The impact of demographic change and the pandemic on retirement planning in the 2020s

Thought Leadership

Source: The Demographic Group

Source: The Demographic GroupAn impact from COVID-19, that is not immediately obvious, is the change that reduced migration will have on the dependency ratio and funding retirement for baby boomers. Australia has typically had a relatively high migration rate that slows down the impact of ageing demographics because migrants are typically working age people with children. With limited movements in 2020, 2021 and potentially longer, the reduced younger migrant population will make funding retirement across the economy harder and encourage older workers to stay in the workforce.

Following the presentation, Jeremy Cooper (Chairman, Retirement Income at Challenger) chaired a panel to discuss how funds can help their member navigate these challenges to achieve the retirement they desire.

The panel included:

- Chris Drew (Investment Manager, Australian Catholic Super Fund)

- Sally Evans (Director Rest, and Non-exec director of Allianz Retire+ Healthcare among others)

- Brnic van Wyk (Head of Asset/Liability management, QSuper)

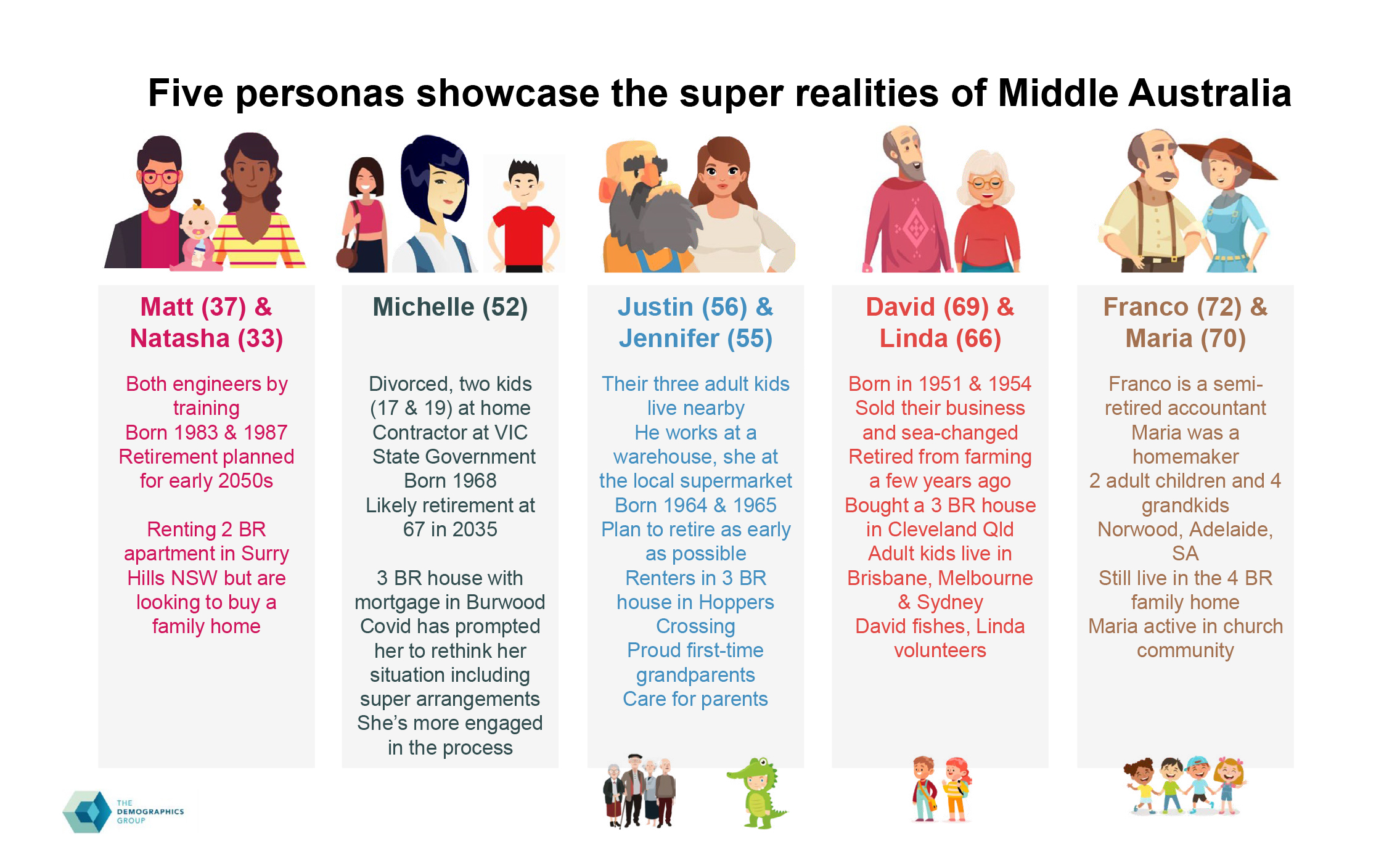

Drawing on Bernard’s presentation, there was general agreement that demographic changes mean that delivering retirement outcomes will remain challenging. Also, while super has been set up to meet that challenge, and while the system is working well to help members accumulate assets, more needs to be done on getting the right outcome for retired members. At the very least is this includes a move to income projections rather than accumulated balances. One difficulty, which is highlighted by the personas, is that people approach retirement with different goals. It can be difficult for a fund to deliver the right solution if some members want a simple lifestyle, others want to pursue more expensive living and some want to leave a legacy. These differing personas are exactly what the funds need to manage with their members.

The panel was questioned on the need for people to allow for aged care funding within their retirement savings. This is a fear many retirees have, but the reality is that the discretionary cost of aged care is not as bad as people expect. Australia has a good aged care system and people should be confident that they will be able to afford the right aged care option. The lack of confidence compounds some of the problems that we see with retirees not spending their retirement savings.

Another fear is that the super rules will change. Some younger members do not engage with super when they think the rules will be completely different by the time they retire. Funds could help by providing a clear solution for members to generate some certainty, but the constant tweaks to the system make it hard for funds to deliver this solution.

