Super funds are ramping up capacity for retirement income solutions

Thought Leadership

The retirement income covenant (RIC) is a key piece of legislation on the path to improving the retirement phase of superannuation. The RIC requires super funds to develop strategies for their members to maximise their retirement income, while addressing key risks in retirement, including (but not limited to) longevity, inflation and investment risk.

Earlier this year, Challenger commissioned CoreData to conduct qualitative and quantitative research into super funds’ perceived readiness to comply with their RIC obligations by the 1 July 2022 deadline. The research consisted of one-on-one interviews and quantitative surveys conducted with 43 professionals working at 19 super funds.

Retirement income strategies are well advanced

Publishing a strategy is the first step on the journey to expanding retirement income solutions for members that comply with the RIC obligations and address member needs in retirement. Results from our survey and interviews suggest that super funds are well prepared to meet their RIC obligations from a strategic perspective. Overall, super fund senior executives have a high level of confidence in being on track to announce their RIC strategy in the first half of the calendar year.

The RIC requires trustees to have a strategy in place from 1 July but super funds don’t yet have a specific deadline for implementing any new products to support their strategy. The research suggests that plans for implementation are not yet fully defined by all super funds. Just over half the senior executives say they are confident in the path they’ll be taking to deliver their retirement income products and solutions.

Building capacity to deliver to member

Retirement income products are not new to super funds, but the requirements of the RIC are stretching their knowledge and capacity to comply and deliver a competitive, best-in-class solution to members. Half the super funds surveyed are expecting to manage development and delivery of their retirement income solutions in-house. Comments from the research suggest super funds are looking to utilise either existing business functions or new dedicated teams to deliver fit-for-purpose retirement income solutions.

While it makes sense for super funds to bolster their internal capacity across product, investment and customer teams for delivering on their RIC commitments, many recognise that external providers have much to offer in this space. Nearly half the super funds surveyed plan on seeking support from external providers for delivering on their RIC requirements.

The no. 1 knowledge gap: longevity risk

The RIC mandate is for super funds to enable members to ‘maximise expected retirement income throughout their period of retirement’. This requires solutions that help members drawdown their super savings in a sustainable way to supplement their retirement income from other sources such as the Age Pension.

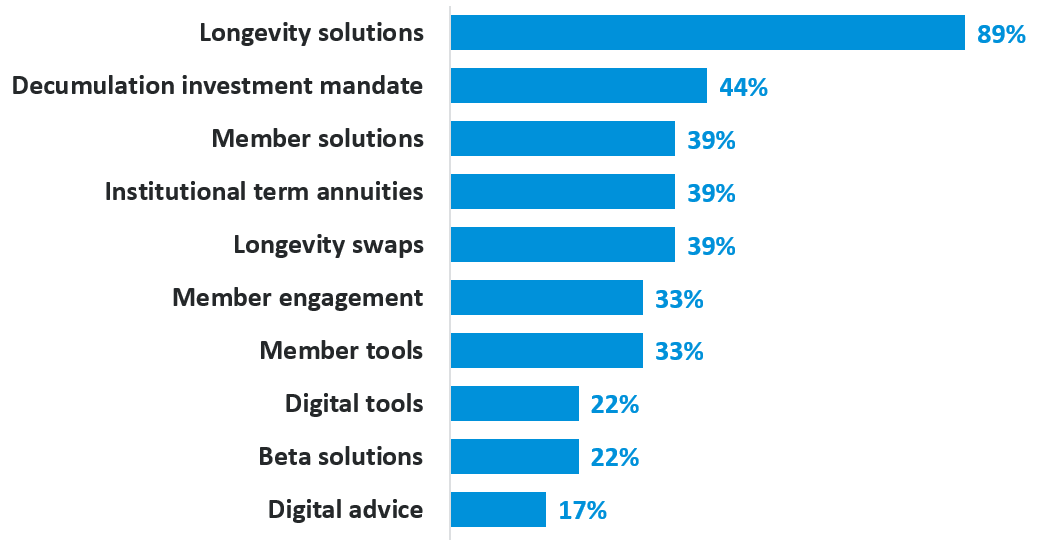

However, using capital for income also introduces longevity risk. Given the uncertainty about how long members will live, super funds need to address a new challenge and one that requires a significant commitment of their operational capability and liability management. So it’s unsurprising there is demand for experts to help super funds meet their RIC obligations. 89% of respondents need longevity solutions which is twice as high compared with any other gap in the knowledge base they are drawing on to support their RIC strategy and program of work.

Source: Challenger/Core Data, Is the super ecosystem ready for the Retirement Income Covenant?, June 2022

Managing longevity risk takes expertise

By working with an expert provider like Challenger, super funds can complement their internal capabilities in investment strategies and product design with proven solutions for managing longevity risk. We offer a way for super funds to provide a secure income stream for life integrated into their own product, enabling them to meet the market with a cost-effective and RIC-compliant solution for retired members that is simple to understand and helps to deliver peace of mind.

Challenger are experts in longevity risk management. Our Asset and Liability Management team has specific experience managing money to achieve set outcomes. Contact our Institutional Solutions team to find out more.