Super members missing out a potential $225bn in retirement

Thought Leadership

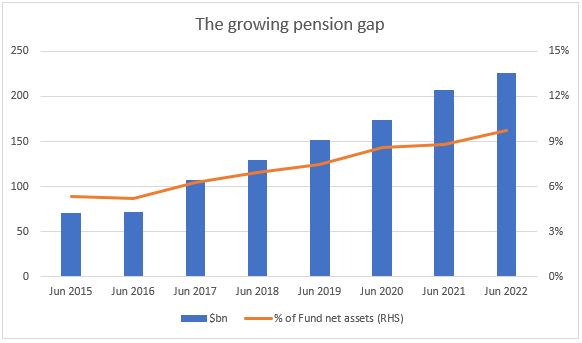

At June 2022 there was $225 billion across more than 1.4 million member accounts where the member was not in a pension account and paying tax when it might not be necessary.

This now represents almost 10% of the net assets in funds with more than 6 members. Back in 2015, just after the Murray Inquiry noted the problem of members not starting a pension, the gap was just over 5% of net assets ($70bn). In the past seven years, the dollars have more than tripled, almost doubling as a proportion of the funds’ assets.

Member choice and the transfer balance cap

Some might think that the growing balances are not necessarily a problem. Media reports have highlighted the recent increase in the employment of older workers. However, many of these are over 55 but still under 65. It is possible to be employed and still hold a super pension before age 65. If someone permanently retires after preservation age, or ceases an employment arrangement after age 60, and then starts a super pension they could subsequently commence another employment arrangement and maintain their super pension in the pension phase, paying no tax on investment earnings. The total number of employed people over 65 at June 2022 was 660,000 according to the ABS and only 295,000 were employed full-time. These employed people would still need an accumulation account to make contributions but they can benefit from the tax-free status if they have the bulk of their super in the pension phase. This might explain half of the accumulation accounts (assuming none of the older workers use a self-managed fund) but it doesn’t explain why the gap is worth 10% of funds’ net assets.

Another possible explanation is that the transfer balance cap (current $1.7m) requires some people to retain some of their super in an accumulation account. APRA doesn’t have statistics on how many people are above this level, but they do tell us that there were only 82,000 member accounts with more than $1.0m in the funds with more than 6 members. The cap will only be responsible for a small number of the accounts that are not in the pension phase.

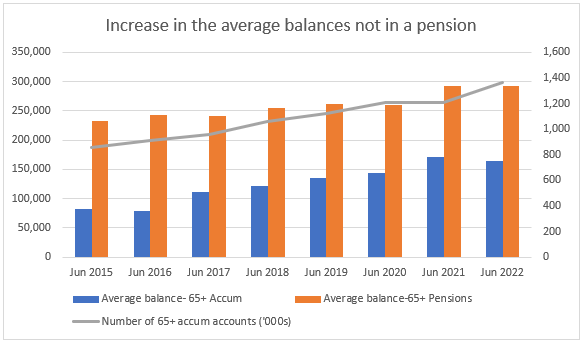

The average balance of the accounts in this gap fell slightly to $165,000, reflecting falling investment values over the year to June 2022. The trend has been an increase in average balances over time, growing faster than the average balances for pension accounts (aged 65+) over the same period.

Hope for improved retirement income strategies

These data reflect the state of retirement funds prior to the introduction of the retirement income covenant on 1 July 2022. Funds have now published their retirement income strategy and many are working on new offers for their members in the retirement phase. As more funds provide a retirement solution that is better suited to their member’s needs then this retirement gap should close over time. There are 225 billion reasons why members want to see this offer from their fund.

[1] e.g. Why Australians are quitting retirement, Australian Financial Review 22 December 2022