020. Notably, the negative performance in the commodities plus call overlay portfolio is no worse than the standalone commodities performance through March, but the equity exposure from the call overlay contributes positively in the post-Covid rebound. By contrast, the commodities plus 50% equities portfolio underperforms standalone commodities meaningfully through the March drawdown period.

Figure 5: Calendar year performance of commodities with ‘upside’ equity hedges vs ‘Other’ Benchmark

The analysis above demonstrates it is possible to invest in assets such as commodities – which are classified as ‘Other’ and benchmarked to the YFYS ‘Other’ Benchmark – by ‘hedging’ with a call overlay strategy. Importantly, the call overlay hedges against strong benchmark performance, as opposed to hedging the performance of the underlying asset. As such, any investment in commodities (or any ‘Other’ asset for that matter) is still at risk from poor performance of the underlying investment. But at least that is as it should be, whereas we’d argue that benchmarking commodities against a benchmark comprising of Equities and FI is less than sensible.

The Solutions Team

The Solutions team provides derivative overlay and risk management fiduciary services to Asset Owners and Managers in Australia. Our goal is to provide asset owners and managers with an experienced overlay advisory and execution service to improve portfolio outcomes and cost efficiency.

Important notice

Financial services provided by Challenger Investment Solutions Management Pty Ltd (ABN 63 130 035 353 AFSL 487354) (CIP Asset Management, CIPAM). The material in this document is general background information about Challenger’s Investment Solutions activities and is current at the date of this document. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These individual circumstances should be considered with professional advice when deciding if an investment is appropriate. Nothing in this document should be considered a solicitation, offer or invitation to buy, subscribe or sell any, or a recommendation of, financial products. All reasonable care has been taken to ensure that the facts stated and opinions given in this document are fair and accurate. To the maximum extent permitted by law, the recipient releases each member of the Challenger Limited group of companies, their directors, officers, employees, representatives and advisers from any liability (including, without limitation, in respect of direct, indirect or consequential loss or damage or loss or damage arising by negligence) arising in relation to any recipient relying on anything contained in or omitted from this document. Any forward looking statements included in this presentation involve subjective judgment and analysis and are subject to significant uncertainties, risks and contingencies, many of which are outside the control of, and are unknown to, Challenger. In particular, they speak only as of the date of these materials, and they are subject to significant regulatory, business, competitive and economic uncertainties and risks. Actual future events may vary materially from forward looking statements and assumptions on which those statements are based. Given these uncertainties, recipients are cautioned not to place undue reliance on such forward looking statements. Any past performance information provided in this presentation is not a reliable indication of future performance. This document is not audited.