The alchemy of Index Plus

Thought Leadership

The need to stay better than 0.5% pa behind benchmark creates an incentive to hug the index, rather than risk falling behind. Even just one bad year can result in an under-performance data point leading to a material performance test impact.

This is an environment where the ability to provide an index return ahead of benchmark is valuable. It is even more valuable when there is guaranteed out-performance. So valuable in fact that many think it is alchemy, the equivalent of turning lead into gold. Scientists and historians will tell you that this alchemy is sophistry, but guaranteeing a return above the index is real.

The key to this solution is not stock selection. No-one can get that right often enough to guarantee a return above the index. The key is the guaranteed return itself. If you can get a guaranteed (fixed) return that is high enough, you can swap away any underlying exposure in return for the desired index, resulting in a guaranteed return above that index. This process of hedging market exposures to isolate guaranteed returns is a core element of what Challenger Life does in its day-to-day business. The process of delivering a guaranteed excess return above a selected index is Challenger Index Plus.

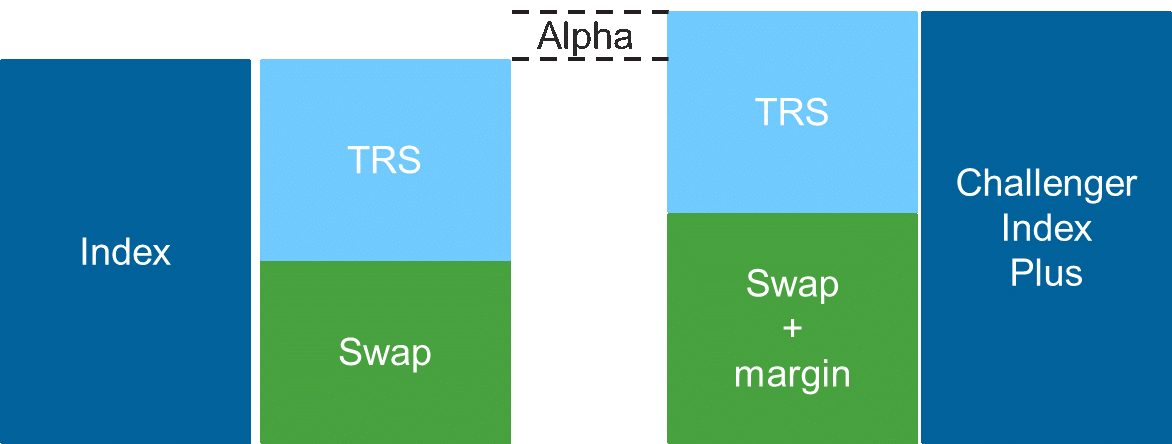

It isn’t alchemy. It is just portable beta. While that’s not the sort of headline that marketing creatives will jump at, it is a creative adaptation of guaranteed investment solutions. In previous years, the concept was known as portable alpha, probably because alpha sounds more appealing.

Higher performance

The traditional approach to generating alpha is to find the right portfolio of stocks or bonds so that the return on that portfolio is higher than the return on the market. This is hard to do consistently. Instead of beating the target market benchmark, using asset and liability management techniques make it possible to swap higher performance over an alternative benchmark to generate a higher guaranteed return over a target benchmark.

This is what Challenger Index Plus does.

Total return swaps are an effective type of hedging instrument that exchanges a swap-based return for an index return plus or minus a spread. This spread is critical. It is set to limit arbitrage opportunities for the market-makers in the derivative market. Typically, the market-makers are funded at bank-to-bank swap rates. Thus, it is possible to beat the index not by getting a stock call right, but by generating a return above the swap curve by the appropriate margin. This margin, plus or minus any spread on the derivative market can produce alpha above the desired market index. This can be seen in the figure below with the higher returns on Index Plus. The benefit comes when the cost to hedge the market (spread between the benchmark returns) is covered by the value-adding margin over the swap curve.

Generating out-performance can be done with asset and liability management expertise and a competitive advantage in generating a return above swap. This is how Challenger generates guaranteed returns for our clients and we can apply this to a range of market indices.