The panel noted that some of the proposed additional requirements on super funds in the retirement phase were a result of the lack of action by funds themselves . Funds have been aware of the increasing number of retiring members, but have been slow to introduce better solutions that meet people's current retirement income needs, or future needs. In the absence of improvement, funds risk a government response that might not be the best outcome for the fund, or their members. This leaves funds with some urgency to work on a better solution, notwithstanding the number of recent policy initiatives that super funds need to manage. This urgency will grow as the super system matures and funds find themselves in net negative cash flow each year as benefits in the retirement phase exceed contributions.

Member engagement is seen as a crucial part of the solution. In order to deliver the right outcome, the member needs to be engaged enough to make the right choice at the appropriate time. This is also true for younger members, such as the Matt and Natasha household persona. In order to sustain engagement, funds need to be both relevant to the member’s current situation and share a vision of retirement that is appealing and achievable. Matt and Natasha will be more concerned with housing today than a retirement drawdown product, so member communications need to be tailored to their situation and show how the two are connected. There is scope for digital tools to assist funds tailor the messages. Funds can use these tools to guide the members along the journey that the Trustees are managing for the members.

In order to tailor communications, funds need to utilise the improving digital tools that are being developed. Super funds have been able to deliver strong benefits by pooling members together to invest. To be able to meet the varying goals of retired members, funds will need flexibility to use smaller cohorts to deliver the right mix for each member. Digital tools have the potential to enable members to be self-guided through this process, without always needing full-service advice. Some funds are engaging with the concept of “a cohort of one”. The aim being to enable the member to be able to select the mix of products and options tailored to them by using digital tools.

Housing, as noted in the recent retirement income review, is strongly linked to retirement savings. For younger households, such as Matt and Natasha, buying a house provides certainty both now and in retirement, so the bias toward saving for a home is understandable. The super system mitigates the risk of leaving it too late to start saving for retirement and missing out on long-term returns.

While the retirement problem is complex and there are many different potential options, there is general agreement that the complexity is not helpful for members. Complexity is a key reason members don’t engage with super. As such, the onus is on funds to do the hard work so that they can simplify the decision-making process, where the choices that the member needs to make are straight-forward.

Bernard Salt’s white paper highlights the challenge of solving for retirement. With demographic changes leading to a greater need for new retirement income solutions for members, funds have to deal with a wide range of member objectives for retirement. Funds are in a very strong position to interpret member needs given their longstanding member relationships, existing date on members and the known member experience preferences for retirement. Funds are making progress in building better solutions, but more still needs to be actioned in order to deliver on members’ best interests.