Can a deferred lifetime annuity help provide retirees with confidence in retirement?

Thought Leadership

A DLA is a form of lifetime annuity that will pay the owner a guaranteed income stream, starting at a future date, for as long as they live thereafter. This means that they don’t have to worry about all of their money running out. In fact, DLAs can give retirees more confidence to spend their retirement savings in the early, ‘active’ years of their retirement. They can do this because they have created a temporal boundary; the point at which their lifetime guaranteed income starts.

A lifetime annuity combines regular income payments and insurance. The DLA has a bigger weight on the insurance element. This is attractive for some retirees and funds because it means that less capital is required to invest in the DLA for the same level of guaranteed income, leaving more money in the account-based pension (ABP) over the deferral period. The longer the deferral period, the smaller the initial capital required to be applied to the DLA. The DLA relies on the time value of money, compounding returns and mortality credits derived from the pooling of longevity risk. Those who live longer are cross subsidised by those who do not.

The key to using a DLA effectively is to make sure that the ABP doesn’t run out before the DLA starts paying. By integrating the DLA and ABP into one retirement solution for the member, a super fund can ensure that the ABP doesn’t run out early. It also provides a simple solution for their members. In addition, retirees with a DLA will not need the sizeable capital buffers that many maintain due to uncertainties around their longevity and the sustainability of their spending.

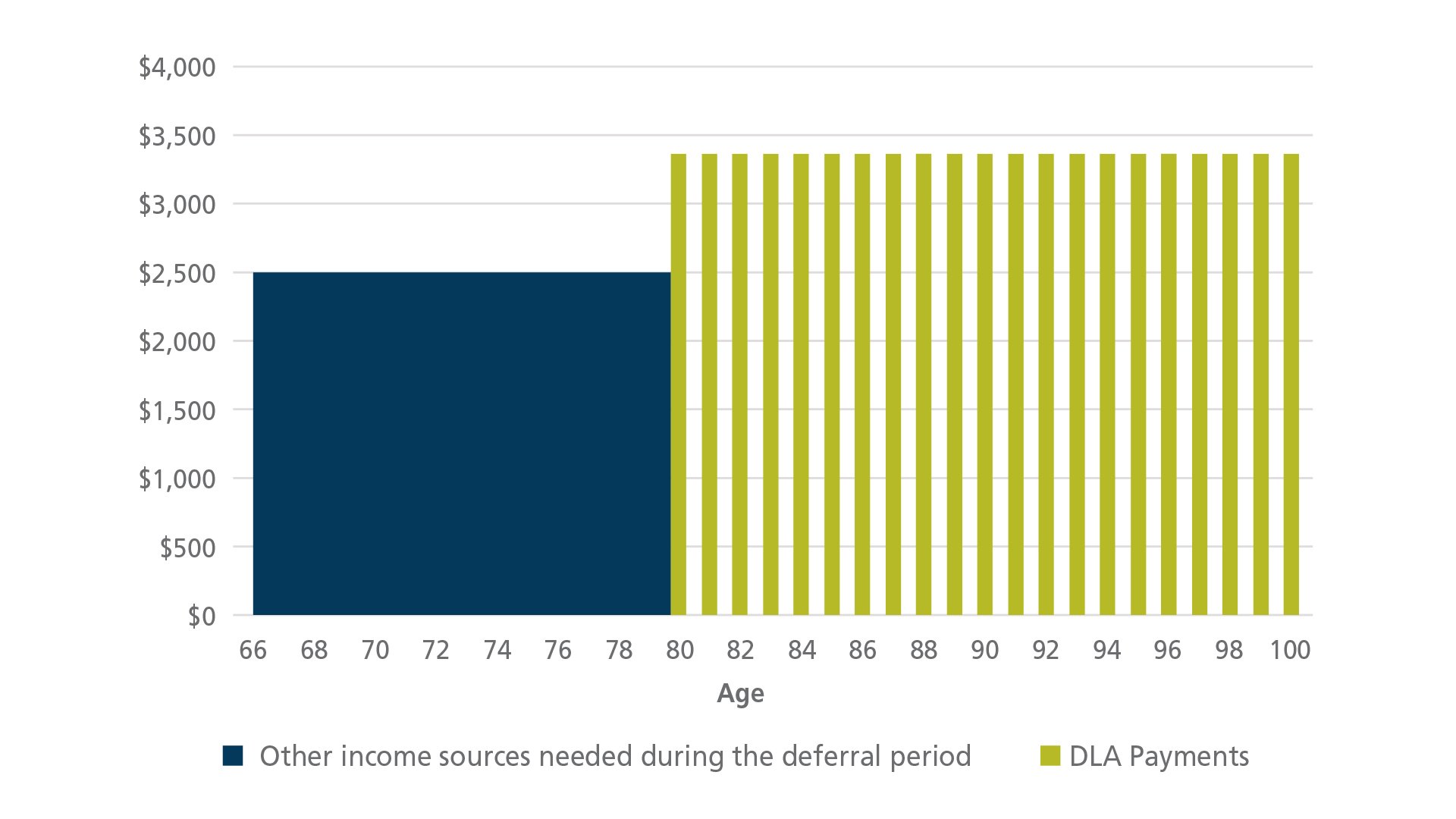

A simple example can explain these two points. Consider Sally, who is a newly retired 66-year-old single woman. She wants to ensure that she is always better off than the Age Pension alone. After speaking to her fund, she targets cash flows of $3,366 a year (adjusted for inflation) above the Age Pension. This is the same as the current gap between the full Age Pension ($24,552p.a.) and the ASFA modest standard ($27,902 p.a.). The gap is the blue zone of the deferral period, ahead of the payments from the DLA, which start at age 80 in Figure 1. This would cost Sally $30,800 to buy based on 23 November 2020 pricing, and it includes a death benefit and some access to capital for up to 21 years [1].

Figure 1: DLA payments are paid after the deferral period

In contrast, if Sally bought an immediate annuity, she would need $84,610 today, but the payments would start immediately. She could lower the initial capital to $20,500 if she deferred payments to age 85, but her ABP would have to last longer [1].

[1] All annuity quotes are based on Challenger Liquid Lifetime Annuity - Flexible rates as at 23 Nov 2020.